Part A

(a)

Prepare

Part A

(a)

Explanation of Solution

Share Based Payments:

Sometimes organizations offer to issue equity shares as a consideration, to employees or other parties such consideration is referred as share based payment. IFRS recognizes three types of share based payments that are, equity-settled, cash-settled or having choice of settlement.

Journalizing:

Journalizing is the process of recording the transactions of an organization in the order of happening of events. Based on these journal entries recorded, the accounts are posted to the relevant ledger accounts.

Accounting rules for journal entries:

- To increase balance of the account: Debit assets, expenses, losses and credit all liabilities, capital, revenue and gains.

- To decrease balance of the account: Credit assets, expenses, losses and debit all liabilities, capital, revenue and gains.

Recording compensation expense:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| 31/12/01 | Compensation expense | 1,867 | ||

| Share based payment liability | 1,867 | |||

| (to record compensation) |

Table (1)

- Since, compensation expense is an expense and expense is increased. Hence, compensation expense account is debited.

- Since, share based payment liability is a liability and liability is increased. Hence, share based payment liability account is credited.

Recording compensation expense:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| 31/12/02 | Compensation expense | 1,867 | ||

| Share based payment liability | 1,867 | |||

| (to record compensation) |

Table (2)

- Since, compensation expense is an expense and expense is increased. Hence, compensation expense account is debited.

- Since, share based payment liability is a liability and liability is increased. Hence, share based payment liability account is credited.

Recording compensation expense:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| 31/12/03 | Compensation expense | 2,566 | ||

| Share based payment liability | 2,566 | |||

| (to record compensation) |

Table (3)

- Since, compensation expense is an expense and expense is increased. Hence, compensation expense account is debited.

- Since, share based payment liability is a liability and liability is increased. Hence, share based payment liability account is credited.

Recording settlement, if company chooses cash alternative:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| 31/12/03 | Share based payment liability | 6,300 | ||

| Cash | 6,300 | |||

| (to settle compensation) |

Table (4)

- Since, share based payment liability is a liability and liability is decreased. Hence, share based payment liability account is debited.

- Since, cash is an asset and asset is decreased. Hence, cash account is credited.

Working Note:

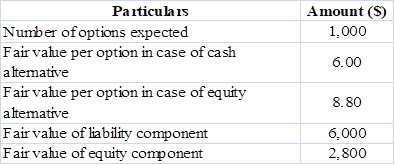

Computation of option expense:

Computation of Year 1 expense:

Computation of Year 2 expense:

Computation of Year 3 expense:

(b)

Prepare journal entries to record settlement of share based payment under share alternative.

(b)

Explanation of Solution

Compensation entries would remain same as in cash alternative however, settlement entry would differ which is presented as follows:

Recording settlement, if company chooses share alternative:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| 31/12/03 | Share based payment liability | 6,300 | ||

| Common stock | 700 | |||

| Additional paid-in capital | 5,600 | |||

| (to settle compensation) |

Table (5)

- Since, share based payment liability is a liability and liability is decreased. Hence, share based payment liability account is debited.

- Since, common stock is capital and capital is increased. Hence, common stock account is credited.

- Since, additional paid-in capital is capital and capital is increased. Hence, additional paid-in capital account is credited.

Part B

Compute the fair value of the stock options at the grant date and the amount to be recognized as compensation expense in Year 1.

Part B

Explanation of Solution

Since, under equity option, fair value is different from cash option due to discount; therefore, fair value of equity component would be greater than zero.

Computation of fair value of options at the grant date:

Table (6)

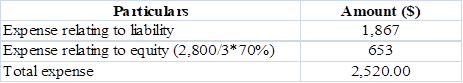

Computation of option expense in Year 1:

Table (7)

Want to see more full solutions like this?

Chapter 5 Solutions

INTERMEDIATE ACCOUNTING

- Provide correct solution with explanation of the financial accountingarrow_forwardBeginning inventory is $60,000. Purchases of inventory during the year are $100,000. Cost of goods sold is $120,000. What is ending inventory? Answer this questionarrow_forwardA business purchased a machine that had a total cost of $300,000 and a residual value of $30,000. The asset is expected to service the business for a period of 8 years or produce a total of 800,000 units. The machine was purchased on January 1st of the current year and has been in service for one complete year. What is the depreciable cost of the asset? A. $270,000 B. $300,000 C. $30,000 D. $250,000arrow_forward

- Need answerarrow_forwardQuestion: Mr. R bought a machine for Rs 25,000 on which he spent Rs 5,000 for carriage and freight; Rs 1,000 for brokerage of the middleman; Rs 3,500 for installation and Rs 500 for an iron pad. The machine is depreciated @ 10% every year on a written down basis. After three years the machine was sold to Mr. B for Rs 30,500 and Rs 500 was paid as commission to the broker. Find out the profit or loss on the sale of the machine. No wrong answerarrow_forwardOn January 1, Trump Financial Services lends a corporate client $180,000 at an 8% interest rate. The amount of interest revenue that should be recorded for the quarter ending March 31 equals:arrow_forward

- RDX Corporation's production budget for September is 22,000 units and includes the following component unit costs: direct materials, $7.50; direct labor, $12.00; variable overhead, $6.20. Budgeted fixed overhead is $55,000. Actual production in September was 23,400 units, actual unit component costs incurred during September include direct materials, $8.10; direct labor, $11.80; variable overhead, $6.50. Actual fixed overhead was $57,000, the standard fixed overhead application rate per unit consists of $2.50 per machine hour and each unit is allowed a standard of 1.2 hours of machine time. Calculate the fixed overhead budget variance.arrow_forwardRIO is a retailer of smart televisions. Typically, the company purchases atelevision for $1,200 and sells it for $1,500. What is the gross profit margin on this television? Correct Answerarrow_forwardSuppose Harbor view Hotel has annual fixed costs applicable to its rooms of $2.5 million for its 350-room hotel. Average daily room rents are $60 per room, and average variable costs are $15 for each room rented. It operates 365 days per year. If the hotel is completely full throughout the year, what is the net income for one year? Don't Use Aiarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education