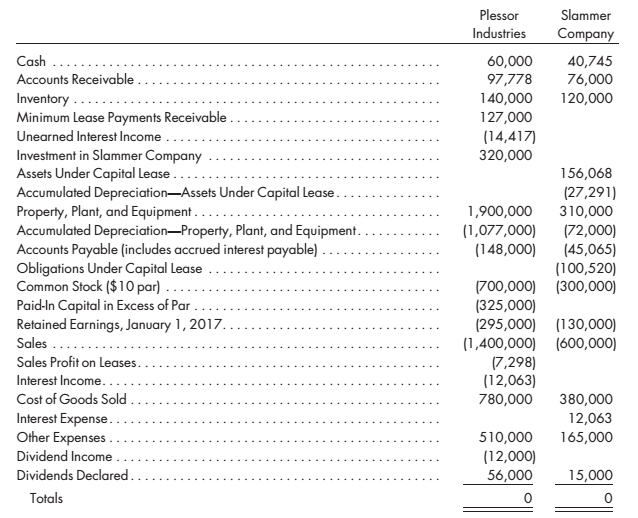

Plessor Industries acquired 80% of the outstanding common stock of Slammer Company on January 1, 2015. for S320,000. On that date, Slammer’s book values approximated fair values. and the balance of its

On January 1, 2016. Slammer signed a 5-year lease with Plessor for the rental of a small factory building with a 10-year life. Payments of $25000 are due at the beginning of each year on January 1, and Slammer is expected to exercise the $5,000 bargain purchase option at the end of the fifth year. The fair value of the factory was $103,770 at the start of the lease term. Plessor’s implicit rate on the lease is 12%. A second lease agreement. for the rental of production equipment with an 8-year life, was signed by Slammer on January 1, 2017. The terms of this 4-year lease require a payment of $15,000 at the beginning of each year on January 1. The present value of the lease payments at Plessor’s 12% implicit rate was equal to the fair value of the equipment, $52,298, when the lease was signed. The cost of the equipment to Plessor was $45,000, and there is a $2,000 bargain purchase option. Eight-year, straight-line depreciation is being used, with no salvage value.

The following

Required

Prepare the worksheet necessary to produce the consolidated financial statements of Plessor Industries and its subsidiary for the year ended December 31. 2017. Include the determination and distribution of excess and income distribution schedules.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

ADVANCED ACCOUNTING

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

- I need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardCan you explain the process for solving this General accounting question accurately?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education