Concept explainers

Inventory:

Inventory refers to the stock or goods which will be sold in the near future and thus is an asset for the company. It comprises of the raw materials which are yet to be processed, the stock which is still going through the process of production and it also includes completed products that are ready for sale. Thus inventory is the biggest and the important source of income and profit for the business.

Perpetual Inventory System:

In perpetual inventory system there is a continuous recording of transactions as and when they take place that is purchase and sale transactions are recorded whenever they occur.

Cost of Goods Available for Sale:

It basically includes the cost of inventory which is ready for sale within an accounting period. It mainly includes the cost of beginning inventory as well as the stock purchased in that year and the production within that period (if any).

Cost of Goods Sold:

Cost of goods sold is the total expenses or the cost incurred by the business during the process of manufacturing of goods and is directly related to the production. It generally includes the cost of raw material, labor and other

Gross Profit:

The profit made after subtracting or debiting the costs related to the goods sold from the total revenue earned or made through sales in a fiscal year is the gross profit.

First in First out:

In case of first in, first out method, also known as FIFO method, the inventory which was bought first will also be the first one to be taken out.

Last in First out:

In case of last in, first out, also known as LIFO method, the inventory which was bought in the last will be taken out first.

Weighted Average Cost method:

In this method the weighted average cost is evaluated after any purchases have been made and transactions are recorded as when purchase or sales take place.

Specific Identification method:

Under this method, there is a continuous tracking of the inventory and the inventory cost at the time of purchase on the basis of unique identity which thus helps in the valuation of the ending inventory as well as the cost of goods sold. This method is used generally when the company is involved in limited expensive goods which are easily identifiable.

To compute: 1. Cost of goods available for sale and number of units available for sale.

2. Number of units in ending inventory.

3. Cost of ending inventory under the following methods:

- (a) FIFO

(b) LIFO

(c) Weighted average

(d) Specific identification

4. Gross profit for each of the four methods in part

5. The inventory costing method suitable incase of bonus earned on gross profit.

Given info,

| Date | Particulars | Units acquired | Cost per unit ($) | Units sold | Retail price per unit ($) |

| May 1 | Beginning inventory | 150 | 300 | ||

| May 6 | Purchase | 350 | 350 | ||

| May 9 | Sales | 800 | 75 | ||

| May 17 | Purchase | 80 | 450 | ||

| May 25 | Purchase | 100 | 458 | ||

| May 30 | Sales | 600 | 75 | ||

| Total | 680 | 480 |

The ending inventory has,

70 units are from May 1,

50 units are from May 6 and

80 units are from May 17.

Explanation of Solution

1.

Cost of goods available for sale

Formula to calculate Cost of goods available for sale is,

Cost and units of goods available for sale:

| Particulars | Number of units | Cost per unit ($) | Amount ($) |

| Beginning Inventory | 150 | 300 | 45,000 |

| Purchases: | |||

| May 6 | 350 | 350 | 122,500 |

| May 17 | 80 | 450 | 36,000 |

| May 25 | 100 | 458 | 45,800 |

| Total Purchases | 530 | 204,300 | |

| Available for sale | 680 | 249,300 |

Table (1)

The cost of goods available for sale is $249,300 and the number of units available for sale is 680 units.

2.

Number of units in ending inventory

| Particulars | Number of units |

| Number of units available for sale (given) | 680 |

| Less: units sold (given) | 480 |

| Number of units in ending inventory | 200 |

Table (2)

The number of units in ending inventory is 200 units.

3.

(a)

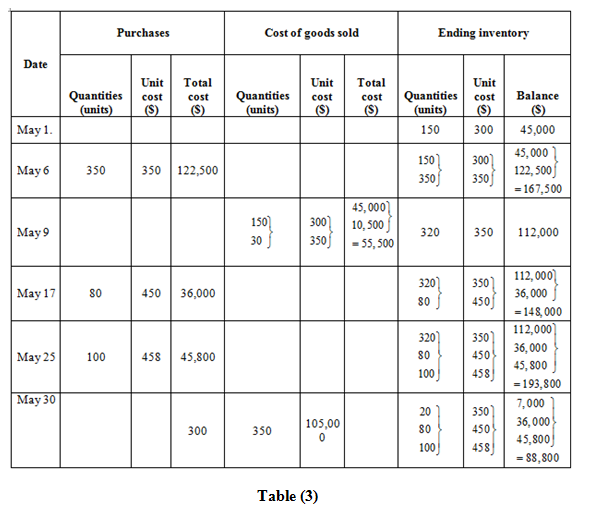

First in, First out method (FIFO)

Ending inventory

Cost of goods sold

Formula to calculate cost of goods sold is,

Substitute $249,300 for cost of goods available for sale (calculated in part (1)) and $24,000 for cost of ending inventory (as calculated above in the table) in the above formula.

Under FIFO method, the amount of ending inventory is $88,800 and cost of goods sold is $160,500.

(b)

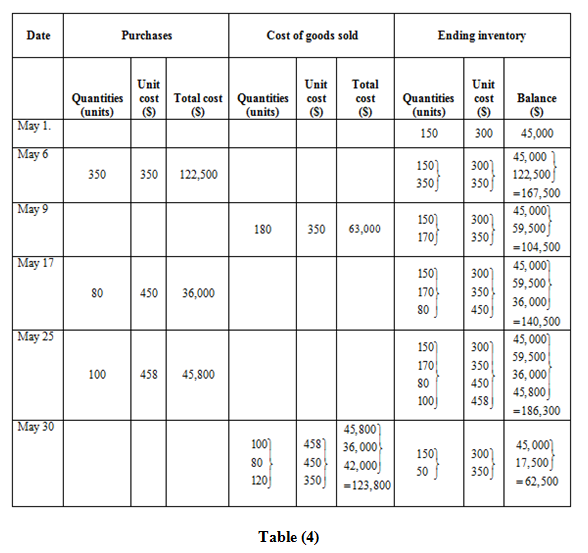

Last in, first out method (LIFO)

Ending inventory

Cost of goods sold

Formula to calculate cost of goods sold is,

Substitute $249,300 for cost of goods available for sale (calculated in part (1)) and $62,500 for cost of ending inventory (as calculated above in the table) in the above formula.

Under LIFO method, the amount of ending inventory is $62,500 and cost of goods sold is $186,800.

(c)

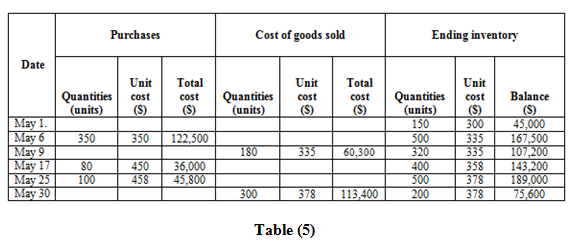

Weighted average method

Ending inventory

Working Notes:

Calculation of weighted average cost per unit:

Cost of goods sold

Formula to calculate cost of goods sold is,

Substitute $249,300 for cost of goods available for sale (calculated in part (1)) and $75,600 for cost of ending inventory (as calculated above in the table) in the above formula.

Under weighted average method, the amount of ending inventory is $75,600 and cost of goods sold is $173,700.

(d)

Specific identification method

Ending Inventory

| Date of Purchase | Number of units (A) | Cost per unit ($) (B) | Amount ($) |

| May 1 | 70 | 300 | 21,000 |

| May 6 | 50 | 350 | 17,500 |

| May 17 | 80 | 450 | 36,000 |

| Cost of Ending Inventory | 74,500 | ||

Table (6)

Cost of goods soldFormula to calculate cost of goods sold is,

Substitute $249,300 for cost of goods available for sale (calculated in part (1)) and $74,500 for cost of ending inventory (calculated above in the table) in the above formula.

The cost of ending inventory is $74,500 and the cost of goods sold is $174,500.

4.

Sales are $636,000 (working notes).

Cost of goods sold in case of FIFO is $160,500. (Calculated in part (3(a))

Cost of goods sold in case LIFO is $186,800. (Calculated in part (3(b))

Cost of goods sold in case of weighted average is $173,700 and (Calculated in part (3(c))

Cost of goods sold in case of specific identification is $174,800. (Calculated in part (3(d))

Gross Profit

Formula to calculate gross profit is,

| Particulars | FIFO | LIFO | Weighted average | Specific identification |

| Sales (working notes) | $636,000 | $636,000 | $636,000 | $636,000 |

| Less: Cost of goods sold | $160,500 | $186,800 | $173,700 | $174,800 |

| Gross profit | $475,500 | $449,200 | $462,300 | $461,200 |

Table (7)

Working notes:

Calculation of sales

The gross profit in case of FIFO it is $475,500, of LIFO it is $449,200, of weighted average it is $462,300 and of specific identification it is $461,200.

5.

Preferred method:

FIFO inventory method resulted in highest gross profit that is $475,500 as compared to other four methods. The bonus will be more on the highest gross profit made by the company and herein it is the FIFO method which resulted in the highest gross profit.

Thus, the First in, first out inventory costing method is suitable so to earn more amount of bonus on gross profit.

Want to see more full solutions like this?

Chapter 5 Solutions

FINANCIAL & MANAGERIAL ACCOUNTING

- Solve clearly with correct dataarrow_forwardPROBLEM E Mulles, the owner of a successful fertilizer business, felt that it is time to expand operations. Mulles offered to form a partnership with Lucena, the owner of a nearby warehouse. The partnership would be called Mulles & Lucena Storage and Sales. Lucena accepted Mulles' offer and the partnership was formed on July 1,2024. Presented below is the trial balance for Mulles Fertilizer Supply on June 30, 2024: Cash Accounts Receivable Allowance for Uncollectible Accounts. Inventory Prepaid Rent Store Equipment Accumulated Depreciation Notes Payable Accounts Payable Mulles, Capital Total P 229,500 2,103,000 P 117,000 1,012,500 29,250 390,000 P3,764,250 97,500 330,000 505,500 2,714,250 P3,764,250 The partners agreed to share profits and losses equally and decided to invest an equal amount in the partnership. Lucena and Mulles agreed that Lucena's land is worth P500,000 and his building P1,450,000. Lucena is to contribute cash in an amount sufficient to make his capital account…arrow_forwardPLEASE HELP. ALL RED CELLS ARE INCORRECT. NOTICE, REVENUE ACCOUNTS ARE IN THE DROPDOWN!arrow_forward

- Journalize these transactions, also post the transcations to T-accounts and determine month-end balances. Finally prepare a trail balance.arrow_forwardSuppose during 2023, BlueStar Shipping reported the following financial information (in millions): Net Sales: $40,000 Net Income: $150 Total Assets at Beginning of Year: $26,000 • Total Assets at End of Year: $24,800 Calculate the following: (a) Asset Turnover (b) Return on Assets (ROA) as a percentagearrow_forwardPlease fill all cells! I need helparrow_forward

- Hilary owns a fruit smoothie shop at the local mall. Each smoothie requires 1/2 pound of mixed berries, which are expected to cost $5.50 per pound during the summer months. Shop employees are paid $7.00 per hour. Variable overhead consists of utilities and supplies, with a variable overhead rate of $0.12 per minute of direct labor time. Each smoothie should require 4 minutes of direct labor time. Determine the following standard costs per smoothie: Direct materials cost Direct labor cost Variable overhead costarrow_forwardgeneral accountingarrow_forwardThe following financial information is provided for Brightstar Corp.: Net Income (2023): $500 million Total Assets on January 1, 2023: $3,500 million Total Assets on December 31, 2023: $4,500 million What is Brightstar Corp. _ s return on assets (ROA) for 2023? A. 11.80% B. 12.50% C. 13.20% D. 14.00%arrow_forward

- PLEASE FILL ALL CELLS. ALL RED CELLS ARE INCORRECT OR EMPTY.arrow_forwardAssume Bright Cleaning Service had a net income of $300 for the year. The company's beginning total assets were $4,500, and ending total assets were $4,100. Calculate Bright Cleaning Service's Return on Assets (ROA). A. 6.50% B. 7.25% C. 6.98% D. 5.80%arrow_forwardwhat is the investment turnover?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education