Personal Finance (MindTap Course List)

13th Edition

ISBN: 9781337099752

Author: E. Thomas Garman, Raymond Forgue

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 3DTM

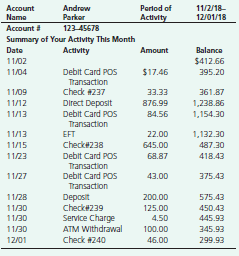

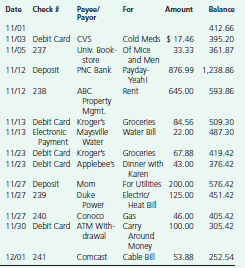

Reconciling a Checking Account. Andrew Parker, of San Marcos, Texas, has a checking account at the credit union affiliated with his university. Illustrated below are his monthly statement and check register for the account. Reconcile the checking

Account and answer the following questions.

- What is the total of the outstanding checks?

- What is the total of the outstanding deposits?

- Why is there a difference between the uncorrected balance in the check register and the balance on the statement?

- What is the updated and correct balance in the check register on the next page?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The beta of a stock measures:

A. Total riskB. Unsystematic riskC. Systematic riskD. Credit risk

finance pr

no chatgpt

The beta of a stock measures:

A. Total riskB. Unsystematic riskC. Systematic riskD. Credit risk

A bond with a face value of $1,000 and a 10% coupon pays:

A. $1,000 annuallyB. $10 annuallyC. $100 annuallyD. $110 annuallyneed help.

Chapter 5 Solutions

Personal Finance (MindTap Course List)

Ch. 5.1 - Prob. 1CCCh. 5.1 - Explain the circumstances when it would be...Ch. 5.1 - Prob. 3CCCh. 5.1 - Summarize your insurance protections when you have...Ch. 5.2 - Explain why opening a checking account and a money...Ch. 5.2 - Prob. 2CCCh. 5.2 - Prob. 3CCCh. 5.2 - Prob. 4CCCh. 5.3 - Prob. 1CCCh. 5.3 - Prob. 2CC

Ch. 5.4 - Prob. 1CCCh. 5.4 - Prob. 2CCCh. 5.4 - Prob. 3CCCh. 5.4 - Prob. 4CCCh. 5.5 - Prob. 1CCCh. 5.5 - Prob. 2CCCh. 5 - Invest Now or Later? Twins Natalie and Kaitlyn are...Ch. 5 - Prob. 2DTMCh. 5 - Reconciling a Checking Account. Andrew Parker, of...Ch. 5 - Saving for College. You want to create a college...Ch. 5 - Prob. 5DTMCh. 5 - Prob. 1FPCCh. 5 - Prob. 2FPCCh. 5 - Prob. 3FPCCh. 5 - Prob. 4FPCCh. 5 - Prob. 5FPCCh. 5 - Prob. 6FPCCh. 5 - Prob. 7FPCCh. 5 - Prob. 8FPCCh. 5 - Keep Your Accounts Current. Go online every few...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The beta of a stock measures: A. Total riskB. Unsystematic riskC. Systematic riskD. Credit riskarrow_forwardGive answer The beta of a stock measures: A. Total riskB. Unsystematic riskC. Systematic riskD. Credit riskarrow_forwardI need help A bond with a face value of $1,000 and a 10% coupon pays: A. $1,000 annuallyB. $10 annuallyC. $100 annuallyD. $110 annuallyarrow_forward

- I want the correct answer with financial accounting questionarrow_forwardAs a finance manager for a major utility company. Thinking about some of the capital budgeting techniques that I might use for some upcoming projects. I need help Discussing at least 2 capital budgeting techniques and how my company can benefit from the use of these tools.arrow_forwardI need assistance with this financial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

What Is A Checking Account?; Author: The Smart Investor;https://www.youtube.com/watch?v=vGymt1Rauak;License: Standard Youtube License