Concept explainers

1.

Ascertain the cost of goods available for sale, and the number of units available for sales.

1.

Explanation of Solution

Ascertain the cost of goods available for sale, and the number of units available for sales as follows:

| Details | Number of Units | Rate per Unit ($) | Total Cost ($) |

| Beginning balance | 600 | 45 | 27,000 |

| Add: Purchases | |||

| February 10 | 400 | 42 | 16,800 |

| March 13 | 200 | 27 | 5,400 |

| August 21 | 100 | 50 | 5,000 |

| September 5 | 500 | 46 | 23,000 |

| Total Goods available for Sale | 1,800 | 77,200 |

Table (1)

Therefore, the number of units available for sales is 1,800 units, and the cost of goods available for sale is $77,200.

2.

Ascertain the number of units in ending inventory.

2.

Explanation of Solution

Ascertain the number of units in ending inventory as follows:

| Details | Number of Units |

| Total Goods available for Sale | 1,800 |

| Less: Sales: | |

| March 15 | 800 |

| September 10 | 600 |

| Ending Inventory | 400 |

Table (2)

Therefore, the number of units in ending inventory is 400.

3.

Ascertain the cost assigned to ending inventory under (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification.

3.

Explanation of Solution

Perpetual inventory system: The method or system of maintaining, recording, and adjusting the inventory perpetually throughout the year, is referred to as perpetual inventory system.

First-in-First-Out (FIFO): In this method, items purchased initially are sold first. So, the value of the ending inventory consist the recent cost for the remaining unsold items.

Last-in-First-Out (LIFO): In this method, items purchased recently are sold first. So, the value of the ending inventory consist the initial cost for the remaining unsold items.

Weighted-average Cost Method: In this method, the inventories are priced at the average rate of goods available for sales.

Specific identification method: Specific identification method identifies the cost of each item in ending inventory by separating purchases. In this method, the value of ending inventory is computed based on the lower of cost or market value.

Ascertain the cost assigned to ending inventory under (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification as follows:

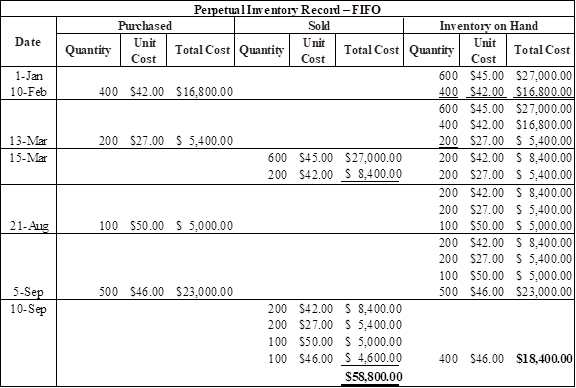

(a) FIFO

Table (3)

Therefore, the cost of ending inventory under FIFO is $18,400.

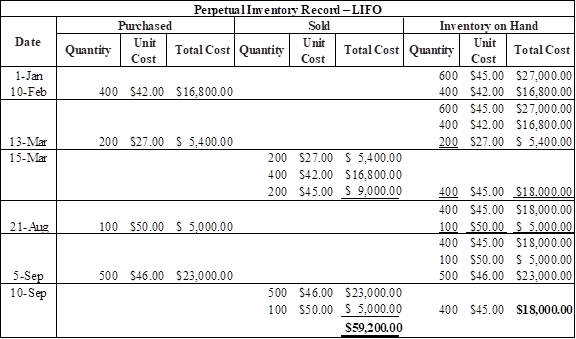

(b) LIFO

Table (4)

Therefore, the cost of ending inventory under LIFO is $18,000.

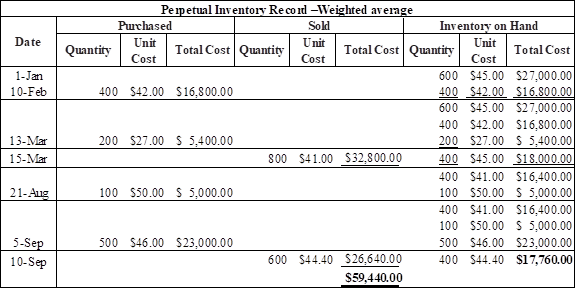

(c) Weighted average method:

Refer working note 1 and 2 for calculation of weighted average cost

Table (5)

Therefore, the cost of ending inventory under weighed average method is $17,760.

Working note:

Calculate the weighted average cost of inventory after March 13purchase

Calculate the weighted average cost of inventory after September 5 purchase

(d) Specific identification method:

| Details | Number of Units | Rate per Unit ($) | Total Cost ($) |

| Cost of goods available for sale (refer table 1) | 77,200 | ||

| Less: Cost of goods sold | |||

| Beginning inventory | 600 | 45 | 27,000 |

| February 10 | 300 | 42 | 12,600 |

| March 13 | 200 | 27 | 5,400 |

| August 21 | 50 | 50 | 2,500 |

| September 5 | 250 | 46 | 11,500 |

| Ending inventory | 18,200 |

Table (6)

Therefore, the cost of ending inventory under specific identification method is $18,200.

4.

Ascertain the gross profit earned by the company for the each of the given methods.

4.

Explanation of Solution

Ascertain the gross profit earned by the company for the each of the given methods as follows:

| Particulars | FIFO | LIFO | Specific Identification | Weighted Average |

| Sales | $ 105,000 | $ 105,000 | $105,000 | $ 105,000 |

| Less: Cost of goods sold | $ 58,800 | $ 59,200 | $ 59,000 | $ 59,440 |

| Gross profit | $ 46,200 | $ 45,800 | $46,000 | $ 45,560 |

Table (7)

5.

Identify the inventory method which is preferred by the manager, if company’s manger earns a bonus based on a percent of gross profit.

5.

Explanation of Solution

Identify the inventory method which is preferred by the manager, if company’s manger earns a bonus based on a percent of gross profit as follows:

In this case, gross profit under FIFO method ($46,200) is more than the other three methods. Hence, the manager of Company would likely to prefer the FIFO method.

Want to see more full solutions like this?

Chapter 5 Solutions

FINANCIAL ACCOUNTING ACCT 2301 >IC<

- I need help with this general accounting question using the proper accounting approach.arrow_forwardDuring 2018, the band Maroon 5 is touring across the U.S. on its "Red Pill Blues Tour 2018." Two of those concerts, on October 14 and 15, will be held at Madison Square Garden in New York City. Madison Square Garden has a seating capacity for concerts of approximately 19,000. According to a Business Insider article in December 2016, Maroon 5 had an average concert ticket price of $165.Assume that these two Madison Square Garden concerts were sold out on the first day the tickets were available for sale to the public, November 4, 2017. Also assume, for the sake of simplicity, that all tickets are sold directly by Maroon 5.Question:How will Maroon 5's balance sheet and income statement be impacted by the sale of the Madison Square Garden tickets on November 4, 2017 and what specific accounts will be impacted and will it increase ir decrease.arrow_forwardAccounting problem with helparrow_forward

- What are rangoons profit margin and debt ratio?arrow_forwardQuestion: When will Maroon 5 recognize revenue from its 2018 concerts at Madison Square Garden in New York City?During 2018, the band Maroon 5 is touring across the U.S. on its "Red Pill Blues Tour 2018." Two of those concerts, on October 14 and 15, will be held at Madison Square Garden in New York City. Madison Square Garden has a seating capacity for concerts of approximately 19,000. According to a Business Insider article in December 2016, Maroon 5 had an average concert ticket price of $165.Assume that these two Madison Square Garden concerts were sold out on the first day the tickets were available for sale to the public, November 4, 2017. Also assume, for the sake of simplicity, that all tickets are sold directly by Maroon 5.arrow_forwardI want to this question answer for General accounting question not need ai solutionarrow_forward

- Greenfield Company has current liabilities of $60,000 and long-term liabilities of $90,000. It also has $80,000 in common stock and $40,000 in retained earnings. Calculate Greenfield's debt-to-equity ratio.arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forwardNot use ai solution for accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education