EBK CORNERSTONES OF COST MANAGEMENT

3rd Edition

ISBN: 8220100474972

Author: MOWEN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 24E

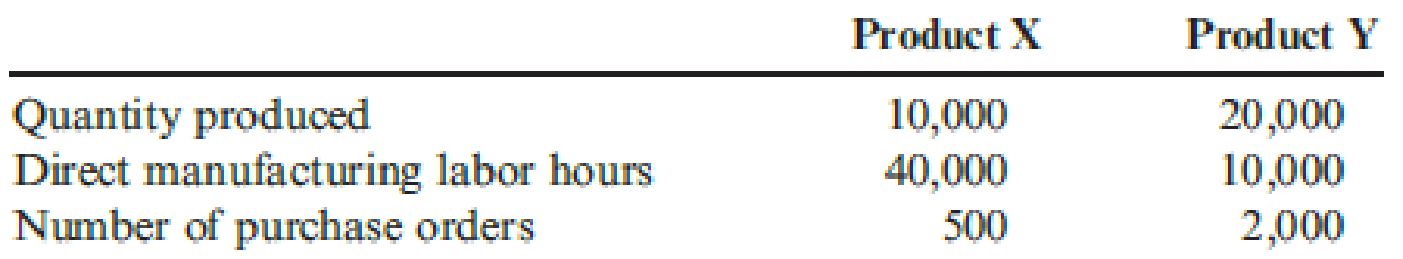

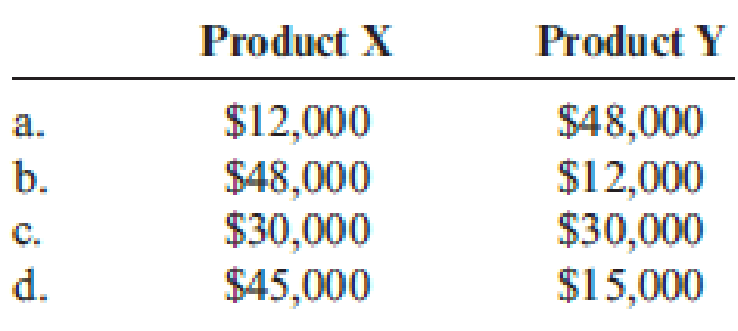

Geneva, Inc., makes two products, X and Y, that require allocation of indirect

The total cost of purchasing and receiving parts used in manufacturing is $60,000. The company uses a

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

1.

Record the proper journal entry for each transaction.

2.

By the end of January, was manufacturing overhead overallocated or underallocated? By how much?

Rocky River Fast Lube does oil changes on vehicles in 15 minutes or less. The variable cost associated with each oil change is $12 (oil, filter, and 15 minutes of employee time). The fixed costs of running the shop are $8,000 each month (store manager salary, depreciation on shop and equipment, insurance, and property taxes). The shop has the capacity to perform 4,000 oil changes each month.

The formula to calculate the amount of manufacturing overhead to allocate to jobs is:

Question content area bottom

Part 1

A.

predetermined overhead rate times the actual amount of the allocation base used by the specific job.

B.

predetermined overhead rate divided by the actual allocation base used by the specific job.

C.

predetermined overhead rate times the estimated amount of the allocation base used by the specific job.

D.

predetermined overhead rate times the actual manufacturing overhead used on the specific job.

Chapter 5 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

Ch. 5 - What is cost measurement? Cost accumulation? What...Ch. 5 - Why is actual costing rarely used for product...Ch. 5 - Explain the differences between job-order costing...Ch. 5 - What are some differences between a manual...Ch. 5 - Prob. 5DQCh. 5 - How do firms collect job-related information on...Ch. 5 - Explain the role of activity drivers in assigning...Ch. 5 - Define the following terms: expected actual...Ch. 5 - Why would some prefer normal activity to expected...Ch. 5 - When using normal costing, how are jobs charged...

Ch. 5 - Wilson Company has a predetermined overhead rate...Ch. 5 - Why are the accounting requirements for job-order...Ch. 5 - Explain the difference between normal cost of...Ch. 5 - Amber Company produces custom framing. For one...Ch. 5 - Amber Company produces custom framing. For one...Ch. 5 - Naranjo Company designs industrial prototypes for...Ch. 5 - Naranjo Company designs industrial prototypes for...Ch. 5 - Heitger Company is a job-order costing firm that...Ch. 5 - Frieling Company installs granite countertops in...Ch. 5 - Frieling Company installs granite countertops in...Ch. 5 - Prob. 6ECh. 5 - Vince Melders, of EcoScape Company, designs and...Ch. 5 - Refer to the data in Exercise 5.7. Vince Melders,...Ch. 5 - Reggie Wilmore has just started a new...Ch. 5 - Reggie Wilmore has just started a new...Ch. 5 - During March, Aragon Company worked on three jobs....Ch. 5 - Job Cost On April 1, Sangvikar Company had the...Ch. 5 - Job Cost On April 1, Sangvikar Company had the...Ch. 5 - On August 1, Cairle Companys work-in-process...Ch. 5 - On August 1, Cairle Companys work-in-process...Ch. 5 - Ehrling Brothers Company makes jobs to customer...Ch. 5 - During August, Skyler Company worked on three...Ch. 5 - Prob. 18ECh. 5 - Kapoor Company uses job-order costing. During...Ch. 5 - Salazar Company is a job-order costing firm that...Ch. 5 - Lorrimer Company has a job-order cost system. The...Ch. 5 - Prob. 22ECh. 5 - Prob. 23ECh. 5 - Geneva, Inc., makes two products, X and Y, that...Ch. 5 - Prob. 25ECh. 5 - During May, the following transactions were...Ch. 5 - Firenza Company manufactures specialty tools to...Ch. 5 - Prob. 28PCh. 5 - Cherise Ortega, marketing manager for Romer...Ch. 5 - Lieu Company is a specialty print shop. Usually,...Ch. 5 - Warrens Sporting Goods Store sells a variety of...Ch. 5 - Sutton Construction Inc. is a privately held,...Ch. 5 - Dr. Alyx Hemmings is employed by Mesa Dental. Mesa...Ch. 5 - Prob. 34P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Fantastic Ice Cream Shoppe sold 9,000 servings of ice cream during June for $4 per serving. The shop purchases the ice cream in large tubs from the Dream Ice Cream Company. Each tub costs the shop $9 and has enough ice cream to fill 20 ice cream cones. The shop purchases the ice cream cones for $0.10 each from a local warehouse club. Located in an outdoor mall, the rent for the shop space is $2,050 per month. The shop expenses $290 a month for the depreciation of the shop's furniture and equipment. During June, the shop incurred an additional $2,700 of other operating expenses (75% of these were fixed costs).arrow_forwardHello tutor please provide correct answer general accounting questionarrow_forwardRobinson Manufacturing discovered the following information in its accounting records: $519,800 in direct materials used, $223,500 in direct labor, and $775,115 in manufacturing overhead. The Work in Process Inventory account had an opening balance of $72,400 and a closing balance of $87,600. Calculate the company’s Cost of Goods Manufactured.arrow_forward

- Sanjay would like to organize HOS (a business entity) as either an S corporation or as a corporation (taxed as a C corporation) generating a 16 percent annual before-tax return on a $350,000 investment. Sanjay’s marginal tax rate is 24 percent and the corporate tax rate is 21 percent. Sanjay’s marginal tax rate on individual capital gains and dividends is 15 percent. HOS will pay out its after-tax earnings every year to either its members or its shareholders. If HOS is taxed as an S corporation, the business income allocation would qualify for the deduction for qualified business income (assume no limitations on the deduction). Assume Sanjay does not owe any additional Medicare tax or net investment income tax. Required 1. For each scenario, C corporation and S corporation, calculate the total tax (entity level and owner level). 2. For each scenario, C corporation and S corporation, calculate the effective tax rate. C Corporation S Corporation 1. Total tax…arrow_forwardI need correct solution of this general accounting questionarrow_forwardHii expert please given correct answer general accountingarrow_forward

- Markowis Corp has collected the following data concerning its maintenance costs for the pest 6 months units produced Total cost July 18,015 36,036 august 37,032 40,048 September 36,036 55,055 October 22,022 38,038 November 40,040 74,575 December 38,038 62,062 Compute the variable coot per unit using the high-low method. (Round variable cost per mile to 2 decimal places e.g. 1.25) Compute the fixed cost elements using the high-low method.arrow_forwardUse the following data to determine the total dollar amount of assets to be classified as current assets. Marigold Corp. Balance Sheet December 31, 2025 Cash and cash equivalents Accounts receivable Inventory $67000 Accounts payable $126000 86500 Salaries and wages payable 11100 149000 Bonds payable 161500 Prepaid insurance 83000 Total liabilities 298600 Stock investments (long-term) 193000 Land 199500 Buildings $226000 Common stock 309400 Less: Accumulated depreciation (53500) 172500 Retained earnings 475500 Trademarks 133000 Total stockholders' equity 784900 Total assets $1083500 Total liabilities and stockholders' equity $1083500 ○ $269100 $385500 ○ $236500 ○ $578500arrow_forwardShould the machine be replaced?arrow_forward

- Using the following balance sheet and income statement data, what is the total amount of working capital? Current assets $39700 Net income $52100 Current liabilities 19800 Stockholders' equity 96700 Average assets 198400 Total liabilities 52100 Total assets 148800 Average common shares outstanding was 18600. ○ $9900 ○ $39700 ○ $19900 ○ $12400arrow_forwardSuppose that Old Navy has assets of $4265000, common stock of $1018000, and retained earnings of $659000. What are the creditors' claims on their assets? ○ $2588000 ○ $3906000 ○ $1677000 ○ $4624000arrow_forwardBrody Corp. uses a process costing system. Beginning inventory for January consisted of 1,400 units that were 46% completed. 10,300 units were started during January. On January 31, the inventory consisted of 550 units that were 77% completed. How many units were completed during the period?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY