Concept explainers

1.

Prepare journal entries to record each transaction of Fireworks P.

1.

Explanation of Solution

1.

Prepare

| Date | Account titles and Explanation | Debit | Credit |

| $7,000 | |||

| Service revenue | $7,000 | ||

| (To record service provided on account) |

Table (1)

- Accounts receivable is a current asset, and it is increased. Therefore, debit accounts receivable account for $7,000.

- Service revenue is a component of

stockholders’ equity , and it is increased. Therefore, credit service revenue account for $7,000.

2.

Prepare journal entry to record receive cash from customers within 10 days of the services being provided on account.

| Date | Account titles and Explanation | Debit | Credit |

| Cash | $4,900 | ||

| Sales discount (1) | $100 | ||

| Account receivable | $5,000 | ||

| (To record cash received on account with sales discount) |

Table (2)

Working note:

Calculate sales discount.

(1)

- Cash is a current asset, and it is increased. Therefore, debit cash account for $4,900.

- Sales discount is a contra revenue account, and it is increased. Therefore, debit sales discount account for $100.

- Accounts receivable is a current asset, and it is decreased. Therefore, credit accounts receivable account for $5,000.

3.

Prepare journal entry to record write off customer accounts of $1,500 as uncollectible.

| Date | Account titles and Explanation | Debit | Credit |

| Allowance for uncollectible accounts | $1,500 | ||

| Accounts receivable | $1,500 | ||

| (To record write off uncollectible accounts) |

Table (3)

Allowance for uncollectible accounts is a contra asset, and it is decreased. Therefore, debit allowance for uncollectible accounts for $1,500.

Accounts receivable is a current asset, and it is decreased. Therefore, credit accounts receivable account for $1,500.

2.

Prepare

2.

Explanation of Solution

a.

Prepare adjusting entry to record uncollectible accounts.

| Date | Account titles and Explanation | Debit | Credit |

| December 31 | Bad debt expense | $3,500 | |

| Allowance for uncollectible accounts | $3,500 | ||

| (To record adjustment entry of uncollectible accounts) |

Table (4)

Working notes:

Calculate ending bad debt expense.

(2)

- Bad debt expense is a component of stockholders’ equity, and it is decreased. Therefore, debit

bad debts expense account for $3,500. - Allowance for uncollectible accounts is a contra asset, and it is increased. Therefore, credit allowance for uncollectible accounts for $3,500.

b.

Prepare adjustment entry to record interest receivable.

| Date | Account titles and Explanation | Debit | Credit |

| December 31 | Interest receivable | $200 | |

| Interest revenue | $200 | ||

| (To record adjustment entry of interest receivable) |

Table (5)

- Interest receivable is a current asset, and it is increased. Therefore, debit interest receivable account for $200.

- Interest revenue is a component of stockholders’ equity, and it is increased. Therefore, credit interest revenue account for $200.

3.

Prepare adjusted trail balance as on 31st December 2021 of Fireworks P.

3.

Explanation of Solution

Prepare adjusted trail balance as on 31st December 2021 of Fireworks P as follows:

| Fireworks' P | ||

| Adjusted | ||

| December 31 2021 | ||

| Accounts | Debit ($) | Credit ($) |

| Cash | 26,100 | |

| Accounts Receivable | 42,000 | |

| Allowance for Uncollectible Accounts | 4,200 | |

| Interest Receivable | 200 | |

| Supplies | 6,700 | |

| Notes Receivable | 10,000 | |

| Land | 85,000 | |

| Accounts Payable | 12,300 | |

| Common Stock | 106,000 | |

| 29,900 | ||

| Service Revenue | 131,800 | |

| Sales Discounts | 100 | |

| Interest Revenue | 200 | |

| Salaries Expense | 70,900 | |

| Utilities Expense | 24,200 | |

| Supplies Expense | 15,700 | |

| Bad Debt Expense | 3,500 | |

| Totals | 284,400 | 284,400 |

Table (6)

Working notes:

Calculate ending cash balance.

(3)

Calculate ending balance of accounts receivable.

(4)

Calculate ending balance of allowance for uncollectible accounts.

(5)

Calculate ending balance of service revenue.

(6)

4.

Prepare income statement for the period ended December 31, 2021.

4.

Explanation of Solution

Prepare income statement for the period ended December 31, 2021 as follows:

| Fireworks P | |

| Income Statement | |

| For the year ended December 31, 2021 | |

| Amount ($) | |

| Revenues: | |

| Service revenue | 131,800 |

| Sales Discounts | (100) |

| Interest revenue | 200 |

| Net revenues | 131,900 |

| Less: Expenses: | |

| Salaries Expense | 70,900 |

| Utilities Expense | 24,200 |

| Supplies Expense | 15,700 |

| Bad debt expense | 3,500 |

| Total expenses | 114,300 |

| Net income | 17,600 |

Table (7)

5.

Prepare classified

5.

Explanation of Solution

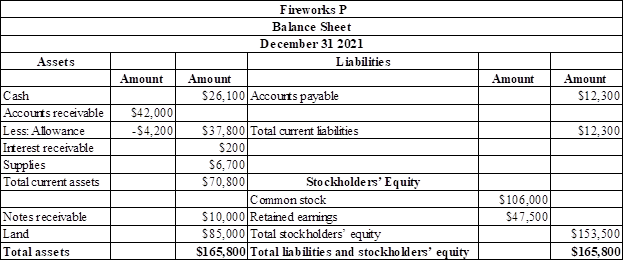

Prepare classified balance sheet as on December 31, 2021 as follows:

Figure (1)

6.

Record closing entries of Fireworks P.

6.

Explanation of Solution

Prepare closing entry of revenue accounts.

| Date | Account titles and Explanation | Debit | Credit |

| 31 December 2021 | Service revenue | $131,580 | |

| Interest revenue | $200 | ||

| Sales discount | $100 | ||

| Retained earnings | $131,900 | ||

| (To record close revenue accounts) |

Table (8)

- Service revenue is a component of stock holders’ equity and decreased it. So debit service revenue account for $131,580.

- Interest revenue is a component of stock holders’ equity and decreased it. So debit the interest revenue account for $200.

- Sales discount is a contra revenue account, and it is decreased. Therefore, credit sales discount account for $100.

- Retained earnings are a liability and increased it. So credit the retained earnings account for $131,900.

Prepare closing entry to record expense accounts.

| Date | Account titles and Explanation | Debit | Credit |

| 31 December 2021 | Retained earnings | $114,300 | |

| Utilities expense | $24,200 | ||

| Salaries expense | $70,900 | ||

| Supplies expense | $15,700 | ||

| Bad debt expense | $3,500 | ||

| (To record close expense accounts) |

Table (9)

- Retained earnings are a liability and decreased it. So debit the retained earnings.

- Supplies expenses are an expense which is a component of stock holder’s equity and decreases it. So credit the supplies expense account.

- Salaries expenses are an expense which is a component of stock holder’s equity and decreases it. So credit the salaries expense account.

- Utilities expenses are an expense which is a component of stock holder’s equity and decreases it. So credit the utilities expense account.

- Bad debt expenses are an expense which is a component of stock holder’s equity and decreases it. So credit the bad debt expense account.

7.a.

Identify the bad debts expense for the year 2021.

7.a.

Explanation of Solution

Calculate bad debts expense.

b.

Identify the ending balance of allowance for uncollectible accounts.

b.

Explanation of Solution

Calculate ending balance of allowance for uncollectible accounts.

c.

Identify the expected cash collected from the customers amount.

c.

Explanation of Solution

Calculate expected cash collected.

Want to see more full solutions like this?

Chapter 5 Solutions

Financial Accounting (Connect NOT Included)

- Can you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward

- general accountingarrow_forwardSales discount, sales return, and allowance is_____. (a) Revenue accounts (b) Permanent accounts (c) Contra revenue accounts (d) Contra expenses accounts.arrow_forwardSunrise Corp. has an average accounts receivable of $2,500 million and a receivables turnover ratio of 10. What are the net credit sales? What is the average collection period (in days)?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education