1.

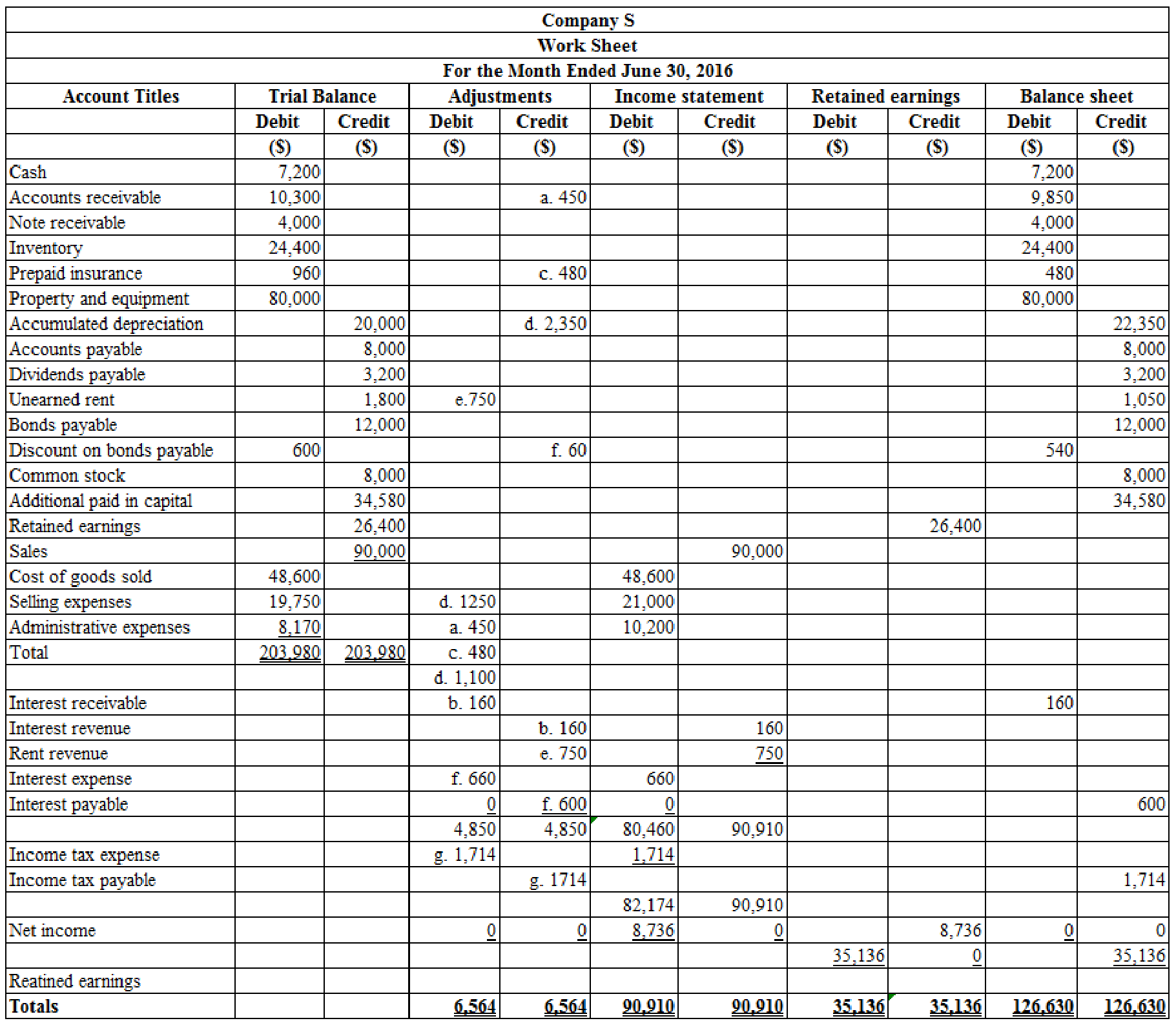

Prepare the worksheet to develop Company S’s financial statements for the first 6 months of 2016.

1.

Explanation of Solution

Worksheet: A worksheet is a tool that is used while preparing a financial statement. It is a type of form, having multiple columns and it is used in the adjustment process.

Prepare the worksheet to develop Company S’s financial statements for the first 6 months of 2016:

Table (1)

Working notes:

a. Calculate the amount of

b. Calculate the amount of interest revenue:

c. Calculate the amount of insurance expense:

d. Calculate the amount of

e. Calculate the amount of rent revenue:

f. Calculate the amount of interest expense:

g. Calculate the amount of income tax expense for first 6 months:

Calculate estimated annual pre-tax income:

Calculate estimated effective income tax rate:

Calculate the amount of income tax expense for first 6 months:

2 (a)

Prepare the income statement for the first 6 months of 2016.

2 (a)

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare the income statement for the first 6 months of 2016:

| Company S | ||

| Interim Income statement | ||

| For the period ended June 30, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | 90,000 | |

| Less: Cost of goods sold | (48,600) | |

| Gross profit | 41,400 | |

| Operating expenses: | ||

| Selling expenses | 21,000 | |

| Administrative expenses | 10,200 | |

| Total operating expenses | (31,200) | |

| Pre-tax operating income | 10,200 | |

| Other items: | ||

| Interest revenue | 160 | |

| Rent revenue | 750 | |

| Interest expense | (660) | |

| Total other revenues and expenses | 250 | |

| Income before income taxes | 10,450 | |

| Less: Income tax expense | (1,714) | |

| Net income | $8,736 | |

| Earnings per share | $1.09 | |

Table (2)

Working notes:

h. Calculate earnings per share for 6 months:

2 (b)

Prepare the income statement for the second quarter of 2016.

2 (b)

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare the income statement for the second quarter of 2016:

| Company S | ||

| Interim Income statement | ||

| For the period ended June 30, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | 50,000 | |

| Less: Cost of goods sold | (25,600) | |

| Gross profit | 24,400 | |

| Operating expenses: | ||

| Selling expenses | 12,200 | |

| Administrative expenses | 5,990 | |

| Total operating expenses | (18,190) | |

| Pre-tax operating income | 6,210 | |

| Other items: | ||

| Interest revenue | 120 | |

| Rent revenue | 450 | |

| Interest expense | (330) | |

| Total other revenues and expenses | 240 | |

| Income before income taxes | 6,450 | |

| Less: Income tax expense | (1,014) | |

| Net income | $5,436 | |

| Number of shares | 8,000 shares | |

| Earnings per share | $0.68 | |

Table (3)

Working notes:

i. Calculate the amount of sales for second quarter:

j. Calculate the amount of cost of goods sold for 3 months:

k. Calculate the amount of selling expenses for second quarter:

l. Calculate the amount of administrative expenses for second quarter:

m. Calculate the amount of interest revenue for second quarter:

n. Calculate the amount of rent revenue for second quarter:

o. Calculate the amount of interest expense for second quarter:

p. Calculate the amount of income tax expenses for second quarter:

q. Calculate earnings per share for second quarter:

3.

Prepare the statement of

3.

Explanation of Solution

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare the statement of retained earnings for the first 6 months:

| Company S | ||

| Statement of Retained Earnings | ||

| For First 6 Months Ended June 30, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, January 1, 2016 | 29,600 | |

| Add: Net income | 8,736 | |

| Subtotal | 38,336 | |

| Less: Dividends | (3,200) | |

| Retained earnings at June 30, 2016 | $35,136 | |

Table (4)

Working note:

r. Calculate the amount of retained earnings, January 1, 2016:

4.

Prepare the

4.

Explanation of Solution

Balance Sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Interim financial reports: these are the financial reports prepared by the company between the two annual reports.

Prepare the balance sheet as on June 30, 2016 of Company S:

| Company S | ||

| Balance Sheet | ||

| As on June 30, 2016 | ||

| Assets | ||

| Current assets: | Amount ($) | Amount ($) |

| Cash | 7,200 | |

| 9,850 | ||

| Note receivable | 4,000 | |

| Interest receivable | 160 | |

| Inventory | 24,400 | |

| Prepaid insurance | 480 | |

| Total current assets | 46,090 | |

| Property and equipment | 80,000 | |

| (22,350) | ||

| Net property, plant and equipment | 57,650 | |

| Total assets | $103,740 | |

| Liabilities | ||

| Current liabilities: | ||

| Accounts payable | 8,000 | |

| Interest payable | 600 | |

| Dividends payable | 3,200 | |

| Income tax payable | 1,714 | |

| Unearned rent | 1,050 | |

| Bonds payable | 12,000 | |

| Less: Discount on bonds payable | (540) | 11,460 |

| Total liabilities | 26,024 | |

| Shareholders’ Equity | ||

| Contributed Capital: | ||

| Common stock | 8,000 | |

| Additional paid in capital on common stock | 34,580 | |

| Retained earnings | 35,136 | |

| Total shareholders’ equity | 77,716 | |

| Total liabilities and shareholders’ equity | $103,740 | |

Table (5)

Want to see more full solutions like this?

Chapter 5 Solutions

Cengagenowv2, 1 Term Printed Access Card For Wahlen/jones/pagach’s Intermediate Accounting: Reporting And Analysis, 2017 Update, 2nd

- I am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning