Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

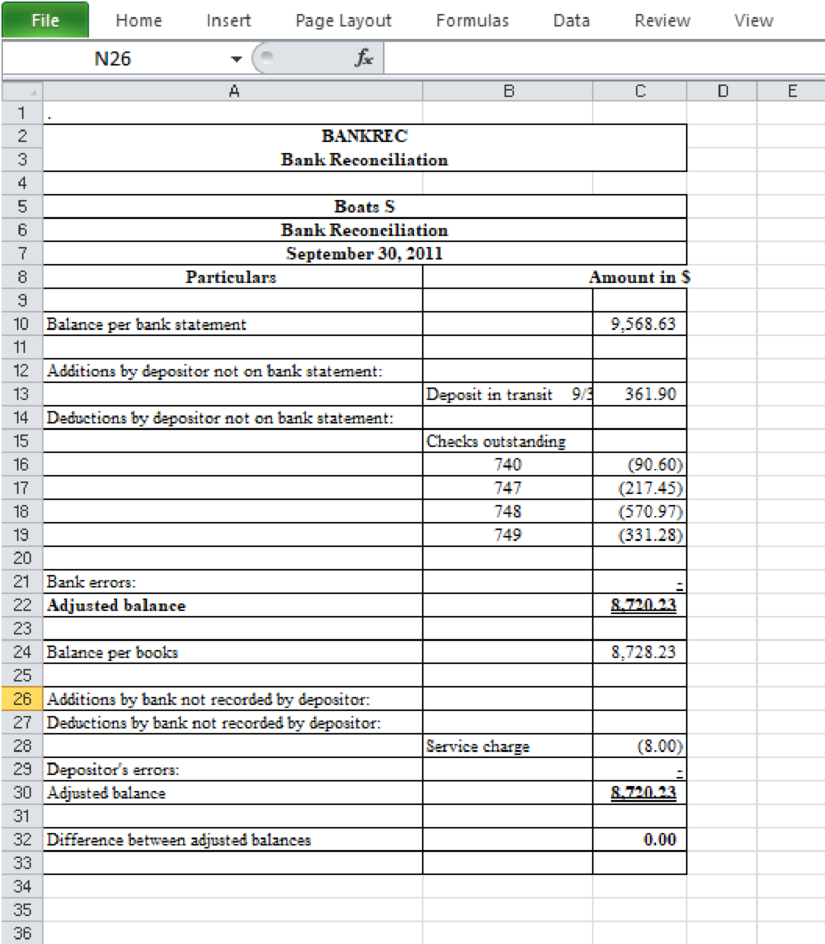

Chapter 5, Problem 1R

To determine

Prepare

Expert Solution & Answer

Explanation of Solution

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Aanya's Boutique had 75 dresses in beginning inventory. During the month, they purchased 50 more dresses and sold 85 dresses. Calculate how many dresses remain in ending inventory.

subject general accounting

What is the effect on net income ?

Chapter 5 Solutions

Excel Applications for Accounting Principles

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please show me the correct way to solve this financial accounting problem with accurate methods.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forward

- Company W reported FIFO ending inventory of $152,600 and beginning inventory of $138,500 for 2022.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardXenta Products has a contribution margin ratio of 40%. The company's break-even point is 75,000 units, and the selling price of its only product is $6.25 per unit. What are the company's fixed expenses?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub