Concept explainers

Inventory

Inventory refers to the stock or goods which will be sold in the near future and thus is an asset for the company. It comprises of the raw materials which are yet to be processed, the stock which is still going through the process of production and it also includes completed products that are ready for sale. Thus inventory is the biggest and the important source of income and profit for the business.

Perpetual Inventory System

In perpetual inventory system there is a continuous recording of transactions as and when they take place that is purchase and sale transactions are recorded whenever they occur.

Cost of Goods Available for Sale

It basically includes the cost of inventory which is ready for sale within an accounting period. It mainly includes the cost of beginning inventory as well as the stock purchased in that year and the production within that period (if any).

Cost of Goods Sold

Cost of goods sold is the total expenses or the cost incurred by the business during the process of manufacturing of goods and is directly related to the production. It generally includes the cost of raw material, labor and other

Gross Profit

The profit made after subtracting or debiting the costs related to the goods sold from the total revenue earned or made through sales in a fiscal year is the gross profit.

First in First out

In case of first in, first out method, also known as FIFO method, the inventory which was bought first will also be the first one to be taken out.

Last in First out

In case of last in, first out, also known as LIFO method, the inventory which was bought in the last will be taken out first.

Weighted Average Cost Method

In this method the weighted average cost is evaluated after any purchases have been made and transactions are recorded as when purchase or sales take place.

Specific Identification Method

Under this method, there is a continuous tracking of the inventory and the inventory cost at the time of purchase on the basis of unique identity which thus helps in the valuation of the ending inventory as well as the cost of goods sold. This method is used generally when the company is involved in limited expensive goods which are easily identifiable.

To compute: 1. Cost of goods available for sale and number of units available for sale.

2. Number of units in ending inventory.

3. Cost of ending inventory under the following methods:

- (a) FIFO

(b)LIFO

(c) Weighted average

(d) Specific identification

Given info,

| Date | Particulars | Units acquired | Cost per unit ($) | Units sold | Retail price per unit ($) |

| Apr 1 | Beginning inventory | 20 | 3,000 | ||

| Apr 6 | Purchase | 30 | 3,500 | ||

| Apr 9 | Sales | 35 | 12,000 | ||

| Apr 17 | Purchase | 5 | 4,500 | ||

| Apr 25 | Purchase | 10 | 4,800 | ||

| Apr 30 | Sales | 25 | 14,000 | ||

| Total | 65 | 60 |

The ending inventory consists of 5 units from April 17.

Explanation of Solution

1.

Cost of goods available for sale

Formula to calculate Cost of goods available for sale is,

Cost and units of goods available for sale:

| Particulars | Number of units | Cost per unit ($) | Amount ($) | |

| Beginning Inventory | 20 | 3000 | 60,000 | |

| Purchases: | ||||

| April 6 | 30 | 3,500 | 105,000 | |

| April 17 | 5 | 4,500 | 22,500 | |

| April 25 | 10 | 4,800 | 48,000 | |

| Total Purchases | 45 | 175,500 | ||

| Available for sale | 65 | 235,500 | ||

| Table (1) | ||||

(2)

Number of units in ending inventory

| Particulars | Number of units | |||

| Number of units available for sale (given) | 65 | |||

| Less: units sold (given) | 60 | |||

| Number of units in ending inventory | 5 | |||

| Table (2) | ||||

The number of units in ending inventory is 5 units.

3.

(a)

First in, First out method (FIFO)

Ending inventory

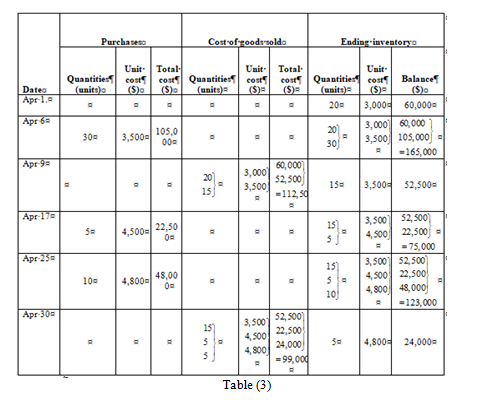

| Date | Purchases | Cost of goods sold | Ending inventory | ||||||

| Quantities (units) | Unit cost ($) | Total cost ($) | Quantities (units) | Unit cost ($) | Total cost ($) | Quantities (units) | Unit cost ($) | Balance ($) | |

| Apr 1. | 20 | 3,000 | 60,000 | ||||||

| Apr 6 | 30 | 3,500 | 105,000 | | | | |||

| Apr 9 | | | | 15 | 3,500 | 52,500 | |||

| Apr 17 | 5 | 4,500 | 22,500 | | | | |||

| Apr 25 | 10 | 4,800 | 48,000 | | | | |||

| Apr 30 | | | | 5 | 4,800 | 24,000 | |||

| Table (4) | |||||||||

Cost of goods sold

Formula to calculate cost of goods sold is,

Substitute $235,500for cost of goods available for sale (calculated in part (1)) and $24,000 for cost of ending inventory (as calculated above in the table) in the above formula.

Under FIFO method, the amount of ending inventory is $24,000 and cost of goods sold is $211,500.

(b)

Last in, first out method (LIFO)

Ending inventory

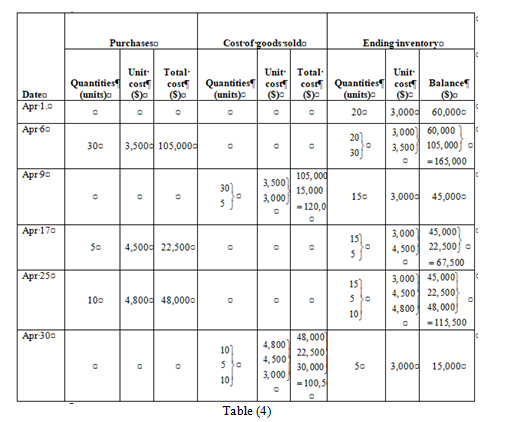

| Date | Purchases | Cost of goods sold | Ending inventory | ||||||

| Quantities (units) | Unit cost ($) | Total cost ($) | Quantities (units) | Unit cost ($) | Total cost ($) | Quantities (units) | Unit cost ($) | Balance ($) | |

| Apr 1. | 20 | 3,000 | 60,000 | ||||||

| Apr 6 | 30 | 3,500 | 105,000 | | | | |||

| Apr 9 | | | | 15 | 3,000 | 45,000 | |||

| Apr 17 | 5 | 4,500 | 22,500 | | | | |||

| Apr 25 | 10 | 4,800 | 48,000 | | | | |||

| Apr 30 | | | | 5 | 3,000 | 15,000 | |||

| Table (6) | |||||||||

Cost of goods sold

Formula to calculate cost of goods sold is,

Substitute $235,500for cost of goods available for sale (calculated in part (1)) and $15,000 for cost of ending inventory (as calculated above in the table) in the above formula.

Under LIFO method, the amount of ending inventory is $15,000 and cost of goods sold is $220,500.

(c)

Weighted Average Method

Ending inventory

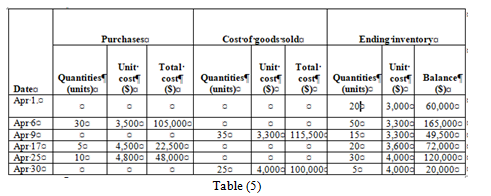

| Date | Purchases | Cost of goods sold | Ending inventory | ||||||

| Quantities (units) | Unit cost ($) | Total cost ($) | Quantities (units) | Unit cost ($) | Total cost ($) | Quantities (units) | Unit cost ($) | Balance ($) | |

| Apr 1. | 20 | 3,000 | 60,000 | ||||||

| Apr 6 | 30 | 3,500 | 105,000 | 50 | 3,300 | 165,000 | |||

| Apr 9 | 35 | 3,300 | 115,500 | 15 | 3,300 | 49,500 | |||

| Apr 17 | 5 | 4,500 | 22,500 | 20 | 3,600 | 72,000 | |||

| Apr 25 | 10 | 4,800 | 48,000 | 30 | 4,000 | 120,000 | |||

| Apr 30 | 25 | 4,000 | 100,000 | 5 | 4,000 | 20,000 | |||

| Table (8) | |||||||||

Working Notes:

Calculation of weighted average cost per unit:

Cost of goods sold

Formula to calculate cost of goods sold is,

Substitute $235,500for cost of goods available for sale (calculated in part (1)) and $20,000 for cost of ending inventory (as calculated above in the table) in the above formula.

Under weighted average method, the amount of ending inventory is $20,000 and cost of goods sold is $215,500.

(d)

Specific identification method

Given info,

The ending inventory consists of 5 units from April 17.

Cost of Ending Inventory

| Date of Purchase | Number of units (A) | Cost per unit ($) (B) | Amount ($) | |

| April 17 | 5 | 4,500 | 22,500 | |

| Cost of Ending Inventory | 22,500 | |||

| Table (9) | ||||

Cost of goods sold

Formula to calculate cost of goods sold is,

Substitute $235,500for cost of goods available for sale (calculated in part (1)) and $22,500 for cost of ending inventory (calculated above in the table) in the above formula.

The cost of ending inventory is $22,500 and the cost of goods sold is $213,000.

4.

Sales are $770,000 (working notes).

Cost of goods sold in case of FIFO is $211,500. (Calculated in part (3(a))

Cost of goods sold in case LIFO is $220,500.(Calculated in part (3(b))

Cost of goods sold in case of weighted average is $215,500 and (Calculated in part (3(c))

Cost of goods sold in case of specific identification is 213,000.(Calculated in part (3(d))

Gross Profit

Formula to calculate gross profit is,

| Particulars | FIFO | LIFO | Weighted average | Specific identification |

| Sales(working notes) | $770,000 | $$770,000 | $770,000 | $770,000 |

| Less: Cost of goods sold | $211,500 | $220,500 | $215,500 | $213,000 |

| Gross profit | $558,500 | $549,500 | $554,500 | $557,000 |

| Table (10) | ||||

Working notes:

Calculation of sales

The gross profit in case of FIFO it is $558,500, of LIFO it is $549,500, of weighted average it is $554,500 and of specific identification it is $557,000.

Want to see more full solutions like this?

Chapter 5 Solutions

GEN CMB FINCL MGRL ACCT CNCT >BI<

- Please help me solve this financial accounting question using the right financial principles.arrow_forwardSales made in fiscal 2025 for $50,000,000 include a 5-year warranty coverage. The estimated cost for warranty is expected to be 2% for each of the first 4 years and 5% for the last year. Determine how much warranty expense will be recorded in fiscal 2025. Question 2 options: $6,500,000 $4,000,000 $1,000,000 $5,000,000arrow_forwardAgree or disagree with the post Financial statements provide raw data, but without analysis, they lack meaningful insight. Different tools help uncover trends, assess financial health, and compare performance effectively. Horizontal analysis tracks changes over time, identifying growth patterns or declines. Vertical analysis expresses financial items as percentages of a base figure, making comparisons across companies easier. Like liquidity, profitability, and solvency measures, ratios offer critical efficiency, risk, and stability assessments. These tools translate numbers into actionable intelligence, helping businesses, investors, and analysts spot risks, make informed decisions, and drive strategic planning. Without them, financial statements can be overwhelming and lack clarity. Agree or disagree with the postarrow_forward

- A $100,000 5-year 6% bond is issued on January 1, 2026. The bond pays interest annually. The market rate is 7%. What is the selling price of the bonds, rounded to the nearest dollar? Question 6 options: $104,213 $95,900 $100,000 $4,100arrow_forwardA $100,000 5-year 6% bond is issued on January 1, 2026. The bond pays interest annually. The market rate is 7%. What is the selling price of the bonds, rounded to the nearest dollar? Question 6 options: $104,213 $95,900 $100,000 $4,100arrow_forwardDell Industries has a normal capacity of 30,000 direct labor hours. The company's variable costs are $45,000, and its fixed costs are $27,000 when operating at normal capacity. What is its standard manufacturing overhead rate per unit?arrow_forward

- Which statement about a "treasury shares" is correct? Question 10 options: These shares continue to have voting rights. These shares must be cancelled upon re-purchase. The company does not pay dividends on these shares. These shares are disclosed as issued and outstanding.arrow_forwardWhich statement best describes the accounting when a company cancels its own shares at an amount higher than the average share value? Question 9 options: Contributed surplus and retained earnings will be debited. Contributed surplus will be debited, thereby decreasing equity. Contributed surplus and retained earnings will be credited. Contributed surplus will be credited, thereby increasing equity.arrow_forwardWhich statement is correct? Question 8 options: A corporation need only pay dividends when it declares them to be payable. A company can avoid a cumulative dividend on preferred shares if it declares dividends on common shares. Dividends are never discretionary payments. Companies must pay the shareholders interest to compensate for the time value of money lost on the deferral of dividend payments. No entryarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education