Concept explainers

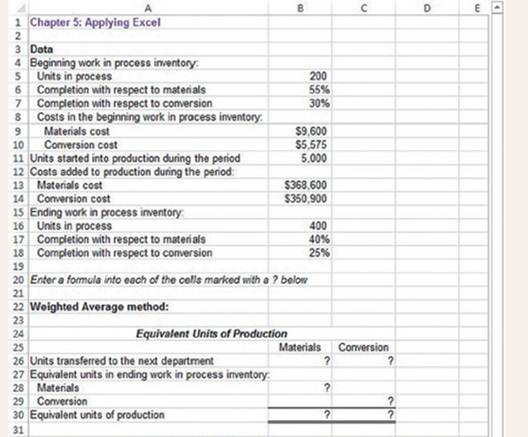

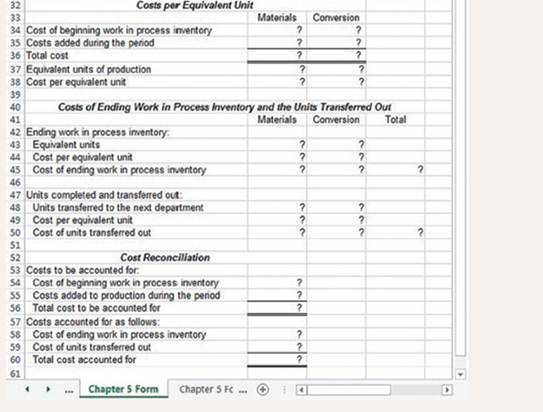

This exercise relates to the Double Diamond Skis’ Shaping and Milling Department that was discussed earlier in the chapter. The Excel worksheet form that appears below consolidates data from Exhibits 5-5 and 5-8. Download the workbook containing this form from Connect, where you will also receive instructions about how to use this worksheet form.

You should proceed to the requirements below only after completing your worksheet.

Required:

- Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50. If you do not get these answers, find the errors in your worksheet and correct them. How much is the total cost of the units transferred out? Did it change? Why or why not?

Total cost of units transferred out.

Unit of goods completed in the production process and transferred to other department during in the period, cost incurred to this completed goods which includes material and conversions jointly is known as total cost of units transferred out.

Total cost of the units transferred out and its cost is changed or not.

Answer to Problem 1AE

Solution:

| Costs per equivalent unit | Materials | Conversion |

| Cost of beginning work in process inventory | 9600 |

5575 |

| Cost added during the period | 368600 | 350900 |

| Total Cost | 378200 | 356475 |

| Equivalent unit of production | 2480 | 2450 |

| Cost per equivalent unit | 152.50 | 145.50 |

Total cost of the units transferred out is $715,200.

Yes, total cost of the units transferred out was changed because current equivalent unit of production was decreased at the same time cost per equivalent unit has increased.

Explanation of Solution

Explanations:

Formulas used:

Calculations:

- Total cost for material= $9600 + $368600=$378,200

Total cost for conversion= $5575+$350900=$356475

Equivalent unit of production for materials = 2400 units +80 units (200 units *40/100=80) =2480units

Equivalent unit of production for conversion = 2400 units +50 units (200 units * 25/100=50) =2450 units.

Cost per equivalent unit for material = $378,200 / 2480units = $152.50

Cost per equivalent unit for conversion=$356475 / 2450 units = $145.50

Units complete and transferred during in the period = 2500 units -100 units=2400

Total cost of the units transferred out = 2400 * $298 ($152.50+$145.50=$298) =$715,200.

Above calculation derived given cost per equivalent unit for materials as well as conversion also derived total cost of the units transferred and above explanation stated total cost of the units transferred out was changed.

Want to see more full solutions like this?

Chapter 5 Solutions

GEN COMBO LOOSELEAF INTRODUCTION TO MANAGERIAL ACCOUNTING; CONNECT AC

- If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardWhich of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardWhat type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenueneed helparrow_forwardno ai What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forward

- Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forwardHelp Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning