Loose Leaf for Corporate Finance Format: Loose-leaf

12th Edition

ISBN: 9781260139716

Author: Ross

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 18QAP

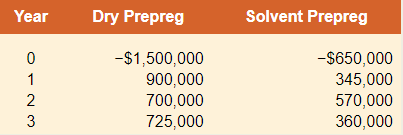

Comparing Investment Criteria Consider the following cash flows of two mutually exclusive projects for Tokyo Rubber Company. Assume the discount rate for both projects is 8 percent.

a. Based on the payback period, which project should be taken?

b. Based on the

c. Based on the

d. Based on this analysis, is incremental IRR analysis necessary? If yes, please conduct the analysis.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The beta of a stock measures:

A. Total riskB. Unsystematic riskC. Systematic riskD. Credit risk

finance pr

no chatgpt

The beta of a stock measures:

A. Total riskB. Unsystematic riskC. Systematic riskD. Credit risk

A bond with a face value of $1,000 and a 10% coupon pays:

A. $1,000 annuallyB. $10 annuallyC. $100 annuallyD. $110 annuallyneed help.

Chapter 5 Solutions

Loose Leaf for Corporate Finance Format: Loose-leaf

Ch. 5 - Payback Period and Net Present Value If a project...Ch. 5 - Net Present Value Suppose a project has...Ch. 5 - Comparing Investment Criteria Define each of the...Ch. 5 - Payback and Internal Rate of Return A project has...Ch. 5 - Prob. 5CQCh. 5 - Capital Budgeting Problems What are some of the...Ch. 5 - Prob. 7CQCh. 5 - Prob. 8CQCh. 5 - Net Present Value versus Profitability Index...Ch. 5 - Internal Rate of Return Projects A and B have the...

Ch. 5 - Net Present Value You are evaluating Project A and...Ch. 5 - Modified Internal Rate of Return One of the less...Ch. 5 - Net Present Value It is sometimes stated that the...Ch. 5 - Prob. 14CQCh. 5 - Prob. 1QAPCh. 5 - Prob. 2QAPCh. 5 - Prob. 3QAPCh. 5 - Prob. 4QAPCh. 5 - Prob. 5QAPCh. 5 - Prob. 6QAPCh. 5 - Prob. 7QAPCh. 5 - Prob. 8QAPCh. 5 - Prob. 9QAPCh. 5 - Prob. 10QAPCh. 5 - NPV versus IRR Consider the following cash flows...Ch. 5 - Prob. 12QAPCh. 5 - Prob. 13QAPCh. 5 - Prob. 14QAPCh. 5 - Prob. 15QAPCh. 5 - Comparing Investment Criteria Consider the...Ch. 5 - Prob. 17QAPCh. 5 - Comparing Investment Criteria Consider the...Ch. 5 - Prob. 19QAPCh. 5 - Prob. 20QAPCh. 5 - MIRR Suppose the company in the previous problem...Ch. 5 - Prob. 22QAPCh. 5 - Prob. 23QAPCh. 5 - Prob. 24QAPCh. 5 - Prob. 25QAPCh. 5 - Prob. 26QAPCh. 5 - Prob. 27QAPCh. 5 - Prob. 28QAPCh. 5 - Prob. 29QAPCh. 5 - Prob. 30QAPCh. 5 - Construct a spreadsheet to calculate the payback...Ch. 5 - Based on your analysis, should the company open...Ch. 5 - Prob. 3MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The beta of a stock measures: A. Total riskB. Unsystematic riskC. Systematic riskD. Credit riskarrow_forwardGive answer The beta of a stock measures: A. Total riskB. Unsystematic riskC. Systematic riskD. Credit riskarrow_forwardI need help A bond with a face value of $1,000 and a 10% coupon pays: A. $1,000 annuallyB. $10 annuallyC. $100 annuallyD. $110 annuallyarrow_forward

- I want the correct answer with financial accounting questionarrow_forwardAs a finance manager for a major utility company. Thinking about some of the capital budgeting techniques that I might use for some upcoming projects. I need help Discussing at least 2 capital budgeting techniques and how my company can benefit from the use of these tools.arrow_forwardI need assistance with this financial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Risks - Part 1; Author: KnowledgEquity - Support for CPA;https://www.youtube.com/watch?v=mFjSYlBS-VE;License: Standard youtube license