1.

Prepare the worksheet to develop Company S’s financial statements for the first 6 months of 2019.

1.

Explanation of Solution

Worksheet: A worksheet is a tool that is used while preparing a financial statement. It is a type of form, having multiple columns and it is used in the adjustment process.

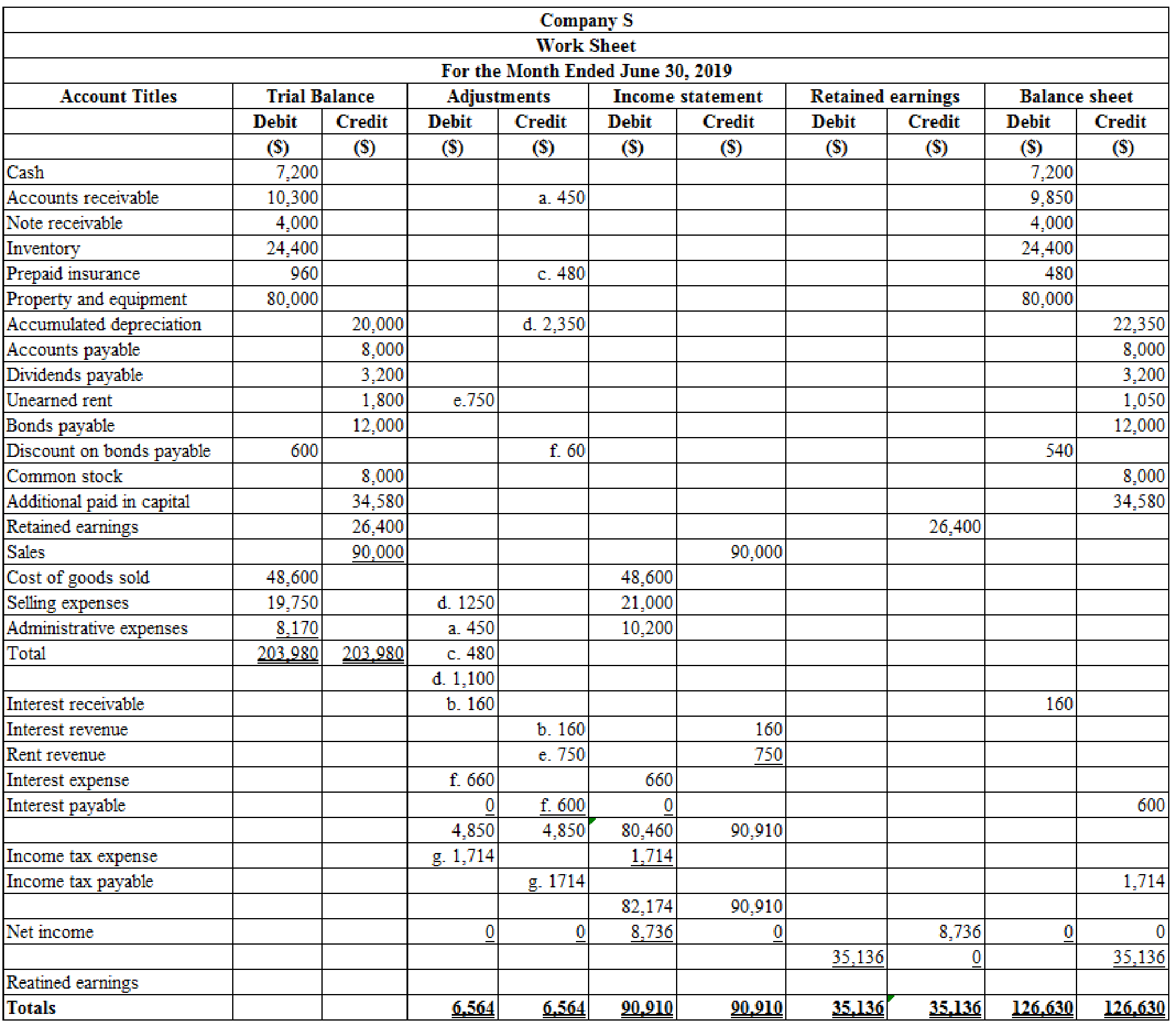

Prepare the worksheet to develop Company S’s financial statements for the first 6 months of 2019:

Table (1)

Working notes:

a. Calculate the amount of

b. Calculate the amount of interest revenue:

c. Calculate the amount of insurance expense:

d. Calculate the amount of

e. Calculate the amount of rent revenue:

f. Calculate the amount of interest expense:

g. Calculate the amount of income tax expense for first 6 months:

Calculate estimated annual pre-tax income:

Calculate estimated effective income tax rate:

Calculate the amount of income tax expense for first 6 months:

2 (a)

Prepare the income statement for the first 6 months of 2019.

2 (a)

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare the income statement for the first 6 months of 2019:

| Company S | ||

| Interim Income statement | ||

| For the period ended June 30, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | 90,000 | |

| Less: Cost of goods sold | (48,600) | |

| Gross profit | 41,400 | |

| Operating expenses: | ||

| Selling expenses | 21,000 | |

| Administrative expenses | 10,200 | |

| Total operating expenses | (31,200) | |

| Pre-tax operating income | 10,200 | |

| Other items: | ||

| Interest revenue | 160 | |

| Rent revenue | 750 | |

| Interest expense | (660) | |

| Total other revenues and expenses | 250 | |

| Income before income taxes | 10,450 | |

| Less: Income tax expense | (1,714) | |

| Net income | $8,736 | |

| Earnings per share | $1.09 | |

Table (2)

Working notes:

h. Calculate earnings per share for 6 months:

2 (b)

Prepare the income statement for the second quarter of 2019.

2 (b)

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare the income statement for the second quarter of 2019:

| Company S | ||

| Interim Income statement | ||

| For the period ended June 30, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | 50,000 | |

| Less: Cost of goods sold | (25,600) | |

| Gross profit | 24,400 | |

| Operating expenses: | ||

| Selling expenses | 12,200 | |

| Administrative expenses | 5,990 | |

| Total operating expenses | (18,190) | |

| Pre-tax operating income | 6,210 | |

| Other items: | ||

| Interest revenue | 120 | |

| Rent revenue | 450 | |

| Interest expense | (330) | |

| Total other revenues and expenses | 240 | |

| Income before income taxes | 6,450 | |

| Less: Income tax expense | (1,014) | |

| Net income | $5,436 | |

| Earnings per share | $0.68 | |

Table (3)

Working notes:

i. Calculate the amount of sales for second quarter:

j. Calculate the amount of cost of goods sold for 3 months:

k. Calculate the amount of selling expenses for second quarter:

l. Calculate the amount of administrative expenses for second quarter:

m. Calculate the amount of interest revenue for second quarter:

n. Calculate the amount of rent revenue for second quarter:

o. Calculate the amount of interest expense for second quarter:

p. Calculate the amount of income tax expenses for second quarter:

q. Calculate earnings per share for second quarter:

3.

Prepare the statement of

3.

Explanation of Solution

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare the statement of retained earnings for the first 6 months:

| Company S | ||

| Statement of Retained Earnings | ||

| For First 6 Months Ended June 30, 2019 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, January 1, 2019 | 29,600 | |

| Add: Net income | 8,736 | |

| Subtotal | 38,336 | |

| Less: Dividends | (3,200) | |

| Retained earnings at June 30, 2019 | $35,136 | |

Table (4)

Working note:

r. Calculate the amount of retained earnings, January 1, 2019:

4.

Prepare the

4.

Explanation of Solution

Balance Sheet: Balance Sheet is one of the financial statements which summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Interim financial reports: these are the financial reports prepared by the company between the two annual reports.

Prepare the balance sheet as on June 30, 2019 of Company S:

| Company S | ||

| Balance Sheet | ||

| As on June 30, 2019 | ||

| Assets | ||

| Current assets: | Amount ($) | Amount ($) |

| Cash | 7,200 | |

| Accounts receivable | 9,850 | |

| Note receivable | 4,000 | |

| Interest receivable | 160 | |

| Inventory | 24,400 | |

| Prepaid insurance | 480 | |

| Total current assets | 46,090 | |

| Property and equipment | 80,000 | |

| Accumulated depreciation | (22,350) | |

| Net property, plant and equipment | 57,650 | |

| Total assets | $103,740 | |

| Liabilities | ||

| Current liabilities: | ||

| Accounts payable | 8,000 | |

| Interest payable | 600 | |

| Dividends payable | 3,200 | |

| Income tax payable | 1,714 | |

| Unearned rent | 1,050 | |

| Bonds payable | 12,000 | |

| Less: Discount on bonds payable | (540) | 11,460 |

| Total liabilities | 26,024 | |

| Shareholders’ Equity | ||

| Contributed Capital: | ||

| Common stock | 8,000 | |

| Additional paid in capital on common stock | 34,580 | |

| Retained earnings | 35,136 | |

| Total shareholders’ equity | 77,716 | |

| Total liabilities and shareholders’ equity | $103,740 | |

Table (5)

Want to see more full solutions like this?

Chapter 5 Solutions

Intermediate Accounting: Reporting and Analysis - With Access

- MOH Cost: Top Dog Company has a budget with sales of 7,500 units and $3,400,000. Variable costs are budgeted at $1,850,000, and fixed overhead is budgeted at $970,000. What is the budgeted manufacturing cost per unit?arrow_forwardWhat was Ghana's cost of goods sold for 2023?arrow_forwardNeed Answerarrow_forward

- Sameer has $9,800 of net long-term capital gain and $5,200 of net short-term capital loss. This nets out to a: (a) $4,700 net long-term loss (b) $4,600 net long-term gain (c) $4,700 net short-term gain (d) $4,700 short-term loss helparrow_forwardWhat is the adjusted cost of goods sold for the year?arrow_forwardcan you show the step by step i am confused on a partarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning