Concept explainers

JOURNALIZE AND

REQUIRED

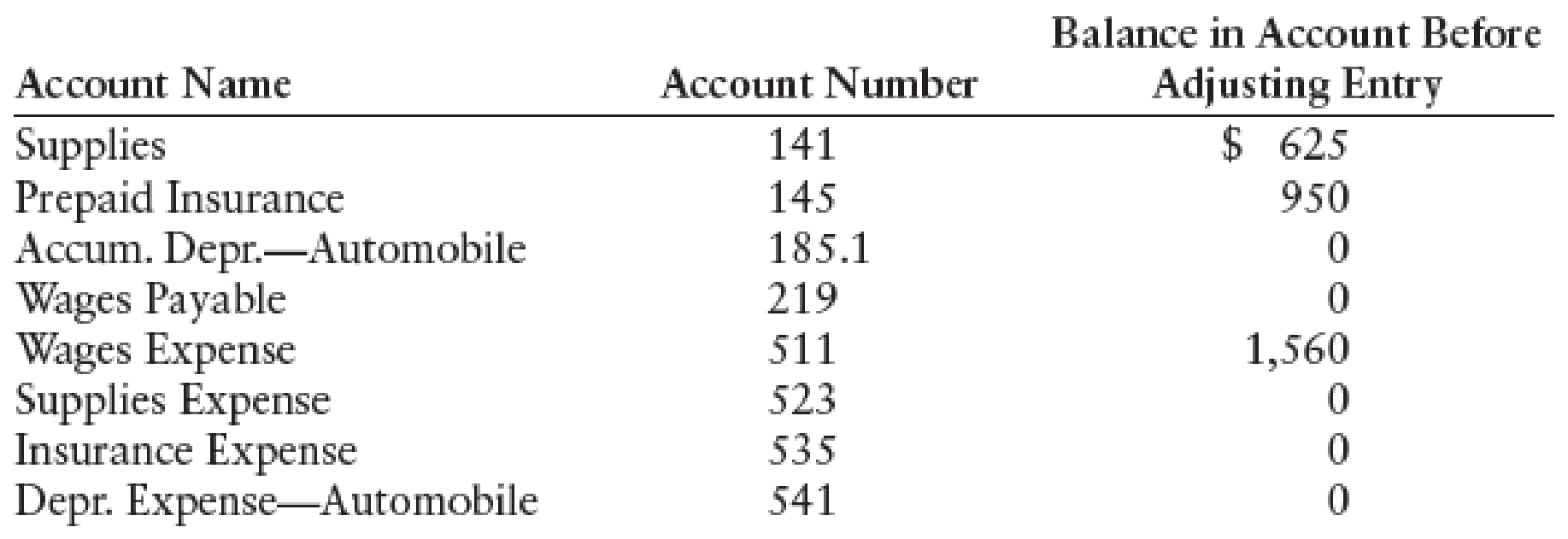

- 1. Journalize the adjusting entries on page 3 of the general journal.

- 2. Post the adjusting entries to the general ledger. (If you are not using the working papers that accompany this text, enter the balances provided in this problem before posting the adjusting entries.)

1.

Prepare adjusting entries for the given transactions.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Prepare adjusting entries for the ending inventory on supplies on October 31, $210.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| October 31 | Supplies expense | 523 | 415 | |

| Supplies | 141 | 415 | ||

| (To record the additional amount of supplies that must be used) |

Table (1)

- Supplies expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the supplies expense by $415.

- Supplies are an asset and there is decrease in the value of an asset. Hence, credit the supplies by 415.

Prepare adjusting entries for the unexpired insurance as of October 31, $800.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| October 31 | Insurance expense | 535 | 150 | |

| Prepaid insurance | 145 | 150 | ||

| (To record the insurance expense during the end of the year.) |

Table (2)

- Insurance expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the insurance expense by $150.

- Prepaid insurance is an asset and there is decrease in the value of an asset. Hence, credit the prepaid insurance by $150.

Prepare adjusting entries for the depreciation of automobile, $250.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| October 31 | Depreciation expense | 541 | 250 | |

| Accumulated depreciation | 185.1 | 250 | ||

| (To record the depreciation expense at the end accounting of the year.) |

Table (3)

- Depreciation expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the depreciation expense by $250.

- Accumulated depreciation is a contra asset and it has increased. Therefore, credit the accumulated depreciation by $250.

Prepare adjusting entries for the wages earned but not yet paid as of October 31, $175.

| Date | Account Titles and explanation | Post. Ref. | Debit ($) | Credit ($) |

| October 31 | Wages expense | 511 | 175 | |

| Wages payable | 219 | 175 | ||

| (To record the wages earned but not yet paid to the employees at the end of the year.) |

Table (4)

- Wages expense (Expense) is a component of stockholder’s equity and there is an increase in the value of expense. Hence, debit the wages expense by $175.

- Wages payable is a liability and there is an increase in the value of the liability. Hence, credit the wages payable by $175.

2.

Post the adjusting entries to the general ledger.

Explanation of Solution

Post the adjusting entries to the general ledger.

| Supplies Account No: 141 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 1 | Unadjusted | 625 | 625 | |||

| 31 | Adjusting | 415 | 210 | ||||

(Table 5)

| Prepaid insurance Account No: 145 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 1 | Unadjusted | 950 | 950 | |||

| 31 | Adjusting | 150 | 800 | ||||

(Table 6)

| Accumulated Depreciation-Automobile Account No: 185.1 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 250 | 250 | |||

(Table 7)

| Wages Payable Account No: 219 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 175 | 175 | |||

(Table 8)

| Wages Expense Account No: 511 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 1 | Unadjusted | 1,560 | ||||

| 31 | Adjusting | 175 | 1,735 | ||||

(Table 9)

| Supplies expense Account No: 523 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 415 | 415 | |||

(Table 10)

| Insurance Expense Account No: 535 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 150 | 150 | |||

(Table 11)

| Depreciation expense-Automobile Account No: 541 | |||||||

| Date | Item | Post ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| October | 31 | Adjusting | 250 | 250 | |||

(Table 12)

Want to see more full solutions like this?

Chapter 5 Solutions

College Accounting, Chapter 1-15 (Looseleaf)

- I need help with this financial accounting question using standard accounting techniques.arrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardI am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub