FUNDAMENTAL ACCOUNTING PRINCIPLES

24th Edition

ISBN: 9781260811704

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 5, Problem 14QS

To determine

Concept Introduction:

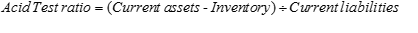

Acid test ratio:

It is also known as

Current assets:

These assets appear on the assets side of the Balance Sheet and are expected to be converted into cash within a year.

Current Liabilities:

These are those obligations of a company that are due within a year.

Formula to compute acid test ratio is:

To Compute:

The acid test ratio and interpret its results and explain what the acid test ratio of a company measures.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this general accounting problem using accurate calculation methods?

Solve this financial accounting problem

Provide right answer

Chapter 5 Solutions

FUNDAMENTAL ACCOUNTING PRINCIPLES

Ch. 5 - Prob. 1DQCh. 5 - Prob. 2DQCh. 5 - Prob. 3DQCh. 5 - Prob. 4DQCh. 5 - 5. How does a company that uses a perpetual...Ch. 5 - Prob. 6DQCh. 5 - What is the difference between a sales discount...Ch. 5 - Prob. 8DQCh. 5 - Prob. 9DQCh. 5 - What is the difference between the single-step and...

Ch. 5 - Prob. 11DQCh. 5 - Prob. 12DQCh. 5 - Prob. 13DQCh. 5 - Refer to the income statement of Samsung in...Ch. 5 - Prob. 15DQCh. 5 - Applying merchandising terms C1 P1 Enter the...Ch. 5 - Identifying inventory costs C2 Costs of $5.000...Ch. 5 - Merchandise accounts and computations C2 Use the...Ch. 5 - Computing net invoice amounts P1 Compute the...Ch. 5 - Recording purchases, returns, and discounts taken...Ch. 5 - Recording purchases and discounts taken P1 Prepare...Ch. 5 - Recording purchases and discounts missed Pl...Ch. 5 - Recording sales, returns, and discounts taken P2...Ch. 5 - Accounting for shrinkage—perpetual system P3...Ch. 5 - Closing entries P3 Refer to QS 5-9 and prepare...Ch. 5 - Multiple-step income statement P4 For each item...Ch. 5 - Preparing a multiple-step income statement P4...Ch. 5 - Exercise 5-13 Physical count error and profits A2...Ch. 5 - Prob. 14QSCh. 5 - Prob. 15QSCh. 5 - Prob. 16QSCh. 5 - Recording purchases, returns, and...Ch. 5 - Recording sales. returns, and discounts—periodic &...Ch. 5 - Prob. 19QSCh. 5 - Prob. 20QSCh. 5 - Prob. 21QSCh. 5 - Prob. 22QSCh. 5 - QS 5-23 Sales transactions P2

Prepare journal...Ch. 5 - Exercise 5-1 Computing revenues, expenses, and...Ch. 5 - Prob. 2ECh. 5 - Exercise 5-3 Recording purchases, purchases...Ch. 5 - Exercise 5-4 Recording sales, sales returns, and...Ch. 5 - Exercise 5.5 Recording purchases, purchases...Ch. 5 - Exercise 5-6 Recording sales, purchases, and cash...Ch. 5 - Exercise 5-7 Recording sales, purchases, shipping,...Ch. 5 - Exercise 5-8 Inventory and cost of sales...Ch. 5 - Exercise 5-9 Recording purchases, sales, returns,...Ch. 5 - Exercise 5-10 Preparing adjusting and closing...Ch. 5 - Prob. 11ECh. 5 - Exercise 5-12 Impacts of inventory error on key...Ch. 5 - Exercise 5-13 Physical count error and profits...Ch. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Prob. 18ECh. 5 - Prob. 19ECh. 5 - Prob. 20ECh. 5 - Prob. 21ECh. 5 - Prob. 22ECh. 5 - Prob. 23ECh. 5 - Prob. 24ECh. 5 - Prob. 25ECh. 5 - Problem 5-1A

Preparing journal entries for...Ch. 5 - Problem 5-2A

Preparing journal entries for...Ch. 5 - Problem 5-3A Computing merchandising amounts and...Ch. 5 - Problem 5-4A Preparing closing entries and...Ch. 5 - Prob. 5APSACh. 5 - Problem 5-1 B

Preparing journal entries for...Ch. 5 - Problem 5-2B

Preparing journal entries for...Ch. 5 - Problem 5-3B Computing merchandising amounts and...Ch. 5 - Problem 5-4B Preparing closing entries and...Ch. 5 - Problem 5-5B Preparing adjusting entries and...Ch. 5 - SP 5 Santana Rey created Business Solutions on...Ch. 5 - Prob. 1GLPCh. 5 - Prob. 2GLPCh. 5 - Prob. 3GLPCh. 5 - Prob. 1AACh. 5 - Key comparative figures for Apple and Google...Ch. 5 - Prob. 3AACh. 5 - Prob. 1BTNCh. 5 - Prob. 2BTNCh. 5 - Prob. 3BTNCh. 5 - Prob. 4BTNCh. 5 - Prob. 5BTNCh. 5 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the end of the year, actual manufacturing overhead costs were $120,000, and applied manufacturing overhead costs were 136,500. If the denominator activity for the year was 20,000 machine hours, and if 21,000 standard machine hours were allowed for the year's production, calculate the predetermined overhead rate per machine hour.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardStep by step answerarrow_forward

- I need help with this general accounting question using the proper accounting approach.arrow_forwardIn 2023, Siemens Industries sold 5,500 units at $420 each. Variable expenses were $275 per unit, and fixed expenses were $693,000. The same variable expenses per unit and fixed expenses are expected for 2024. If Siemens cuts selling price by 6%, what is Siemens's break-even point in units for 2024? Correct answerarrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

- Calculate the total fixed expense for the year.arrow_forwardAccountingarrow_forwardMeridian Business Group obtained an office building, parking lot, and furniture in a lump-sum purchase for $520,000. An appraisal set the value of the office building at $312,000, the parking lot at $208,000, and the furniture at $104,000. At what amount should Meridian Business Group record each new asset on its books?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Chapter 19 Accounting for Income Taxes Part 1; Author: Vicki Stewart;https://www.youtube.com/watch?v=FMjwcdZhLoE;License: Standard Youtube License