PRINCIPLES OF CORPORATE FINANCE

13th Edition

ISBN: 9781264052059

Author: BREALEY

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 14PS

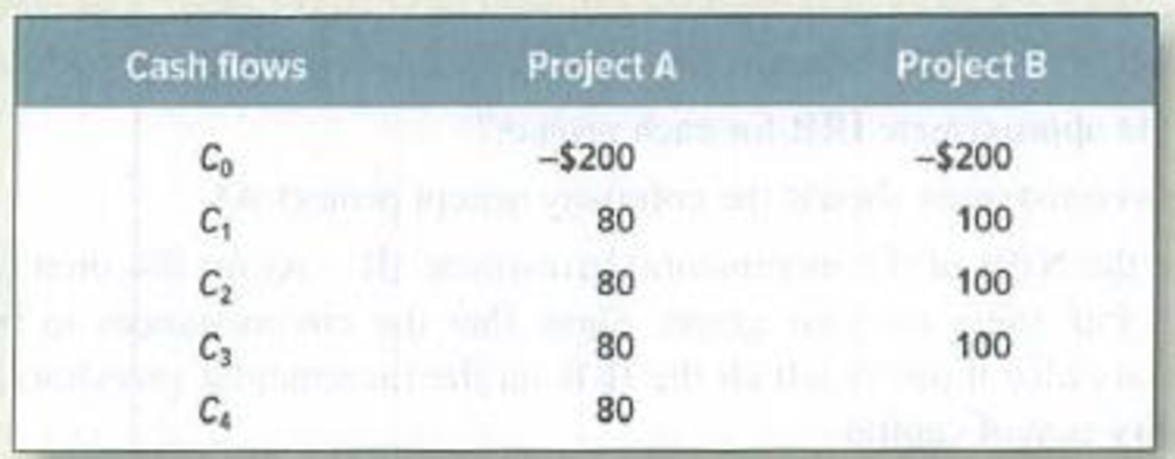

Investment criteria Consider the following two projects:

- a. If the opportunity cost of capital is 11%, which of these two projects would you accept (A, B, or both)?

- b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 11%.

- c. Which one would you choose if the cost of capital is 16%?

- d. What is the payback period of each project?

- e. Is the project with the shortest payback period also the one with the highest

NPV ? - f. What are the

internal rates of return on the two projects? - g. Does the IRR rule in this case give the same answer as NPV?

- h. If the opportunity cost of capital is 11%, what is the profitability index for each project? Is the project with the highest profitability index also the one with the highest NPV? Which measure should you use to choose between the projects?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the difference between a contra asset account and a liability?i need help.

What is the significance of a company’s price-to-earnings (P/E) ratio? i need answer.

What is the significance of a company’s price-to-earnings (P/E) ratio?

Chapter 5 Solutions

PRINCIPLES OF CORPORATE FINANCE

Ch. 5 - (IRR) Check the IRRs for project F in Section 5-3.Ch. 5 - (IRR) What is the IRR of a project with the...Ch. 5 - (XIRR) What is the IRR of a project with the...Ch. 5 - Payback a. What is the payback period on each of...Ch. 5 - Payback Consider the following projects: a. If the...Ch. 5 - Prob. 3PSCh. 5 - IRR Write down the equation defining a projects...Ch. 5 - Prob. 5PSCh. 5 - IRR Calculate the IRR (or IRRs) for the following...Ch. 5 - IRR rule You have the chance to participate in a...

Ch. 5 - IRR rule Consider a project with the following...Ch. 5 - IRR rule Consider projects Alpha and Beta: The...Ch. 5 - IRR rule Consider the following two mutually...Ch. 5 - IRR rule Mr. Cyrus Clops, the president of Giant...Ch. 5 - Prob. 12PSCh. 5 - Investment criteria Consider the following two...Ch. 5 - Profitability index Look again at projects D and E...Ch. 5 - Capital rationing Suppose you have the following...Ch. 5 - Prob. 17PSCh. 5 - Prob. 18PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License