a.

Calculate FICA tax (OASDI and HI) to be withheld for each person.

a.

Explanation of Solution

Federal Insurance Contributions Act (FICA) tax: Federal government imposes taxes on the employees’ pay to provide benefits to retired, old age, orphans, and disabled. This tax is also referred to as Social Security tax because the program is devised to benefit the society. FICA tax includes two components, OASDI (Old age, survivors, and disability insurance), and HI (health insurance).

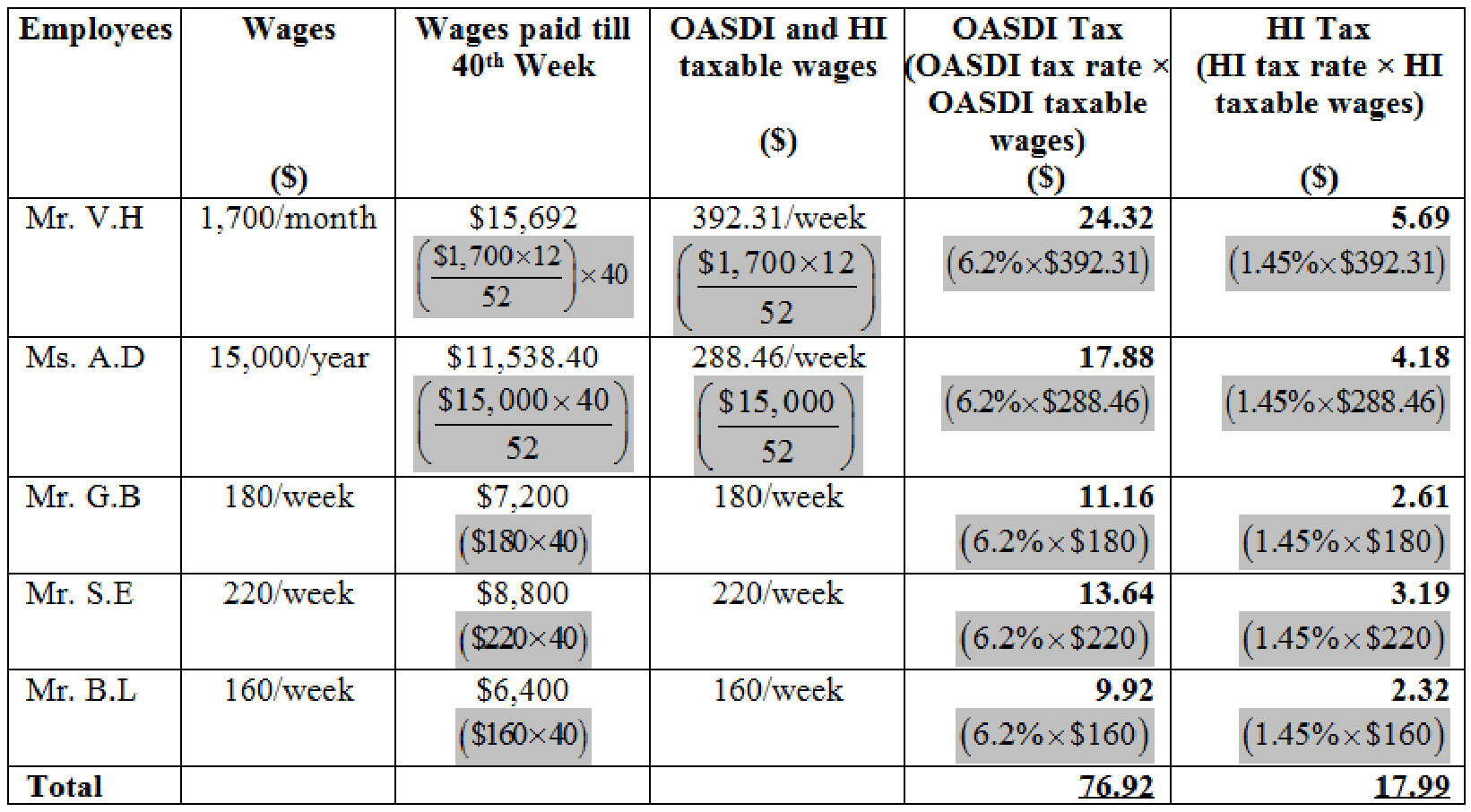

Calculate FICA tax (OASDI and HI) to be withheld for each person.

Table (1)

Note 1: For all the employees, the wages paid till 40th Week is less than the taxable wage limit of $128,400. Hence, full weekly wages of each employee will be taxable for OASDI and HI.

Note 2: The amount received by both the partners is considered as the drawings and not a salary. Thus, FICA taxes are not imposed.

b.

Calculate the amount of the employer’s FICA taxes for the weekly payroll.

b.

Explanation of Solution

Calculate the amount of the employer’s FICA taxes for the weekly payroll.

c.

Calculate the amount of state

c.

Explanation of Solution

State unemployment compensation tax (SUTA): This is the compensation provided to the unemployed people by the state government from the taxes collected from the employers, as a percentage of 5.4% of employees’ payrolls.

Calculate the amount of state unemployment contributions for the weekly payroll.

Step 1: Compute 41st week taxable wages of employee’s for SUTA.

| Employee | Designation | Wages ($) | Wages up to 40th week ($) | Taxable wages on 41st week ($) |

| Mr. V.H | General office worker | 1,700/month |

15,692.40 |

- |

| Ms. A.D | Saleswoman | 15,000/year |

11,538.46 |

- |

| Mr. G.B | Stock clerk | 180/week |

7,200 |

180 |

| Mr. S.E | Deliveryman | 220/week |

8,800 |

- |

| Mr. B.L | Cleaning and maintenance, part-time | 160/week |

6,400 |

160 |

| Total | 340 |

Table (2)

Note 1: For Mr. V.H, Ms. A.D, and Mr. S.E, up to 40th week, the wages is crossing the limit of $8,100. So, none of the wages is taxable in 41st week.

Note 2: For Mr. G.B, up to 40th week, the wages of $7,200 is not crossing the limit of $8,100. So, the full wages of $180 is taxable in 41st week.

Note 3: For Mr. B.L, up to 40th week, the wages of $6,400 is not crossing the limit of $8,100. So, the full wages of $160 is taxable in 41st week.

Step 2: Compute the amount of state unemployment contributions for the weekly payroll.

Hence, the amount of state unemployment contributions for the weekly payroll is $10.54.

d.

Calculate net FUTA tax on the payroll.

d.

Explanation of Solution

Federal unemployment compensation tax (FUTA): This is the compensation provided to the unemployed people by the federal government from the taxes collected from the employers, as a percentage of 6.0% on the first $7,000 of employees’ earnings. Federal government refunds the employers with 5.4% on FUTA, if the employers have paid SUTA. So, FUTA would be reduced to 0.6% for those employers.

Calculate net FUTA tax on the payroll.

Step 1: Compute 41st week taxable wages of employee’s for FUTA.

| Employee | Designation | Wages ($) | Wages up to 40th week ($) | Taxable wages on 41st week ($) |

| Mr. V.H | General office worker | 1,700/month |

15,692.40 |

- |

| Ms. A.D | Saleswoman | 15,000/year |

11,538.46 |

- |

| Mr. G.B | Stock clerk | 180/week |

7,200 |

- |

| Mr. S.E | Deliveryman | 220/week |

8,800 |

- |

| Mr. B.L | Cleaning and maintenance, part-time | 160/week |

6,400 |

160 |

| Total | 160 |

Table (3)

Note 1: For Mr. V.H, Ms. A.D, Mr. GB, and Mr. S.E, up to 40th week, the wages is crossing the limit of $7,000. So, none of the wages is taxable in 41st week.

Note 3: For Mr. B.L, up to 40th week, the wages of $6,400 is not crossing the limit of $7,000. So, the full wages of $160 is taxable in 41st week.

Step 2: Calculate net FUTA tax.

Hence, the net FUTA tax on the payroll is $0.96.

e.

Calculate the total amount of employer’s payroll taxes for the weekly payroll.

e.

Explanation of Solution

| Calculation of employer’s payroll taxes | |

| Type of Tax | Tax Amount |

| OASDI | $76.92 |

| HI | $17.99 |

| FUTA | $0.96 |

| SUTA | $10.54 |

| Total employer’s payroll taxes | $106.41 |

Table (4)

Hence, the total amount of employer’s payroll taxes for the weekly payroll is $106.41.

Want to see more full solutions like this?

Chapter 5 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

- Hii teacher please provide for General accounting question answer do fastarrow_forwardMosco Industries manufactures a single product and follows a JIT policy where ending inventory must equal 20% of the next month's sales. It estimates that November's ending inventory will consist of 32,000 units. December and January sales are estimated to be 210,000 and 225,000 units, respectively. Mosco assigns variable overhead at a rate of $2.85 per unit of production. Fixed overhead equals $375,000 per month. Compute the number of units to be produced and the total budgeted overhead that would appear on the factory overhead budget for the month of December.arrow_forwardGiven the solution and accountingarrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardTrevino Manufacturing Company produces custom jackets. Each jacket (unit) requires 3.5 yards of material. Selected data from Trevino's master budget for next quarter are shown below: Each unit requires 2.4 hours of direct labor, and the average hourly cost of Trevino's direct labor is $14.50. What is the cost of Trevino Manufacturing Company's direct labor in November if they produce 8,200 jackets?arrow_forwardGeneral accountingarrow_forward