Concept explainers

Comprehensive Problem; Second Production Department-Weighted-Average Method

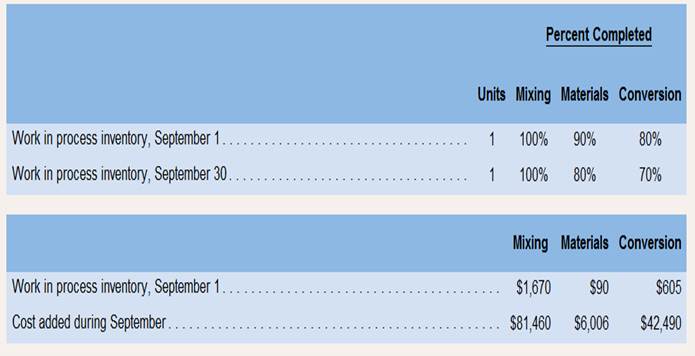

Old Country Links, Inc. produces sausages in three production department-Mixing, Casing and Curing, and Packaging. In the Mixing Department, meats are prepared and ground and then mixed with spices. The spiced meat mixture is then transferred to the Casing and Curing Department, where the mixture is force-fed into casings and then hung and cured in climate-controlled smoking chambers. In the packaging Department, the cured sausages are sorted, packed, and labeled. The company uses the weighted-average method in its

Required:

- Determine the Casing and Curing Department’s equivalent units of production for mixing, material, and conversion for the month of September. Do not round off your computations.

- Compute the Casing and Curing Department’s cost per equivalent unit for mixing, materials, and conversion for the month of September.

- Compute the Casing and Curing Department’s cost of ending work in process inventory for mixing, materials, conversion, and total for September.

- Compute the Casing and Curing Department’s cost of units transferred out to the Packaging Department for mixing materials, conversion, and in total for September.

- Prepare a cost reconciliation report for the Casing and Curing Department for September.

Computation of equivalent units for each element of cost, cost per equivalent unit and total cost of ending inventory and completed units describes the steps taken for computation of total units completed and equivalents units of each element of cost. The total cost of ending work in process and completed and transferred out shall be determined based on equivalent units and cost per equivalent units. The total units completed are computed by considering the total units in process and ending work in process units. The reconciliation statement of total cost to account and accounted has to be reconciled.

Requirement1:

TheEquivalent number units of each element of cost

Answer to Problem 13P

Solution: The total units completed and transferred out from process and equivalent units shall be as under:

| UNITS TO ACCOUNT FOR:

Beginning Work in Process units Add: Units Started in Process Total Units to account for: |

50.00 1.00 __________ 51.00 | |

|

UNITS TO BE ACCOUNTED FOR:

Units Completed Ending Work in Process Total Units to be accounted for: |

50.00 1.00 51.00 ________ 51.00 | |

Explanation of Solution

The computation of total units completed and transferred out shall be based on the total units in the process during the year. The total units to account for in the process is sum of beginning units of work in process and units started in the process during the year. The Ending units of work in process which is still in process at the end of the year shall be deducted from the total to find out the units completed and transferred out.

When the units completed in previous process is transferred to next process, then the cost of such completed units is taken as Transferred-in Cost of next process and the equivalent units for such Transferred in cost shall also be computed along with material and Conversion cost in next process. For computing the equivalent units of Transferred-in cost, equivalents units for units in process at the end shall be taken on the basis of 100% degree of completion as regards to Transferred-in cost (as the processing in previous process is completed in full which is represented by Transferred-in cost)

Requirement2:

To conclude, it must be said that the equivalent units in each inventory shall multiplied with respective cost per equivalent unit and cost of each element is added up to arrive at the total cost of ending work in process and completed units.

The Cost perequivalent unit for each element of cost

Answer to Problem 13P

Solution: The statement showing the cost per equivalent unit for element is as under:

| Equivalent Units: | ||||||||

| Transferred in Cost | Material Cost | Conversion Cost | ||||||

| % Completion | Units | % Completion | Units | % Completion | Units | |||

| Units completed and transferred

Ending Work in Process Total Equivalent units | 100%

100% | 50.00

1.00 | 100%

80% | 50.00

0.80 | 100%

70% | 50.00

0.70 | ||

| 51 | 50.8 | 50.7 | ||||||

Explanation of Solution

The total cost of Transferred-in cost shall be the sum total of transferred in cost included in beginning work in process and added during the current period. The transferred-in cost per equivalent units shall be computed by dividing the total transferred-in cost by equivalent units of respective cost.

Requirement3:

The Cost of Ending work in process inventory in respect of material, conversion and in total

Answer to Problem 13P

Solution: The statement showing the cost of ending work in process is as under:

| Ending Work in Process (1 unit)

| Equivalent unit | Cost per EU | Total Cost | |||||

| Transferred-in cost | 1.00 | 1630 | 1630 | |||||

| Material cost | 0.80 | 120 | 96 | |||||

| Conversion Cost | 0.70 | 850 | 595 | |||||

| Total cost of Ending Work in process: | 2,321 | |||||||

Explanation of Solution

The total cost of ending work in process shall be computed by multiplying the equivalent units of each element in ending work in process by cost per equivalent unit of respective element. The Summation of each element cost is the total cost of ending work in process.

Requirement4:

The Cost of goods completed and transferred out

Answer to Problem 13P

Solution: The statement showing the cost of units completed and transferred out shall be as under:

| Units Completed and Transferred out (50 units)

| Equivalent unit | Cost per EU | Total Cost | ||||

| Transferred-in cost | 50 | 1630 | 81500 | ||||

| Material cost | 50 | 120 | 6000 | ||||

| Conversion Cost | 50 | 850 | 42500 | ||||

| Total Cost of Units completed and transferred out: | 130000 | ||||||

Explanation of Solution

The total cost of units completed and transferred out shall be computed by multiplying the equivalent units of each element in units completed (which is equal to completed units only) by cost per equivalent unit of respective element. The Summation of each element cost is the total cost of ending work in process.

Requirement5:

To show: The reconciliation statement showing the cost to account for and cost accounted for

Answer to Problem 13P

Solution: The reconciliation statement showing the cost to account for and accounted in ending work in process and completed units is as follows:

| RECONCILIATION STATEMENT | |||||||

| TOTAL COST TO ACCOUNT FOR:

| |||||||

| Transferred-in | Material | Conversion | |||||

| Beginning work in Process | 1,670 | 90 | 605 | ||||

| Cost Added during May | 81,460 | 6,006 | 42,490 | ||||

| Total Cost to account for: | 83,130 | 6,096 | 43,095 | ||||

| Total Cost to account for: | 132,321 | ||||||

| TOTAL COST ACCOUNTED FOR:

| |||||||

| Units Completed and Transferred out (50 units)

| |||||||

| Equivalent unit | Cost per EU | Total Cost | |||||

| Transferred-in cost | 50 | 1630 | 81500 | ||||

| Material cost | 50 | 120 | 6000 | ||||

| Conversion Cost | 50 | 850 | 42500 | ||||

| Total Cost of Units completed and transferred out: | 130000 | ||||||

| Ending Work in Process (1 unit)

| |||||||

| Equivalent unit | Cost per EU | Total Cost | |||||

| Transferred-in cost | 1.00 | 1630 | 1630 | ||||

| Material cost | 0.80 | 120 | 96 | ||||

| Conversion Cost | 0.70 | 850 | 595 | ||||

| Total cost of Ending Work in process: | 2,321 | ||||||

| Total Cost accounted for: | 132,321 | ||||||

| Difference (Total cost to account for-Total cost accounted) | Nil | ||||||

Explanation of Solution

The total cost to account for is the total cost of beginning work in process and cost added during the period in the process. The total cost accounted for is the cost assigned to ending work in process and units completed and transferred out.

The reconciliation means there shall be not be any difference between the total cost to account for and total accounted in the period.

To conclude, it must be said that the equivalent units in each inventory shall multiplied with respective cost per equivalent unit and cost of each element is added up to arrive at the total cost of ending work in process and completed units.

Want to see more full solutions like this?

Chapter 5 Solutions

INTRO MGRL ACCT LL W CONNECT

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,