EXERCISE 5-12 Multiproduct Break-Even Analysis LO5-9

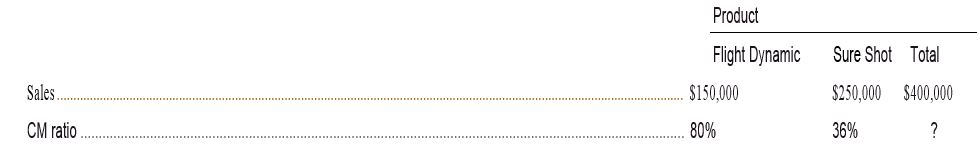

Olongapo Sports Corporation distributes two premium golf balls—Flight Dynamic and Sure Shot. Monthly sales and the contribution margin ratios for the two products follow:

Fixed expenses total $183,750 per month.

Required:

- Prepare a contribution format income statement for the company as a whole. Carry computations to one decimal place.

- What is the company's break-even point in dollar sales based on the current sales mix?

- If sales increase by $100,000 a month, by how much would you expect the monthly net operating income to increase? What are your assumptions?

Break-even analysis: It is an analysis of sales revenue or unit where a company is neither earning profits nor incurring any loss.

The preparation of contribution format income statement and break-even analysis.

Answer to Problem 12E

Solution:

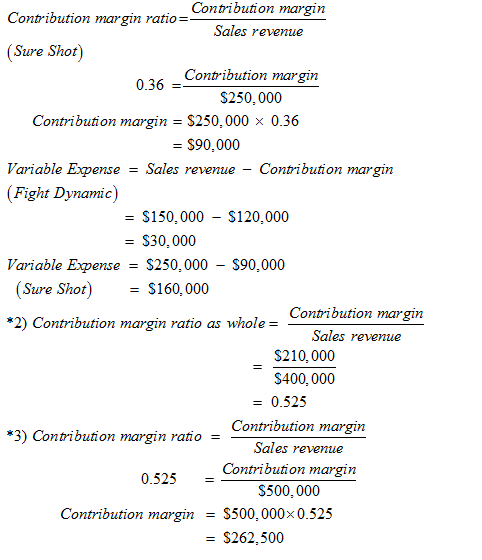

1) Contribution formal income statement for the company as a whole. Carry computations to one decimal place is shown below:-

| Product | |||

| Fight Dynamic | Sure Shot | Total | |

| Sales | $150,000 | $250,000 | $400,000 |

| CM ratio | 80% | 36% | 52.5% |

| Olongapo Sports Corporation’s Contribution format income statement | |

| Total | |

| Sales | $400,000 |

| Variable expenses | $190,000 |

| Contribution Margin | $210,000 |

| Fixed expenses | $183,750 |

| Net operating income | $26,250 |

2) The Break-even point in dollar sales based on the current sales mix is $ 350,000

3) The contribution format income statement with increase in sales by $ 100,000 is shown below:-

| Olongapo Sports Corporation’s Contribution format income statement | |

| Total | |

| Sales | $500,000 |

| Variable expenses | $237,500 |

| Contribution Margin | $262,500 |

| Fixed expenses | $183,750 |

| Net operating income | $78,750 |

It is assume that when sales increase by $100,000, the variable expense increase by 25% and the net operating income increases by 200%.

Explanation of Solution

Given:

| Product | |||

| Fight Dynamic | Sure Shot | Total | |

| Sales | $150,000 | $250,000 | $400,000 |

| CM ratio | 80% | 36% | ? |

Fixed expenses total $183,750 per month.

Hence it is concluded that the Mauro Products will neither earn profit nor incur loss at $350,000sales revenue. But if the company earns beyond this point, it will make profit and if it falls below the point, the company will suffer loss. A break-even point is technique used the companies to predict the outcome of a decision based on the analysis. It shows the exact point where a company will neither make profit nor suffer loss.

Want to see more full solutions like this?

Chapter 5 Solutions

GEN COMBO LL MANAGERIAL ACCOUNTING; CONNECT ACCESS CARD

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardHello tutor please given General accounting question answer do fast and properly explain all answerarrow_forward

- I need guidance in solving this financial accounting problem using standard procedures.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forward

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forwardTransactions: Dec. 3 Wrote off Langston Corporation’s past-due account as uncollectible, $645.75. M203. 9 Accepted a 90-day, 8% note from Farris Company for an extension of time on its account, $2,400.00. NR23. 18 Received cash from Storage Solutions for the maturity value of NR19, a 90-day, 9% note for $2,000.00. R455. 21 Coastal Supply dishonored NR21, a 90-day, 8% note, for $3,000.00. M245. 30 Received cash in full payment of Langston Corporation’s account, previously written off as uncollectible, $645.75. M232 and R463. Task 1 Journalize the transactions for Miller Corporation in Questions Assets that were completed during December of the current year. Use page 12 of the general journal and page 12 of the cash receipts journal. Task 2 Post each entry to the general ledger and to the customer accounts in the accounts receivable ledger. You will not need to make entries to the Item columns of the ledgers. Task 3 Continue to…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College