EXERCISE 5-12 Multiproduct Break-Even Analysis LO5-9

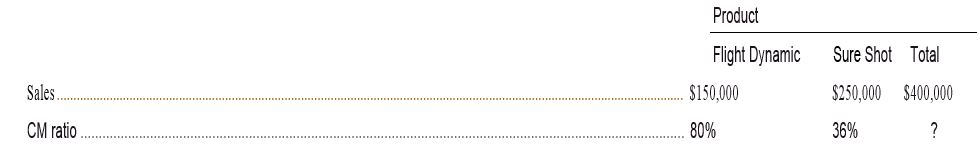

Olongapo Sports Corporation distributes two premium golf balls—Flight Dynamic and Sure Shot. Monthly sales and the contribution margin ratios for the two products follow:

Fixed expenses total $183,750 per month.

Required:

- Prepare a contribution format income statement for the company as a whole. Carry computations to one decimal place.

- What is the company's break-even point in dollar sales based on the current sales mix?

- If sales increase by $100,000 a month, by how much would you expect the monthly net operating income to increase? What are your assumptions?

Break-even analysis: It is an analysis of sales revenue or unit where a company is neither earning profits nor incurring any loss.

The preparation of contribution format income statement and break-even analysis.

Answer to Problem 12E

Solution:

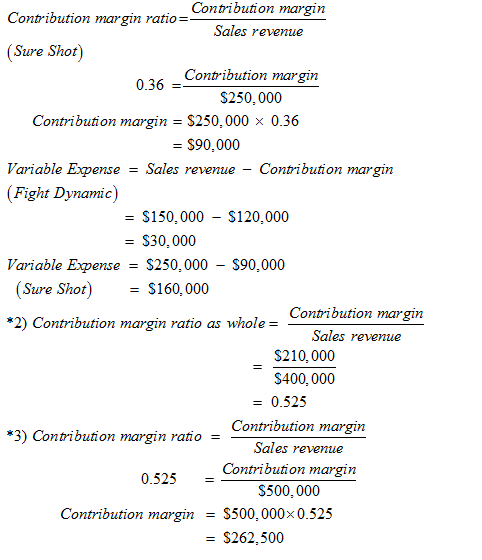

1) Contribution formal income statement for the company as a whole. Carry computations to one decimal place is shown below:-

| Product | |||

| Fight Dynamic | Sure Shot | Total | |

| Sales | $150,000 | $250,000 | $400,000 |

| CM ratio | 80% | 36% | 52.5% |

| Olongapo Sports Corporation’s Contribution format income statement | |

| Total | |

| Sales | $400,000 |

| Variable expenses | $190,000 |

| Contribution Margin | $210,000 |

| Fixed expenses | $183,750 |

| Net operating income | $26,250 |

2) The Break-even point in dollar sales based on the current sales mix is $ 350,000

3) The contribution format income statement with increase in sales by $ 100,000 is shown below:-

| Olongapo Sports Corporation’s Contribution format income statement | |

| Total | |

| Sales | $500,000 |

| Variable expenses | $237,500 |

| Contribution Margin | $262,500 |

| Fixed expenses | $183,750 |

| Net operating income | $78,750 |

It is assume that when sales increase by $100,000, the variable expense increase by 25% and the net operating income increases by 200%.

Explanation of Solution

Given:

| Product | |||

| Fight Dynamic | Sure Shot | Total | |

| Sales | $150,000 | $250,000 | $400,000 |

| CM ratio | 80% | 36% | ? |

Fixed expenses total $183,750 per month.

Hence it is concluded that the Mauro Products will neither earn profit nor incur loss at $350,000sales revenue. But if the company earns beyond this point, it will make profit and if it falls below the point, the company will suffer loss. A break-even point is technique used the companies to predict the outcome of a decision based on the analysis. It shows the exact point where a company will neither make profit nor suffer loss.

Want to see more full solutions like this?

Chapter 5 Solutions

Managerial Accounting

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardNonearrow_forwardOvid Holdings acquired Twilight Enterprises on January 1, 2019 for $8,200,000, and recorded goodwill of $1,500,000 as a result of that purchase. At December 31, 2019, the Twilight Enterprises Division had a fair value of $7,300,000. The net identifiable assets of the Division (excluding goodwill) had a fair value of $6,400,000 at that time. What amount of loss on impairment of goodwill should Ovid Holdings record in 2019? a) $0 b) $600,000 c) $900,000 d) $1,500,000arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College