Concept explainers

Equivalent Unit; Assigning Costs; Cost Reconciliation-Weighted-Average Method

Superior Micro products uses the weighted-average method in its

Required:

- Compute the equivalent units of materials, labor, and overhead in the ending work in process inventory for the month.

- Compute the cost of ending work in process inventory for materials, labor, overhead, and in total for January.

- Compute the cost of the units transferred to the next department for materials, labor, overhead, and in total for January.

- Prepare a cost reconciliation for January. (Note: Your will not be able to break the cost to be accounted for into the cost of beginning work in process inventory and costs added during the month.)

Computation of equivalent units for each element of cost, cost per equivalent unit and total cost of ending inventory and completed units describes the steps taken for computation of total units completed and equivalents units of each element of cost. The total cost of ending work in process and completed and transferred out shall be determined based on equivalent units and cost per equivalent units. The total units completed are computed by considering the total units in process and ending work in process units. The reconciliation statement of total cost to account and accounted has to be reconciled.

Requirement1:

TheEquivalent number units of each element of cost shall be determined.

Answer to Problem 12E

Solution: The total units completed and transferred out from process shall be as under:

| UNITS TO BE ACCOUNTED FOR: | ||

| Units Completed during the month

Ending Work in Process Total Units to be accounted for: | 25,000

3,000 | |

| 28,000 | ||

After computing the units of completed and transferred out, the equivalent units of each element of cost shall be computed as under:

| Equivalent Units: | |||||||

| Material | Labour and Overhead | ||||||

| % Completion | Units | % Completion | Units | ||||

| Units Completed

Ending Work in Process Total Equivalent units | 100%

80% | 25,000

2,400 | 100%

60% | 25,000

1,800 | |||

| 27,400 | 26,800 | ||||||

Explanation of Solution

The computation of total units completed and transferred out shall be based on the total units in the process during the year. The total units to account for in the process is sum of beginning units of work in process and units started in the process during the year. The Ending units of work in process which is still in process at the end of the year shall be deducted from the total to find out the units completed and transferred out.

For computing the total equivalent units of each element of cost, the units completed and transferred out shall be regarded as 100% complete as regards to all elements. Therefore, the equivalent units of completed units shall be same as that of completed units. The ending work in process inventory is not finished and the degree of completion of the inventory is given as regards to each element. The equivalent units of work in process shall be computed accordingly.

The total equivalent units of each element is sum total of equivalent units of respective element in both completed units and ending work in process units.

Requirement2:

To conclude, it must be said that the equivalent units in each inventory shall multiplied with respective cost per equivalent unit and cost of each element is added up to arrive at the total cost of ending work in process and completed units.

The Cost of Ending work in process inventory in respect of material, conversion and in total shall be determined.

Answer to Problem 12E

Solution: The

statement showing the cost of ending work in process is as under:

| Ending Work in Process (3,000 units) | |||||

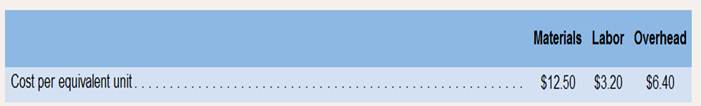

| Equivalent unit | Cost per EU | Total Cost | |||

| Material

Labour Overheads | 2,400

1,800 1800 | 12.5

3.2 6.4 | 30000

5760 11520 | ||

| Total cost of Ending Work in process: | 47,280 | ||||

Explanation of Solution

The total cost of ending work in process shall be computed by multiplying the equivalent units of each element in ending work in process by cost per equivalent unit of respective element. The Summation of each element cost is the total cost of ending work in process.

Requirement3:

The Cost of goods completed and transferred out shall be determined.

Answer to Problem 12E

Solution: The statement showing the cost of units completed and transferred out shall be as under:

| Units Completed and Transferred Out (25,000 units) | |||||

| Equivalent unit | Cost per EU | Total Cost | |||

| Material

Labour Overheads | 25,000

25,000 25000 | 12.5

3.2 6.4 | 312500

80000 160000 | ||

| Total cost of Ending Work in process: | 552,500 | ||||

Explanation of Solution

The total cost of units completed and transferred out shall be computed by multiplying the equivalent units of each element in units completed (which is equal to completed units only) by cost per equivalent unit of respective element. The Summation of each element cost is the total cost of ending work in process.

Requirement4:

The reconciliation statement showing the cost to account for and cost accounted for to be reconciled.

Answer to Problem 12E

Solution: The reconciliation statement showing the cost to account for and accounted in ending work in process and completed units is as follows:

| RECONCILIATION STATEMENT | |||||

| TOTAL COST TO ACCOUNT FOR: | |||||

| Total Cost to account for: | 599,780 | ||||

| TOTAL COST ACCOUNTED FOR: | |||||

| Units Completed and Transferred out (25,000 units) | |||||

| Equivalent unit | Cost per EU | Total Cost | |||

| Material

Labour Conversion Cost | 25,000

25,000 | 12.5

3.2 | 312500

80000 160000 | ||

| 25,000 | 6.4 | ||||

| Total Cost of Units completed and transferred out: | 552500 | ||||

| Ending Work in Process (3,000 units) | |||||

| Equivalent unit | Cost per EU | Total Cost | |||

| Material

Labour Conversion Cost | 2,400

1,800 1800 | 12.5

3.2 6.4 | 30000

5760 11520 | ||

| Total cost of Ending Work in process: | 47,280 | ||||

| Total Cost Accounted for: | 599,780 | ||||

| Difference (Total cost to account for-Total cost accounted) | Nil | ||||

Explanation of Solution

The total cost to account for is the total cost of beginning work in process and cost added during the period in the process. The total cost accounted for is the cost assigned to ending work in process and units completed and transferred out.

The reconciliation means there shall be not be any difference between the total cost to account for and total accounted in the period.

To conclude, it must be said that the equivalent units in each inventory shall multiplied with respective cost per equivalent unit and cost of each element is added up to arrive at the total cost of ending work in process and completed units.

Want to see more full solutions like this?

Chapter 5 Solutions

Introduction To Managerial Accounting

- Please explain the solution to this general accounting problem with accurate explanations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forward

- Can you help me solve this general accounting question using valid accounting techniques?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,