EBK PRINCIPLES OF CORPORATE FINANCE

12th Edition

ISBN: 9781259358487

Author: BREALEY

Publisher: MCGRAW HILL BOOK COMPANY

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 11PS

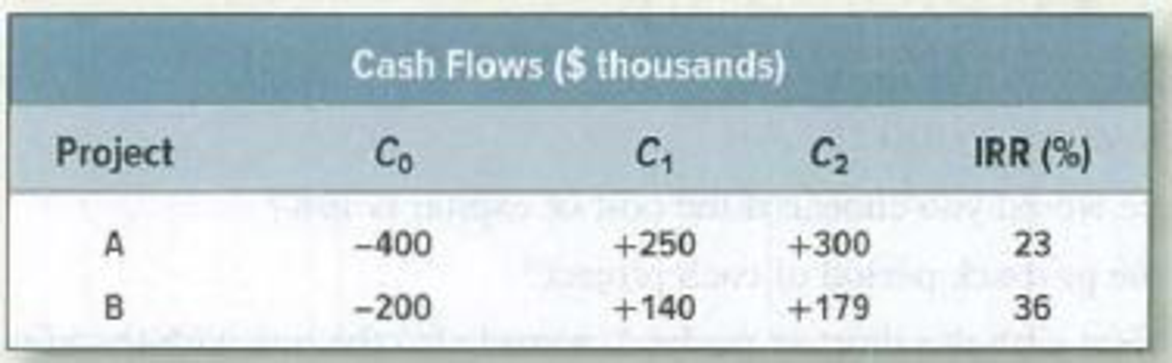

The

- a. Explain to Mr. Clops why this is not the correct procedure.

- b. Show him how to adapt the IRR rule to choose the best project.

- c. Show him that this project also has the higher

NPV .

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

How do interest rates impact the valuation of financial assets, like bonds and stocks? need help

How do interest rates impact the valuation of financial assets, like bonds and stocks in finance?

What are the key differences between stocks and bonds as investment options?

i need correct solution without ai

Chapter 5 Solutions

EBK PRINCIPLES OF CORPORATE FINANCE

Ch. 5 - (IRR) Check the IRRs for project F in Section 5-3.Ch. 5 - (IRR) What is the IRR of a project with the...Ch. 5 - (XIRR) What is the IRR of a project with the...Ch. 5 - Payback a. What is the payback period on each of...Ch. 5 - Payback Consider the following projects: a. If the...Ch. 5 - Prob. 3PSCh. 5 - IRR Write down the equation defining a projects...Ch. 5 - Prob. 5PSCh. 5 - IRR Calculate the IRR (or IRRs) for the following...Ch. 5 - IRR rule You have the chance to participate in a...

Ch. 5 - IRR rule Consider a project with the following...Ch. 5 - IRR rule Consider projects Alpha and Beta: The...Ch. 5 - IRR rule Consider the following two mutually...Ch. 5 - IRR rule Mr. Cyrus Clops, the president of Giant...Ch. 5 - Prob. 12PSCh. 5 - Investment criteria Consider the following two...Ch. 5 - Profitability index Look again at projects D and E...Ch. 5 - Capital rationing Suppose you have the following...Ch. 5 - Prob. 17PSCh. 5 - Prob. 18PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What are the key differences between stocks and bonds as investment options? i need answer properly.arrow_forwardWhat are the key differences between stocks and bonds as investment options?need helparrow_forwardWhat are the key differences between stocks and bonds as investment options?arrow_forward

- What is diversification, and how can it reduce risk in a portfolio? i need correct answer for this question.arrow_forwardI need answer What is diversification, and how can it reduce risk in a portfolio?arrow_forwardDon't use AI What is diversification, and how can it reduce risk in a portfolio?arrow_forward

- No chatgpt! Can you explain the concept of net present value (NPV) and how it is used in investment decisions?arrow_forwardCan you explain the concept of net present value (NPV) and how it is used in investment decisions?i need answerarrow_forwardCan you explain the concept of net present value (NPV) and how it is used in investment decisions? need explarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License