MANAGERIAL ACCOUNTING FOR MANAGERS

6th Edition

ISBN: 9781265365615

Author: Noreen

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4A, Problem 4A.5P

Super-Variable Costing, Variable Costing, and Absorption Costing Income Statements LO4—2, LO4—6

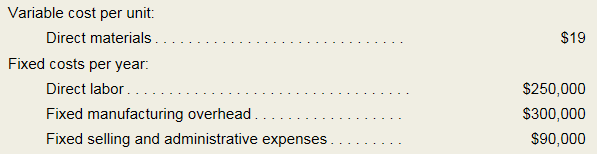

Bracey Company manufactures and sells one product. The following information pertains to the company’s first year of operations:

The company does not incur any variable manufacturing

Required:

- Assume the company uses super-variable costing:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Assume the company uses a variable costing system that assigns $12.50 of direct labor cost to each unit produced:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Assume the company uses an absorption costing system that assigns $12.50 of direct labor cost and $15.00 of fixed

manufacturing overhead cost to each unit produced: - Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net operating incomes. Prepare another reconciliation that explains the difference between the super-variable costing and absorption costing net operating incomes.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide the correct answer to this general accounting problem using accurate calculations.

I want to this question answer for General accounting question not need ai solution

hy expert give me answer please

Chapter 4A Solutions

MANAGERIAL ACCOUNTING FOR MANAGERS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain the correct approach for solving this general accounting question.arrow_forwardMarquette Products incurs a cost of $40.25 per unit, of which $24.00 is variable, to make a product that normally sells for $63.00. A foreign distributor offers to buy 5,400 units at $36.50 each. Marquette will incur additional costs of $3.10 per unit for labeling and shipping. Assume the company has sufficient excess capacity. What is the effect on net income if Marquette accepts the special order?arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forward

- Portland Waxworks budgeted production of 46,000 wax lanterns for the year. Each lantern requires dipping. Assume that 12 minutes are required to dip each lantern. If dipping labor costs $14.50 per hour, determine the direct labor cost budget for the year.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

- Bon Corporation has the following transactions: $820,000 operating income; $640,000 operating expenses; $55,000 municipal bond interest; $150,000 long-term capital gain; and $70,000 short-term capital loss. Compute Bon Corporation's taxable income for the year.arrow_forwardMeena manufacturing company has budgeted overhead costs of $750,000 and expected machine hours of 25,000. During the period, actual overhead costs were $765,000 and actual machine hours were 24,000. Calculate the amount of over or underapplied overhead.arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Pricing Decisions; Author: Rutgers Accounting Web;https://www.youtube.com/watch?v=rQHbIVEAOvM;License: Standard Youtube License