MGMR ACCT F/MANAGERS-CONNECT 180-DAY COD

5th Edition

ISBN: 9781265951627

Author: Noreen

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4A, Problem 4A.5P

Super-Variable Costing, Variable Costing, and Absorption Costing Income Statements LO4—2, LO4—6

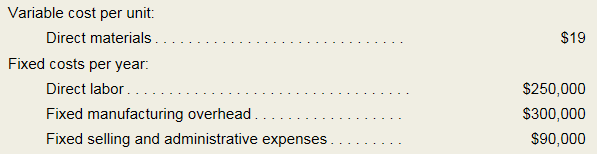

Bracey Company manufactures and sells one product. The following information pertains to the company’s first year of operations:

The company does not incur any variable manufacturing

Required:

- Assume the company uses super-variable costing:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Assume the company uses a variable costing system that assigns $12.50 of direct labor cost to each unit produced:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Assume the company uses an absorption costing system that assigns $12.50 of direct labor cost and $15.00 of fixed

manufacturing overhead cost to each unit produced: - Compute the unit product cost for the year.

- Prepare an income statement for the year.

- Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net operating incomes. Prepare another reconciliation that explains the difference between the super-variable costing and absorption costing net operating incomes.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide the correct answer to this general accounting problem using accurate calculations.

I want to this question answer for General accounting question not need ai solution

hy expert give me answer please

Chapter 4A Solutions

MGMR ACCT F/MANAGERS-CONNECT 180-DAY COD

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain the correct approach for solving this general accounting question.arrow_forwardMarquette Products incurs a cost of $40.25 per unit, of which $24.00 is variable, to make a product that normally sells for $63.00. A foreign distributor offers to buy 5,400 units at $36.50 each. Marquette will incur additional costs of $3.10 per unit for labeling and shipping. Assume the company has sufficient excess capacity. What is the effect on net income if Marquette accepts the special order?arrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forward

- Portland Waxworks budgeted production of 46,000 wax lanterns for the year. Each lantern requires dipping. Assume that 12 minutes are required to dip each lantern. If dipping labor costs $14.50 per hour, determine the direct labor cost budget for the year.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

- Bon Corporation has the following transactions: $820,000 operating income; $640,000 operating expenses; $55,000 municipal bond interest; $150,000 long-term capital gain; and $70,000 short-term capital loss. Compute Bon Corporation's taxable income for the year.arrow_forwardMeena manufacturing company has budgeted overhead costs of $750,000 and expected machine hours of 25,000. During the period, actual overhead costs were $765,000 and actual machine hours were 24,000. Calculate the amount of over or underapplied overhead.arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Pricing Decisions; Author: Rutgers Accounting Web;https://www.youtube.com/watch?v=rQHbIVEAOvM;License: Standard Youtube License