Managerial Accounting for Managers

4th Edition

ISBN: 9781259578540

Author: Eric Noreen, Peter C. Brewer Professor, Ray H Garrison

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4A, Problem 4A.4P

Activity-Based Absorption Costing as an Alternative to Traditional Product Costing LO3-5

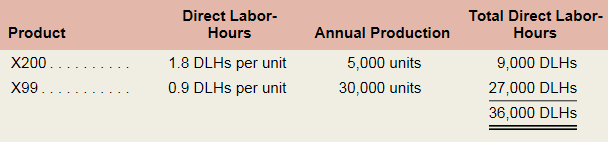

Elix Company manufactures two models of ultra-high fidelity speakers—the X200 model and the X99 model. Data regarding the two products follow:

Additional information about the company follows:

- Model X200 requires S72 in direct materials per unit, and model X99 requires $50.

- The direct labor workers are paid S20 per hour.

- The company has always used direct labor-hours as the base for applying

manufacturing overhead cost to products. - Model X200 is more complex to manufacture than model X99 and requires the use of special equipment.

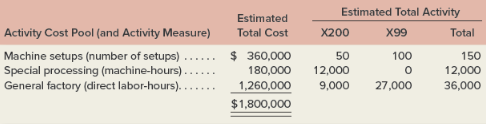

- Because of the special work required in (d) above, the company is considering the use of activity-based absorption costing to apply manufacturing overhead cost to products. Three activity cost pools have been identified as follows:

Required:

- Assume that the company continues to use direct labor-hours as the base for applying overhead cost to products.

- Compute the plantwide predetermined overhead rate.

- Compute the unit product cost of each model.

- Assume that the company decides to use activity-based absorption costing to apply overhead cost to products.

- Compute the activity rate for each activity cost pool and determine the amount of overhead cost that would be applied to each model using the activity-based approach.

- Compute the unit product cost of each model.

- Explain why overhead cost shifted from the high-volume model to the low-volume model under the activity-based approach.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Accounting?

I need guidance with this general accounting problem using the right accounting principles.

accounting question ?

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY