Concept explainers

Super-Variable Costing Income Statement LO4—6

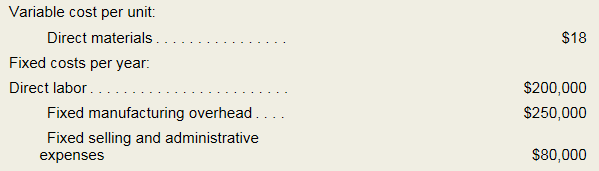

Zola Company manufactures and sells one product. The following information pertains to the company’s first year of operations:

The company does not incur any variable

Required:

- Assume the company uses super-variable costing:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

Concept introduction:

Income statement:

The income statement tells about the revenues earned and expenses incurred by the company in a specific period of time. It is also known as operations statement, earnings statement, revenue statement or profit, and loss statement.

- Calculate the unit product cost.

- Prepare an income statement for the given year.

Answer to Problem 4A.1E

- The unit product cost is $18.

- The income statement of Company Z is as follows:

| Company Z | |||

| Income Statement | |||

| Particulars | Amount (Unit)(a) | Units(b) | Total amount(c = a × b) |

| Sales | $50 | 20000 | $1,000,000 |

| Less: Variable cost | ($18) | 20000 | ($360,000) |

| Contribution margin (a) | $640,000 | ||

| Less: Fixed costs | |||

| Direct labor | $200,000 | ||

| Fixed manufacturing cost | $250,000 | ||

| Fixed selling and administration expenses | $80,000 | ||

| Total fixed costs (b) | $530,000 | ||

| Net operating income (c = a -b) | $110,000 | ||

Table: (1)

Explanation of Solution

(a)

Calculate the unit product cost:

The company uses the variable costing method. Under the variable costing method, the variable cost is considered as the product cost. In the given case, the variable cost of the product is $18.

Thus, the unit product cost is $18.

(b)

Prepare an income statement for the given year:

| Company Z | |||

| Income Statement | |||

| Particulars | Amount (Unit)(a) | Units(b) | Total amount(c = a × b) |

| Sales | $50 | 20000 | $1,000,000 |

| Less: Variable cost | ($18) | 20000 | ($360,000) |

| Contribution margin (a) | $640,000 | ||

| Less: Fixed costs | |||

| Direct labor | $200,000 | ||

| Fixed manufacturing cost | $250,000 | ||

| Fixed selling and administration expenses | $80,000 | ||

| Total fixed costs (b) | $530,000 | ||

| Net operating income (c = a -b) | $110,000 | ||

Table: (2)

Want to see more full solutions like this?

Chapter 4A Solutions

MANAGERIAL ACCOUNTING CONNECT ACCESS <C>

- Question 3.6.14: - During FY 2023, Dixer Company reported sales of $400,000, a contribution margin of $10.00 per unit, fixed costs of $100,000, and a net income of $30,000. Use this information to determine the number of units Adelphi sold during FY 2023. I want right answer with all working formatarrow_forwardWhat is the dollar amount of taxes paid?arrow_forwardThe XYZ Company has total annual sales of 4,500 units, an average inventory level of 375 units, and annual working days of 360 days. Required: Compute the Inventory Days of Supply (DOS). a) 31 days b) 24 days c) 30 days d) None of the abovearrow_forward

- Solve this question accountingarrow_forwardA company has the following financial data: • Beginning work in process inventory: $90,000 Cost of goods manufactured: $1,050,000 • Direct materials cost: $360,000 • Direct labor cost: $240,000 Overhead cost: $350,000 What is the ending work in process inventory? A. $20,000 B. $15,000 C. $0 D. Error: Over-applied Costsarrow_forwardGet accurate answer of this financial accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College