Concept explainers

Super-Variable Costing Income Statement LO4—6

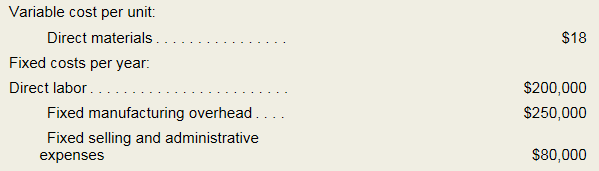

Zola Company manufactures and sells one product. The following information pertains to the company’s first year of operations:

The company does not incur any variable

Required:

- Assume the company uses super-variable costing:

- Compute the unit product cost for the year.

- Prepare an income statement for the year.

Concept introduction:

Income statement:

The income statement tells about the revenues earned and expenses incurred by the company in a specific period of time. It is also known as operations statement, earnings statement, revenue statement or profit, and loss statement.

- Calculate the unit product cost.

- Prepare an income statement for the given year.

Answer to Problem 4A.1E

- The unit product cost is $18.

- The income statement of Company Z is as follows:

| Company Z | |||

| Income Statement | |||

| Particulars | Amount (Unit)(a) | Units(b) | Total amount(c = a × b) |

| Sales | $50 | 20000 | $1,000,000 |

| Less: Variable cost | ($18) | 20000 | ($360,000) |

| Contribution margin (a) | $640,000 | ||

| Less: Fixed costs | |||

| Direct labor | $200,000 | ||

| Fixed manufacturing cost | $250,000 | ||

| Fixed selling and administration expenses | $80,000 | ||

| Total fixed costs (b) | $530,000 | ||

| Net operating income (c = a -b) | $110,000 | ||

Table: (1)

Explanation of Solution

(a)

Calculate the unit product cost:

The company uses the variable costing method. Under the variable costing method, the variable cost is considered as the product cost. In the given case, the variable cost of the product is $18.

Thus, the unit product cost is $18.

(b)

Prepare an income statement for the given year:

| Company Z | |||

| Income Statement | |||

| Particulars | Amount (Unit)(a) | Units(b) | Total amount(c = a × b) |

| Sales | $50 | 20000 | $1,000,000 |

| Less: Variable cost | ($18) | 20000 | ($360,000) |

| Contribution margin (a) | $640,000 | ||

| Less: Fixed costs | |||

| Direct labor | $200,000 | ||

| Fixed manufacturing cost | $250,000 | ||

| Fixed selling and administration expenses | $80,000 | ||

| Total fixed costs (b) | $530,000 | ||

| Net operating income (c = a -b) | $110,000 | ||

Table: (2)

Want to see more full solutions like this?

- What are two double entries the following transaction? Account Receivable. Account payable. Rent Expenses. Cell phone bill, cable, light bill, gas, and monthly income of $4,000.00 what will be your net income after all expenses are paid. Please figure out your own price for each expense.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- I need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College