ACCOUNTING PRINCIPLES V1 6/17 >C<

3rd Edition

ISBN: 9781323761434

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem E4.19E

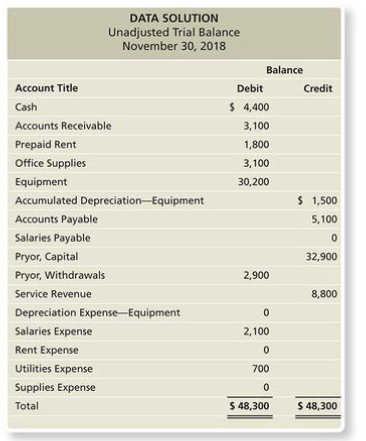

Preparing a worksheet

Learning Objective 2:

Title unadjusted

Additional Information at November 30, 2018:

- Accrued Service Revenue, 5S0Q.

Depreciation. 5350.- Accrued Salaries Expenses, 5650.

- Prepaid Rent expired, 5700.

- Office Supplied used, 5550.

Requirement

- Compute Data Solution’s worksheet for the month ended November 30, 201£.

- How much was net income for November.

Expert Solution & Answer

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

schedule07:24

Students have asked these similar questions

I am looking for the correct answer to this general accounting problem using valid accounting standards.

Calculate break-even sales in units given: Fixed Costs = $10,000; Selling Price per unit = $25; Variable Cost per unit = $15. need help

I am looking for the correct answer to this general accounting problem using valid accounting standards.

Chapter 4 Solutions

ACCOUNTING PRINCIPLES V1 6/17 >C<

Ch. 4 - Assets are listed on the balance sheet in the...Ch. 4 - Which of the following accounts would be included...Ch. 4 - Which situation indicates a net loss within the...Ch. 4 - Which of the following accounts is not closed?...Ch. 4 - What do closing entries accomplish? Learning...Ch. 4 - Which of the following is not a closing entry?...Ch. 4 - Which of the following accounts may appear on a...Ch. 4 - 8. Which of the following steps of the accounting...Ch. 4 - Clean Water Softener Systems has Cash of $600,...Ch. 4 - Which of the following statements concerning...

Ch. 4 - What document are financial statements prepared...Ch. 4 - What does the income statement report?Ch. 4 - Prob. 3RQCh. 4 - Prob. 4RQCh. 4 - Why are financial statements prepared in a...Ch. 4 - Prob. 6RQCh. 4 - Prob. 7RQCh. 4 - Prob. 8RQCh. 4 - Prob. 9RQCh. 4 - How could a worksheet help in preparing financial...Ch. 4 - If a business had a net loss for the year, where...Ch. 4 - Prob. 12RQCh. 4 - What are temporary accounts? Are temporary...Ch. 4 - What are permanent accounts? Are permanent...Ch. 4 - How is the Income Summary account used? Is it a...Ch. 4 - Prob. 16RQCh. 4 - If a business had a net loss for the year, what...Ch. 4 - What types of accounts are listed on the...Ch. 4 - Prob. 19RQCh. 4 - What is the current ratio, and how is it...Ch. 4 - Prob. 21ARQCh. 4 - Preparing an income statement Learning Objective 1Ch. 4 - Preparing a statement of owner’s equity. Learning...Ch. 4 - Preparing a balance sheet (unclassified, account...Ch. 4 - Preparing a balance sheet (classified, report...Ch. 4 - Classifying balance sheet accounts Learning...Ch. 4 - Prob. S4.6SECh. 4 - Prob. S4.7SECh. 4 - Determine net loss using a worksheet Learning...Ch. 4 - Identifying temporary and permanent accounts...Ch. 4 - Prob. S4.10SECh. 4 - Posting closing entries directly to Taccounts...Ch. 4 - S412 Identifying accounts included on a...Ch. 4 - Identifying steps in the accounting cycle Learning...Ch. 4 - Calculating the current ratio Learning Objective 6...Ch. 4 - Journalizing reversing entries Learning Objective...Ch. 4 - E416 Preparing the financial statements The...Ch. 4 - Classifying balance sheet accounts Learning...Ch. 4 - Preparing a classified balance sheet and...Ch. 4 - Preparing a worksheet Learning Objective 2: Title...Ch. 4 - Preparing financial statements from the completed...Ch. 4 - Preparing closing entries from an adjusted trial...Ch. 4 - Preparing closing entries from T-accounts Learning...Ch. 4 - Determining the effects of closing entries on the...Ch. 4 - Preparing a worksheet and closing entries Learning...Ch. 4 - Preparing closing entries from an adjusted trial...Ch. 4 - Preparing a worksheet, closing entries, and a...Ch. 4 - Journalizing reversing entries. Learning Objective...Ch. 4 - Journalizing reversing entries Leaning Objectives...Ch. 4 - Preparing financial statements including a...Ch. 4 - Preparing financial statements including a...Ch. 4 - Preparing a worksheet, financial statements, and...Ch. 4 - Completing the accounting cycle from adjusting...Ch. 4 - Completing the accounting cycle from journal...Ch. 4 - Preparing adjusting entries and reversing entries...Ch. 4 - Preparing financial statements including a...Ch. 4 - Preparing financial statements including a...Ch. 4 - Preparing a worksheet financial statements, and...Ch. 4 - Completing the accounting cycle from adjusting...Ch. 4 - Completing the accounting cycle from journal...Ch. 4 - Preparing adjusting entries and reversing entries...Ch. 4 - Using Excel to prepare financial statements,...Ch. 4 - Completing the accounting cycle from adjusted...Ch. 4 - Completing the accounting cycle from adjusted...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - COMPREHENSIVE PROBLEMS Comprehensive Problem 1 for...Ch. 4 - Comprehensive Problem 2 for Chapters 1 —4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 —4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Comprehensive Problem 2 for Chapters 1 4 This...Ch. 4 - Prob. 4.1TIATCCh. 4 - Prob. 4.1EICh. 4 - Prob. 4.1FSC

Additional Business Textbook Solutions

Find more solutions based on key concepts

Quick ratio (Learning Objective 7) 510 min. Calculate the quick assets and the quick ratio for each of the foll...

Financial Accounting, Student Value Edition (5th Edition)

Using the numbers in the preceding question, what is the size of Ectenias labor force? a. 50 b. 60 c. 70 d. 80

Principles of Economics (MindTap Course List)

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting: Tools for Business Decision Making, 8th Edition

10-10 What challenges do managers face in managing global teams? How should those challenges be handled?

Fundamentals of Management (10th Edition)

Opportunity cost of capital Which of the following statements are true? The opportunity cost of capital:

Equals...

PRIN.OF CORPORATE FINANCE

A typical discounted price of a AAA battery is 0.75. It is designed to provide 1.5 volts and 1.0 amps for about...

Engineering Economy (17th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License