Concept explainers

a.

Prepare the adjusting entry as at December 31, Year 1.

a.

Explanation of Solution

Prepare the adjusting entries:

| Date | Account titles and Explanation | Debit ($) | Credit ($) |

| December 31 | Accounts receivable | 5,280 | |

| Studio revenue earned | 5,280 | ||

| (To record the accrued studio revenue earned) | |||

| December 31 | Supplies expense (1) | 840 | |

| Studio supplies | 840 | ||

| (To record the supplies expense) | |||

| December 31 | Insurance expense (2) | 300 | |

| Unexpired insurance | 300 | ||

| (To record the insurance expense) | |||

| December 31 | Studio rent expense (3) | 2,400 | |

| Prepaid rent | 2,400 | ||

| (To record the studio rent expense) | |||

| December 31 | 1,800 | ||

| 1,800 | |||

| (To record the depreciation expense) | |||

| December 31 | Interest expense (5) | 144 | |

| Interest payable | 144 | ||

| (To record the interest expense) | |||

| December 31 | Unearned studio revenue | 4,320 | |

| Studio revenue earned | 4,320 | ||

| (To record the advance collections earned) | |||

| December 31 | Salaries expense | 648 | |

| Salaries payable | 648 | ||

| (To record the salaries expense) | |||

| December 31 | Income taxes expense | 2,040 | |

| Income taxes payable | 2,040 | ||

| (To record the income tax expense) |

Table (1)

1. To record the accrued studio revenue earned:

- Accounts receivable is an asset account and it is increased. Therefore, debit accounts receivable with $5,280.

- Studio revenue earned is a revenue account and it increases the stockholders’ equity account. Therefore, credit studio revenue earned with $5,280.

2. To record the studio supplies expense:

- Studio supplies expense is an expense account and it decreases the stockholders’ equity account. Therefore, debit studio supplies expense with $840.

- Studio supplies are an asset account and it is decreased. Therefore, credit climbing supplies with $840.

Working note:

Calculate the climbing supplies expense:

3. To record the insurance expense:

- Insurance expense is an expense account and it decreases the stockholders’ equity account. Therefore, debit insurance expense with $300.

- Unexpired insurance is an asset account and it is decreased. Therefore, credit unexpired insurance with $300.

Working note:

Calculate the amount of insurance expense:

4. To record the studio rent expense:

- Studio rent expense is an expense account and it decreases the stockholders’ equity. Therefore, debit studio rent expense with $2,400.

- Prepaid studio rent is an asset account and it is decreased. Therefore, credit prepaid adverting with $2,400.

Working note:

Calculate the amount of studio rent expense:

5. To record the depreciation expense, Recording Equipment:

- Depreciation expense is an expense account and it decreases the stockholders’ equity account. Therefore, debit depreciation expense with $1,800.

- Accumulated depreciation is a contra-account and it decreases the value of asset. Therefore, credit accumulated depreciation with $1,800.

Working note:

Calculate the amount of depreciation expense:

6. To record the interest expense:

- Interest expense is an expense account and it decreases the stockholders’ equity. Therefore, debit interest expenses with $144.

- Interest payable is a liability account and it is increased. Therefore, credit interest payable with $144.

Working note:

Calculate the amount of interest expense:

7. To record the advance collections earned:

- Unearned revenue is a liability account and it is decreased. Therefore, debit unearned studio revenue with $4,320.

- Studio revenue earned is a revenue account and it increases the stockholders’ equity account. Therefore, credit studio revenue earned with $4,320.

8. To record the salaries expense:

- Salaries expense is an expense account and it decreases the stockholders’ equity. Therefore, debit salaries expenses with $3,100.

- Salaries payable is a liability account and it is increased. Therefore, credit salaries payable with $3,100.

9. To record the income tax expense:

- Income tax expense is an expense account and it decreases the stockholders’ equity. Therefore, debit income tax expenses with $648.

- Income tax payable is a liability account and it is increased. Therefore, credit salaries payable with $648.

b.

Compute the net income for the year ended December 31, Year 1.

b.

Explanation of Solution

Net income: The bottom line of income statement which is the result of excess of earnings from operations (revenues) over the costs incurred for earning revenues (expenses) is referred to as net income.

Compute the net income for the year ended December 31, Year 1:

| Incorporation KHE | ||

| Income Statement | ||

| For the Year Ended December 31, Year 1 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue | ||

| Studio Revenue Earned | $138,000 | |

| Total Revenue | $138,000 | |

| Expenses: | ||

| Salaries Expense | $22,248 | |

| Supplies Expense | $2,280 | |

| Insurance Expense | $3,516 | |

| Depreciation Expense | $21,600 | |

| Studio Rent Expense | $27,600 | |

| Utilities Expense | $2,820 | |

| Interest Expense | $1,152 | |

| Income Tax Expense | $23,520 | |

| Total Expenses | $104,736 | |

| Net Income | $33,264 | |

Table (2)

Thus, the net income for the year ended December 31, Year 1 is $33,264.

c.

Explain whether the studio’s monthly rent for the last 2 months of year 1 is more or less than during the first 10 months of the year.

c.

Explanation of Solution

Rent expenses as per the unadjusted

d.

Explain whether the monthly insurance expense for the last 5 months of year 1 is more or less than during the first 7 months of the year.

d.

Explanation of Solution

Calculate the average monthly insurance expense for January to July:

| Particulars | Amount ($) |

| Insurance expense for 12 months ended | $3,516 |

| Less: Insurance expense for August through December | $1,500 |

| Insurance expense for January through July | $2,016 |

| Average monthly insurance expense for January to July | $288 |

Table (3)

Insurance expense per month for last 5 months is $300. But the average monthly insurance expense for the first seven months of the year is $288. Thus, there is a difference of $12

e.

Determine the life of the equipment from the beginning of studios’ operation.

e.

Explanation of Solution

Determine the life of the equipment from the beginning of studios’ operation.

| Particulars | Amount ($) |

| Accumulated depreciation per trial balance | $63,000 |

| Add: December depreciation expense (adjusting entry 5) | $1,800 |

| Accumulated depreciation at December 31, Year 1 | $64,800 |

| Age of equipment at December 31, Year 1 | 36 months |

Table (4)

Thus, the age of the equipment is 36months or 3 years.

f.

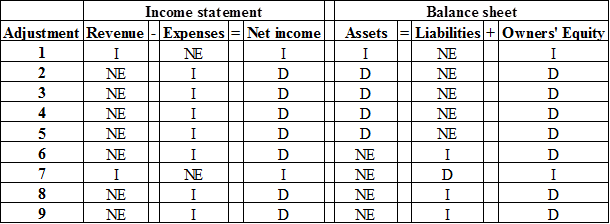

Indicate the effect of the adjusting entry on the income statement and balance sheet.

f.

Explanation of Solution

Indicate the effect of the adjusting entry on the income statement and balance sheet.

Table (5)

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Note:

“I” represents Increase

“D” represents Decrease

“NE” represents No effect

Want to see more full solutions like this?

Chapter 4 Solutions

Financial Accounting

- What amount of ending finished goods inventory will be reported on the balance sheet under variable costing?arrow_forwardI am looking for the correct answer to this financial accounting question with appropriate explanations.arrow_forwardAt what amount should the company's inventory be reported on the balance sheetarrow_forward

- Bentley Enterprises estimated manufacturing overhead for the year at $420,000. Manufacturing overhead for the year was overapplied by $25,000. The company applied $380,000 to Work in Process. The amount of actual overhead would have been_____.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forwardNonearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education