Concept explainers

Problem 4-6BAPreparing adjusting, reversing, and next period entries P4

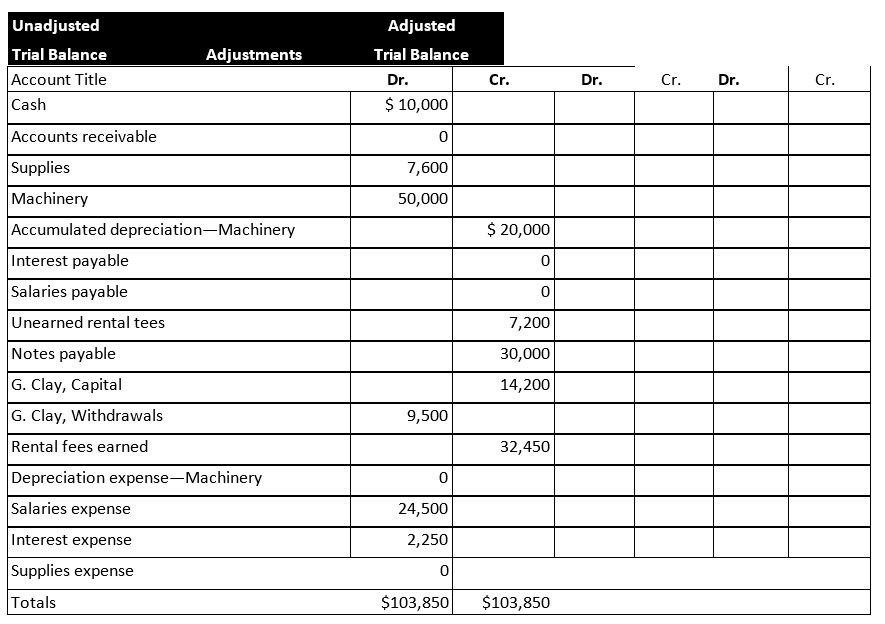

The following six-column table for Solutions Co. includes the unadjusted

Required

Page 162

- Complete the six-column table by entering adjustments that reflect the following information:

a. As of December 31. employees had earned $400 of unpaid and unrecorded wages. The next payday is January 4. at which time $1,200 in wages will be paid.

b. The cost of supplies still available at December 31 is $3,450. C. The notes payable require an interest payment to be made every three months. The amount of unrecorded accrued interest at December 31 is $800. The next interest payment, at an amount of $900. is due on January 15.

d. Analysis of the unearned rental fees shows that $3,200 remains unearned at December 31.

e. In addition to the machinery rental fees included in the revenue account balance, the company has earned another $2,450 in unrecorded fees that will be collected on January 31. Die company is also expected to collect $5,400 on that same day for new fees earned in January.

f.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

FUND OF ACCT PRIN(LOOSE-LEAF)+ACCESS

- Financial accountingarrow_forwardHow can the results from the accounts receivable visualizations be used to estimate bad debts expense and allowance for doubtful accounts? Using the Top 5 Customers by Accounts Receivable Amount Due visualization, which customer has the lowest allowance for doubtful accounts value?arrow_forwardBased on the results of the Sales Order Aging as of December 31, 2022 visualization, what conclusion can be made regarding the outstanding sales orders? a. The sales aging group with the highest value of outstanding sales orders is 90+ days and the sales aging group with the lowest value of outstanding sales orders is 31-60 days. b. The 90+ days sales aging group had a value of outstanding sales orders that was twice as much as the 31-60 days sales aging group. c. The 61-90 days sales aging group had a value of outstanding sales orders that was twice as much as the 31-60 days sales aging group. d. The sales aging group with the highest value of outstanding sales orders is 90+ days and the sales aging group with the lowest value of outstanding sales orders is 61-90 days.arrow_forward

- I am looking for a step-by-step explanation of this financial accounting problem with correct standards.arrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardI need help solving this financial accounting question with the proper methodology.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning