FUND.ACCT.PRIN.

25th Edition

ISBN: 9781260247985

Author: Wild

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 6E

Exercise 4-6

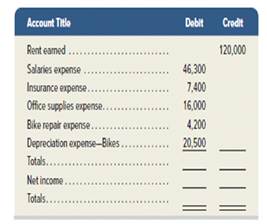

Completing the income statement columns and preparing closing entries

P1 P2

These partially completed Income Statement columns from a 10-column work sheet are for Brown’s Bike Rental Company. (1) Use the information to determine the amount that should be entered on the net income line of the work sheet. (2) Prepare the company’s closing entries.

The owner, H. Brown, did not make any withdrawals this period.

Check Net income. $25.600

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Could you help me solve this financial accounting question using appropriate calculation techniques?

I need help solving this financial accounting question with the proper methodology.

Kindly help me with this General accounting questions not use chart gpt please fast given solution

Chapter 4 Solutions

FUND.ACCT.PRIN.

Ch. 4 - Prob. 1QSCh. 4 - Prob. 2QSCh. 4 - Computing ending capital balance using work sheet...Ch. 4 - Preparing a partial work sheet P1 The ledger of...Ch. 4 - Explaining temporary and permanent accounts Choose...Ch. 4 - Preparing closing entries from the ledger P2 The...Ch. 4 - Prob. 7QSCh. 4 - Prob. 8QSCh. 4 - Prob. 9QSCh. 4 - Prob. 10QS

Ch. 4 - Prob. 11QSCh. 4 - Prob. 12QSCh. 4 - Prob. 13QSCh. 4 - Prob. 14QSCh. 4 - Prob. 15QSCh. 4 - Prob. 16QSCh. 4 - Prob. 17QSCh. 4 - Prob. 18QSCh. 4 - Prob. 19QSCh. 4 - Prob. 20QSCh. 4 - Exercise 4-1 Extending adjusted account balances...Ch. 4 - Exercise 4-2 Extending accounts in a work sheet Pl...Ch. 4 - Exercise 4-3 Preparing adjusting entries from a...Ch. 4 - Exercise 4-4 Preparing unadjusted and adjusted...Ch. 4 - Exercise 4-5 Determining effects of closing...Ch. 4 - Exercise 4-6 Completing the income statement...Ch. 4 - Exercise 4-7 Preparing a work sheet and recording...Ch. 4 - Exercise 4-8

Preparing and posting closing...Ch. 4 - Exercise 4-9 Preparing closing entries and a...Ch. 4 - Exercise 4-10 Preparing closing entries and a...Ch. 4 - Prob. 11ECh. 4 - Exercise 4-12 Preparing a classified balance sheet...Ch. 4 - Exercise 4-13 Computing the current ratio A1 Use...Ch. 4 - Exercise 4-14 Preparing closing entries P2...Ch. 4 - Exercise 4-15 Computing and analysing the current...Ch. 4 - Exercise 4.16A Preparing reversing entries P4 Hawk...Ch. 4 - Exercise 4-17APreparing reversing entries P4 The...Ch. 4 - Problem 4-1A Applying the accounting cycle C2 P2...Ch. 4 - Problem 4-2A Preparing a work sheet, adjusting and...Ch. 4 - Problem 4-3A Determining balance sheet...Ch. 4 - Problem 4-4A Preparing closing entries, financial...Ch. 4 - Problem 4-5A Preparing trial balances, closing...Ch. 4 - Problem 4-6AA Preparing adjusting, reversing, and...Ch. 4 - Problem 4-1B Applying the accounting cycle C2 P2...Ch. 4 - Prob. 2PSBCh. 4 - Problem 4-3B Determining balance sheet...Ch. 4 - Prob. 4PSBCh. 4 - Problem 4-5B Preparing trial balances, closing...Ch. 4 - Problem 4-6BAPreparing adjusting, reversing, and...Ch. 4 - The December 31. 2019= adjusted trial balance of...Ch. 4 - Transactions from the Fast Forward illustration in...Ch. 4 - Prob. 2GLPCh. 4 - Prob. 3GLPCh. 4 - Based on Problem 4-6ACh. 4 - Prob. 5GLPCh. 4 - Refer to Apple' s financial statements in Appendix...Ch. 4 - Prob. 2AACh. 4 - Prob. 3AACh. 4 - Prob. 1DQCh. 4 - That accounts are affected by closing entries?...Ch. 4 - Prob. 3DQCh. 4 - What is the purpose of the Income Summary account?Ch. 4 - Prob. 5DQCh. 4 - Prob. 6DQCh. 4 - Why are the debit and credit entries in the...Ch. 4 - Prob. 8DQCh. 4 - Prob. 9DQCh. 4 - How is unearned revenue classified on the balance...Ch. 4 - Prob. 11DQCh. 4 - Prob. 12DQCh. 4 - Prob. 13DQCh. 4 - Prob. 1BTNCh. 4 - Prob. 2BTNCh. 4 - Prob. 3BTNCh. 4 - The unadjusted trial balance and information for...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain the solution to this financial accounting problem with accurate principles.arrow_forwardHello tutor please given General accounting question answer do fast and properly explain all answerarrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

- Based on the results of the Accounts Receivable Aging as of December 31, 2022 visualization, what conclusion can be made regarding the outstanding accounts receivables? a. The count of unpaid invoices was the highest for invoices within the 90+ days aging group and the lowest for invoices in the 31-60 days aging group. b. The count of unpaid invoices was the highest for invoices within the 31-60 days aging group and the lowest for invoices in the 90+ days aging group. c. The outstanding accounts receivable value for the 90+ days aging group is approximately the value of the other aging groups combined. d. The outstanding accounts receivable value for the 90+ days aging group is approximately twice the value of the other aging groups combined.arrow_forwardPlease given correct answer for General accounting question I need step by step explanationarrow_forwardBased on the results of the Sales Total vs Sales Order Counts by Channel in 2022 visualization, how do the sales channels compare with each other? a. Website sales had the lowest number of sales orders, and the average value of the sales orders was lower compared to the other sales channels. b. B2B sales had the highest number of sales orders, and the average value of the sales orders was lower compared to the other sales channels. c. Storefront sales had the highest number of sales orders, and the average value of the sales orders was lower compared to the other sales channels. d. Storefront sales had the highest number of sales orders, and the average value of the sales orders was higher compared to the other sales channels.arrow_forward

- Please explain this financial accounting problem by applying valid financial principles.arrow_forwardI want to this question answer for Financial accounting question not need ai solutionarrow_forwardI need help with this financial accounting question using accurate methods and procedures.arrow_forward

- Using the Sales Total vs Sales Order Counts by Channel in 2022 visualization, what trends are shown for the B2B sales channel? What recommendations do you have for management for the B2B strategy? What are some considerations when pursuing a B2B strategy?arrow_forwardCan you provide a detailed solution to this financial accounting problem using proper principles?arrow_forwardUsing the results of the Top 5 Customers by Accounts Receivable Amount Due and the Top 5 Customers by Outstanding Sales Order Amount visualization, what conclusion can be made regarding the outstanding sales orders? a. The high value of outstanding accounts receivable for Sanders Corp may be directly related to their high value of outstanding sales orders. b. The high value of outstanding accounts receivable for Williams Corp may be directly related to their high value of outstanding sales orders. c. The high value of outstanding sales orders for Roberts Corp has caused them not to pay a large value of invoices. d. Evans Corp has a high value of outstanding accounts receivable and outstanding sales orders.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY