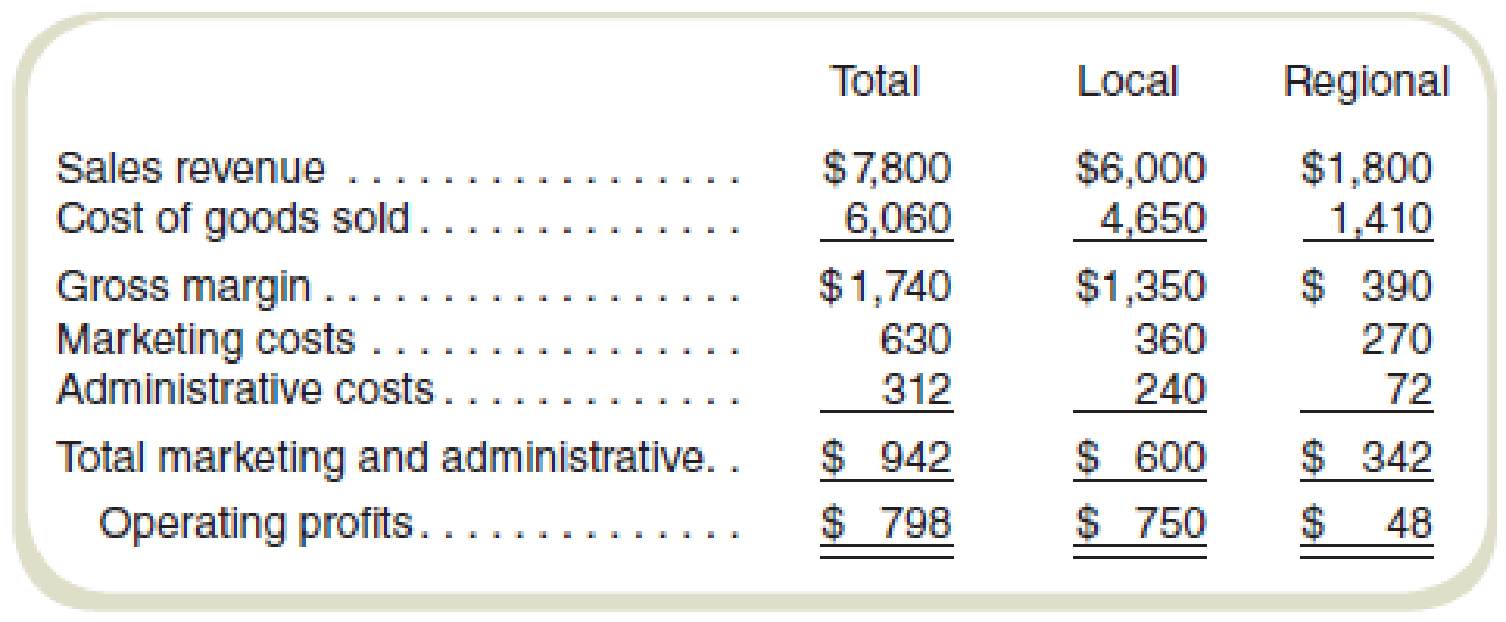

Agnew Manufacturing produces and sells three models of a single product, Standard, Superior, and DeLuxe, in a local market and in a regional market. At the end of the first quarter of the current year, the following income statement (in thousands of dollars) has been prepared:

Management has expressed special concern with the regional market because of the extremely poor return on sales. This market was entered a year ago because of excess capacity. It was originally believed that the return on sales would improve with time, but after a year, no noticeable improvement can be seen from the results as reported in the preceding quarterly statement.

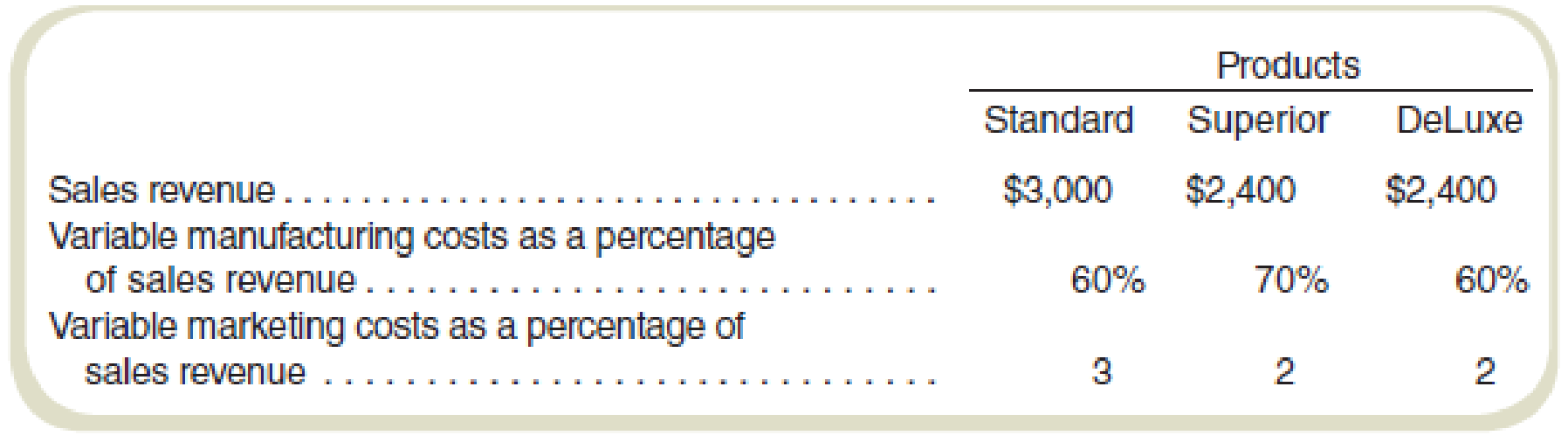

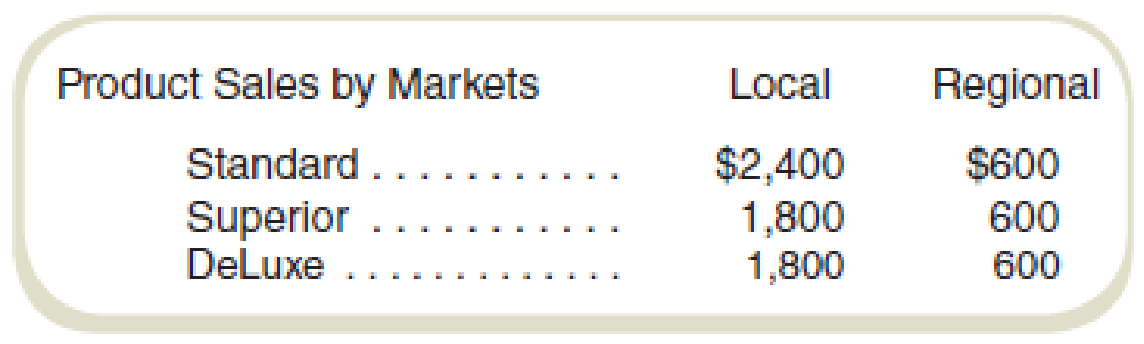

In attempting to decide whether to eliminate the regional market, the following information has been gathered:

All administrative costs and fixed

Required

- a. Assuming there are no alternative uses for Agnew’s present capacity, would you recommend dropping the regional market? Why or why not?

- b. Prepare the quarterly income statement showing contribution margins by products. Do not allocate fixed costs to products.

- c. It is believed that a new model can be ready for sale next year if Agnew decides to go ahead with continued research. The new product would replace DeLuxe and can be produced by simply converting equipment presently used in producing the DeLuxe model. This conversion will increase fixed costs by $60,000 per quarter. What must be the minimum contribution margin per quarter for the new model to make the changeover financially feasible?

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

FUNDAMENTALS OF...(LL)-W/ACCESS>IP<

- chose best answer plzarrow_forward?? Financial accountingarrow_forwardA firm has a market value equal to its book value. Currently, the firm has excess cash of $1,000, other assets of $5,500, and equity of $6,500. The firm has 650 shares of stock outstanding and a net income of $600. The firm has decided to spend half of its excess cash on a share repurchase program. How many shares of stock will be outstanding after the stock repurchase is completed? a. 625 shares b. 640 shares c. 600 shares d. 630 shares e. 615 sharesarrow_forward

- Provide correct answer general accounting questionarrow_forwardanswer plzarrow_forwardThe controller of Afton Manufacturing has collected the following monthly expense data for use in analyzing the cost behavior of maintenance costs: ⚫ January: $2,800 and 3,500 machine hours • February: $3,200 and 4,200 machine hours ⚫ March: $3,800 and 6,000 machine hours ⚫ April: $4,500 and 7,500 machine hours • May: $3,600 and 5,200 machine hours • June: $5,200 and 7,000 machine hours Using the high-low method, determine the estimated fixed cost element and the variable cost per unit of machine hour.arrow_forward

- Subject general accountingarrow_forwardFinancial accountingarrow_forwardDelta Corp. had the following data last year: • Net income = $1,200 • Net operating profit after taxes (NOPAT) = $1,100 • Total assets = $4,500 Total operating capital = $3,500 For the just-completed year, Delta Corp. reported: • Net income = $1,500 • NOPAT = $1,375 • Total assets = $3,800 Total operating capital = $3,900 How much free cash flow (FCF) did Delta generate during the just-completed year?arrow_forward

- Slotnick Chemical received $380,000 from customers as deposits on returnable containers during 2024. Fifteen percent of the containers were not returned. The deposits are based on the container cost marked up 25%. How much profit did Slotnick realize on the forfeited deposits? Note: Do not round intermediate calculations. Multiple Choice $11,400 $0 $14,250 $57,000arrow_forwardPlease see an attachment for details financial accounting questionarrow_forwardmanufacturing overhead cost for may?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning