Concept explainers

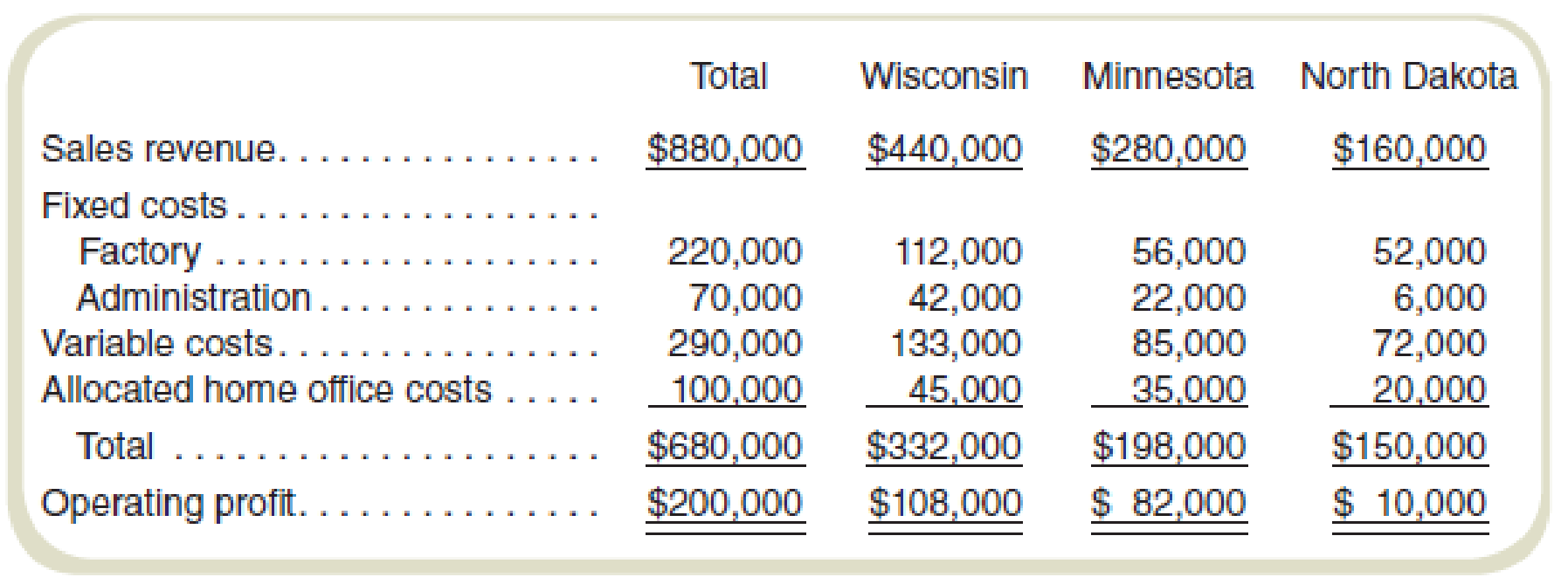

You have been asked to assist the management of Ironwood Corporation in arriving at certain decisions. Ironwood has its home office in Michigan and leases factory buildings in Wisconsin, Minnesota, and North Dakota, all of which produce the same product. Ironwood’s management provided you a projection of operations for next year follow:

The sales price per unit is $5.

Due to the marginal results of operations of the factory in North Dakota, Ironwood has

decided to cease its operations and sell that factory’s machinery and equipment by the end of this year. Ironwood expects that the proceeds from the sale of these assets would equal all termination costs. Ironwood, however, would like to continue serving most of its customers in that area if it is economically feasible and is considering one of the following three alternatives:

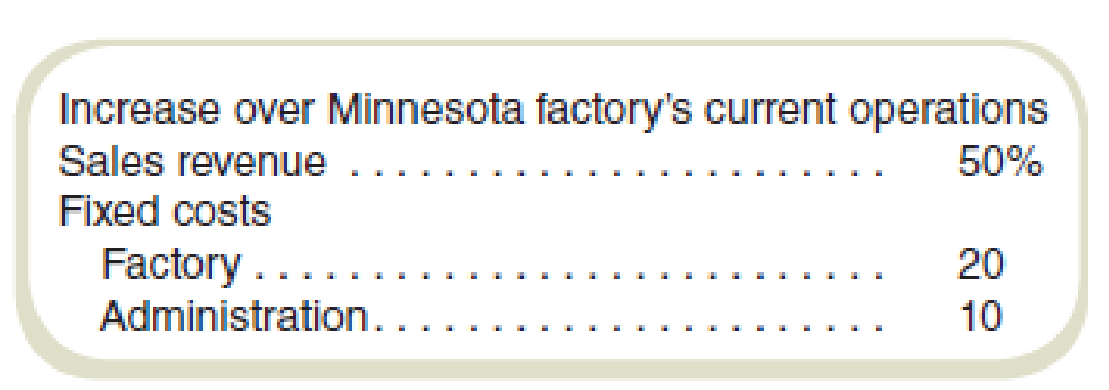

- Expand the operations of the Minnesota factory by using space presently idle. This move would result in the following changes in that factory’s operations:

Under this proposal, variable costs would be $2 per unit sold.

- Enter into a long-term contract with a competitor that will serve that area’s customers. This competitor would pay Ironwood a royalty of $1 per unit based on an estimate of 30,000 units being sold.

- Close the North Dakota factory and not expand the operations of the Minnesota factory.

Total home office costs of $100,000 will remain the same under each situation.

Required

To assist the management of Ironwood Corporation, prepare a schedule computing Ironwood’s estimated operating profit from each of the following options:

- a. Expansion of the Minnesota factory.

- b. Negotiation of the long-term contract on a royalty basis.

- c. Shutdown of the North Dakota operations with no expansion at other locations.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Fundamentals of Cost Accounting

- What is the adjusted cost of goods sold for the year?arrow_forward???!!!arrow_forwardCedar Fabricators uses a standard costing system. For its main product, the standard material cost is $14.00 per kilogram and the standard quantity allowed is 3 kilograms per unit. During April, the company purchased 15,000 kilograms of material at $13.75 per kilogram and used 14,200 kilograms to produce 4,600 units. Calculate the material price variance and material quantity variance.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning