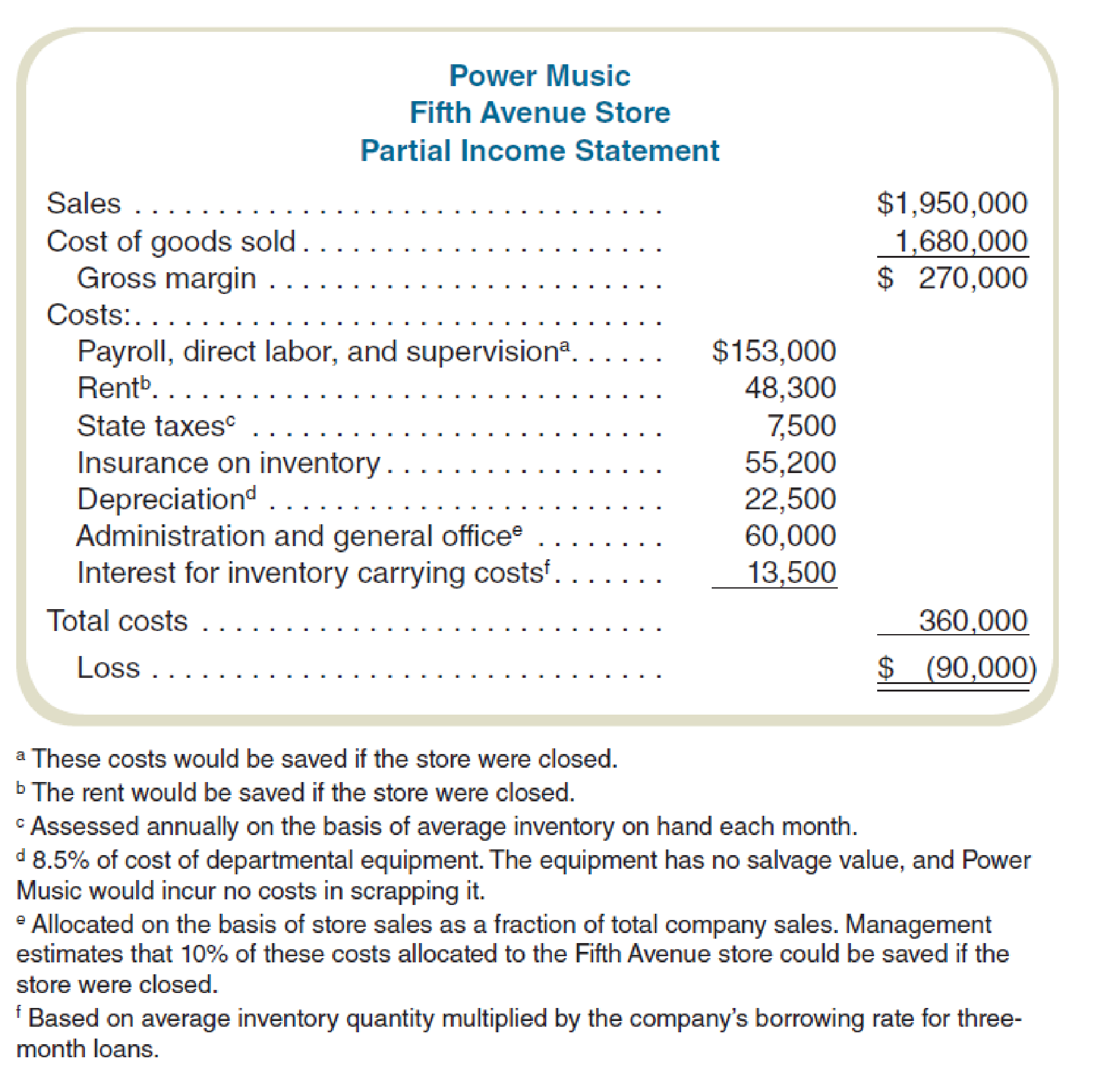

Power Music owns five music stores, where it sells music, instruments, and supplies. In addition, it rents instruments. At the end of last year, the new accounts showed that although the business as a whole was profitable, the Fifth Avenue store had shown a substantial loss. The income statement for the Fifth Avenue store for last month follows:

Analysis of these results has led management to consider closing the Fifth Avenue store. Members of the management team agree that keeping the Fifth Avenue store open is not essential to maintaining good customer relations and supporting the rest of the company’s business. In other words, eliminating the Fifth Avenue store is not expected to affect the amount of business done by the other stores.

Required

What action do you recommend to Power Music’s management? Write a short report to management recommending whether or not to close the Fifth Avenue store. Include the reasons for your recommendation.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

- Can you help me solve this financial accounting problem using the correct accounting process?arrow_forwardCan you solve this financial accounting question using valid financial methods?arrow_forwardI am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forward

- Please provide the accurate answer to this financial accounting problem using valid techniques.arrow_forwardPlease provide the correct answer to this financial accounting problem using valid calculations.arrow_forwardI need help with this financial accounting question using the proper financial approach.arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,