Concept explainers

Concept Introduction:

Bank Reconciliation:

Bank reconciliation is the process in which the entity reconciles its cash entries in accounts with the entries in bank statement issued by the bank. The entity prepares

Requirement-1:

To Prepare:

The Bank reconciliation Statement.

Answer to Problem 60APSA

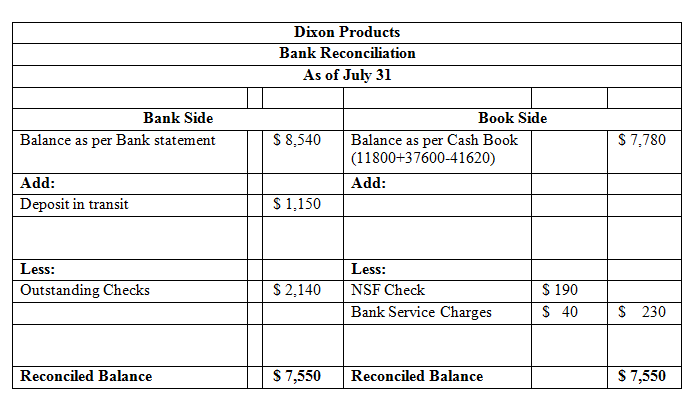

The Bank reconciliation Statement is as follows:

Explanation of Solution

The Bank reconciliation Statement is explained as follows:

| Dixon Products | |||||

| Bank Reconciliation | |||||

| As of July 31 | |||||

| Bank Side | Book Side | ||||

| Balance as per Bank statement | $ 8,540 | Balance as per | $ 7,780 | ||

| Add: | Add: | ||||

| Deposit in transit | $ 1,150 | ||||

| Less: | Less: | ||||

| Outstanding Checks | $ 2,140 | NSF Check | $ 190 | ||

| Bank Service Charges | $ 40 | $230 | |||

| Reconciled Balance | $ 7,550 | Reconciled Balance | $ 7,550 | ||

Concept Introduction:

Bank Reconciliation:

Bank reconciliation is the process in which the entity reconciles its cash entries in accounts with the entries in bank statement issued by the bank. The entity prepares bank reconciliation statement and it has two sides; Bank Side and Cash side.

Requirement-2:

To Prepare:

The necessary

Answer to Problem 60APSA

The necessary adjusting entries are as follows:

| Dixon Products | |||

| Bank Reconciliation | |||

| Date | Accounts titles and Explanation | Debit | Credit |

| July. 31 | Accounts Receivable | $ 190 | |

| Cash | $190 | ||

| July. 31 | Bank Charges | $ 40 | |

| Cash | $ 40 | ||

Explanation of Solution

The necessary adjusting entries are explained as follows:

| Dixon Products | |||

| Bank Reconciliation | |||

| Journal Entries | |||

| Date | Accounts titles and Explanation | Debit | Credit |

| July. 31 | Accounts Receivable | $ 190 | |

| Cash | $190 | ||

| (Being adjustment made for NSF check) | |||

| July. 31 | Bank Charges | $ 40 | |

| Cash | $ 40 | ||

| (Being adjustment made for Bank Charges) | |||

Concept Introduction:

Bank Reconciliation:

Bank reconciliation is the process in which the entity reconciles its cash entries in accounts with the entries in bank statement issued by the bank. The entity prepares bank reconciliation statement and it has two sides; Bank Side and Cash side.

Requirement-3:

To Indicate:

The amount of cash to be reported on

Answer to Problem 60APSA

The amount of cash to be reported on balance sheet shall be $7,550

Explanation of Solution

The Bank reconciliation Statement is explained as follows:

| Dixon Products | |||||

| Bank Reconciliation | |||||

| As of July 31 | |||||

| Bank Side | Book Side | ||||

| Balance as per Bank statement | $ 8,540 | Balance as per Cash Book (11800+37600-41620) | $ 7,780 | ||

| Add: | Add: | ||||

| Deposit in transit | $ 1,150 | ||||

| Less: | Less: | ||||

| Outstanding Checks | $ 2,140 | NSF Check | $ 190 | ||

| Bank Service Charges | $ 40 | $230 | |||

| Reconciled Balance | $ 7,550 | Reconciled Balance | $ 7,550 | ||

Hence, the amount of cash to be reported on October 31 balance sheet shall be $7,550.

Want to see more full solutions like this?

Chapter 4 Solutions

Cornerstones of Financial Accounting - With CengageNow

- Department B had 12,000 units in work in process that were 75% completed as to labor and overhead at the beginning of the period; 52,400 units of direct materials were added during the period; 48,000 units were completed during the period, and 9,500 units were 60% completed as to labor and overhead at the end of the period. All materials are added at the beginning of the process. The first-in, first-out method is used to cost inventories. The number of equivalent units of production for conversion costs for the period was ____ Units.arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forwardTropical Furnishings, Inc. had net cash from operating activities of $178,000. It paid $140,000 to buy new manufacturing equipment by signing a $110,000 note and paying the balance. Net cash from (or used for) investing activities for the period was _.arrow_forward

- Elegant Bites earned net sales revenue of $62,300,000 in2022. The cost of goods sold was $47,950,000, and net income reached $11,400,000, the company’s highest ever. Compute the company’s gross profit percentage for 2022.arrow_forwardCompute the manufacturing margin for the company under variable costingarrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning