Concept explainers

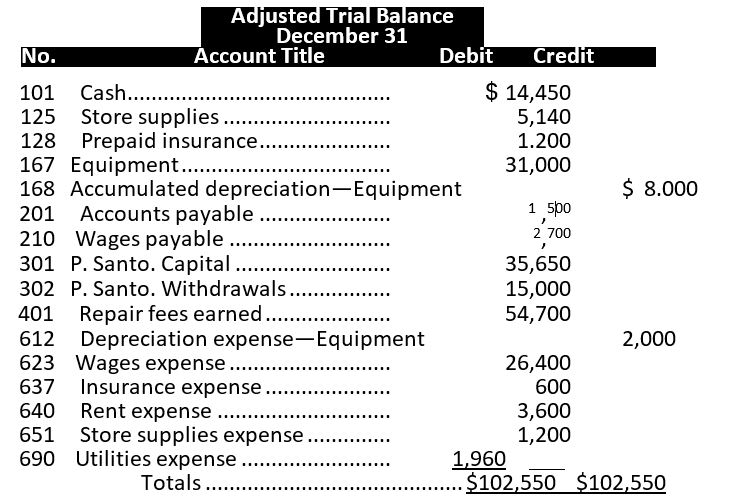

Problem 4-5B Preparing trial balances, closing entries, and financial statements C3 P2 P3

Santo Company's adjusted

Required

1. Prepare an income statement and a statement of owner's equity for the year and a classified

Capital account balance was $35.650 on December 31 of the prior year.

Check (1) Ending capital balance, $39,590

2. Enter the adjusted trial balance in the first two columns of a six-column table. Use the middle two columns for closing entry information and the last

two columns for a post-closing trial balance. Insert an Income Summary account (No. 301) as the last item in the trial balance.

(2)P-C trial balance totals, $51,790

3. Enter closing entry information in the sk-column table and prepare

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

FUNDAMENTAL ACCT.PRIN.-CONNECT ACCESS

- On May 1, Dark Horizons Inc. had a beginning cash balance of $200. April sales were $500, and May sales were $600. During May, the firm had cash expenses of $150 and payments on accounts payable of $300. The firm's accounts receivable period is 30 days. What is Dark Horizons Inc.'s beginning cash balance on June 1?arrow_forwardANSWER?arrow_forwardSerfass Corporation's contribution format income statement for July appears below: Sales Variable expenses $307,800 $153,900 Contribution margin $153,900 Fixed expenses $40,010 Net operating income $113,890 The degree of operating leverage is closest to: a. 0.37 b. 0.74 c. 2.00 d. 1.35arrow_forward

- Hito’s Auto Spa has $95,000 of fixed costs and variable costs equal to 65% of sales. How much total sales are required to achieve a net income of $160,000? Helparrow_forwardOslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses $22,400 12,800 Contribution margin 9,600 Fixed expenses 7,968 Net operating income $1,632 What is the degree of operating leverage?arrow_forwardTech Solutions, Inc. is looking to achieve a net income of 18 percent of sales. Here’s the firm’s profile: Unit sales price is $12; variable cost per unit is $7; total fixed costs are $50,000. What is the level of sales in units required to achieve a net income of 18 percent of sales?arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning