1.

Journalize

1.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and

Record the adjusting entries of Company N.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| a. | Store supplies expense (1) | 4,050 | ||

| Store supplies | 4,050 | |||

| (To record store supplies expense) | ||||

| b. | Insurance expenses | 1,400 | ||

| Prepaid expenses | 1,400 | |||

| (To record prepaid selling expenses) | ||||

| c. | 1,525 | |||

| 1,525 | ||||

| (To record depreciation expenses) | ||||

| d. | Cost of goods sold | 1,600 | ||

| Merchandise inventory (2) | 1,600 | |||

| (To record the inventory shrinkage) |

Table (1)

a. To record store supplies expense:

- Store supplies expense is an expense account and it is increased. Therefore, debit office supplies expense with $4,050.

- Store supplies are an asset account and it is decreased. Therefore, credit office supplies with $4,050.

b. To record prepaid insurance expenses:

- Insurance expense is an expense account and it is increased. Therefore, it is debited with $1,400.

- Prepaid expense is an asset account and it is decreased. Therefore, credit prepaid selling expense with $1,400.

c. To record depreciation expenses:

- Depreciation expense is an expense account and it is increased. Therefore, it is debited with $1,525.

- Prepaid expense is an asset account and it is decreased. Therefore, credit prepaid selling expense with $1,525.

d. To record the shrinkage of inventory:

- Cost of goods sold is an expense and they are increased. Thus, it is debited with $1,600.

- Inventory is an asset account, and they are increased. Hence, debit the inventory returns estimated account by $1,600.

Working Note:

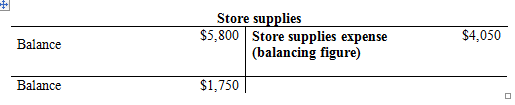

Compute the Store supplies expense.

(1)

(1)

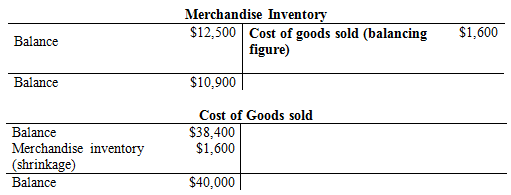

Compute the shrinkage of inventory.

(2)

(2)

2.

Prepare the multi-step income statement of Company N for the year ended January 31, 2017.

2.

Explanation of Solution

Multi-step income statement: The income statement represented in multi-steps with several subtotals, to report the income from principal operations, and separate the other expenses and revenues which affect net income, is referred to as multi-step income statement.

Prepare the income statement of Company N for the year ended January 31, 2017.

| Company N | ||

| Statement of Income | ||

| For the year ended January 31, 2017 | ||

| Particulars | Amount | Amount |

| Sales | $111,950 | |

| Less: Sales discounts | $2,000 | |

| Sales returns and allowances | $2,200 | ($4,200) |

| Net sales | $1,07,750 | |

| Less: Cost of goods sold (2) | ($40,000) | |

| Gross profit | $67,750 | |

| Expenses | ||

| Selling expenses | ||

| Depreciation expense—Store equipment | $1,525 | |

| Sales salaries expense | $17,500 | |

| Rent expense—Selling space | $7,500 | |

| Store supplies expense (1) | $4,050 | |

| Advertising expense | $9,800 | |

| Total selling expenses | $40,375 | |

| General and administrative expenses | ||

| Insurance expense | $1,400 | |

| Office salaries expense | $17,500 | |

| Rent expense—Office space | $7,500 | |

| Total general and administrative expenses | $26,400 | |

| Total expenses | ($66,775) | |

| Net income | $975 | |

Table (2)

Thus, the net income of Company N for the year ended January 31, 2017 is $975.

3.

Prepare the single-step income statement of Company N for the year ended December 31, 2017.

3.

Explanation of Solution

Single-step income statement: This statement displays the total revenues as one line item from which the total expenses including cost of goods sold is subtracted to arrive at the net profit /net loss for the period.

Prepare the income statement of Company N for the year ended January 31, 2017.

| Company N | ||

| Statement of Income | ||

| For the year ended January 31, 2017 | ||

| Particulars | Amount | Amount |

| Net sales | $107,750 | |

| Less: Expenses | ||

| Cost of goods sold (2) | $40,000 | |

| Selling expenses (Refer Table (2)) | $40,375 | |

| General and administrative expense (Refer Table (2)) | $26,400 | |

| Total expenses | ($1,06,775) | |

| Net income | $975 | |

Table (3)

Thus, the net income of Company N for the year ended January 31, 2017 is $975.

4.

Compute

4.

Explanation of Solution

Current ratio: Current ratio is one of the

Acid test ratio: It is a ratio used to determine a company’s ability to pay back its current liabilities by liquid assets that are current assets except inventory and prepaid expenses.

Gross margin ratio: The percentage of gross profit generated by every dollar of net sales is referred to as gross margin ratio. This ratio measures the profitability of a company by quantifying the amount of income earned from sales revenue generated after cost of goods sold are paid. The higher the ratio, the more ability to cover operating expenses. It is calculated by using the formula:

Compute current ratio, acid test ratio and gross margin ratio of Company N.

| Computation of ratios | |

| Particulars | Amount |

| Cash | $1,000 |

| Merchandise inventory (2) | $10,900 |

| Store supplies (1) | $1,750 |

| Prepaid insurance | $1,000 |

| Total current assets (A) | $14,650 |

| Current liabilities (B) | $10,000 |

| Current ratio | 1.47 |

| Quick assets (Cash) (C) | $1,000 |

| Current liabilities (D) | $10,000 |

| Acid-test ratio | 0.10 |

| Net Sales (E) | $107,750 |

| Less: Cost of Goods Sold (2) | ($40,000) |

| Gross margin (F) | $67,750 |

| Gross margin ratio | 0.63 or 63% |

Table (4)

The current ratio, acid- test ratio and gross margin ratio of Company N is 1.47, 0.10 and 0.63 or 63% respectively.

Want to see more full solutions like this?

Chapter 4 Solutions

FINANCIAL ACCT.FUND(LL)W/ACCESS>CUSTOM<

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardhttps://investor.exxonmobil.com/sec-filings/annual-reports/content/0000034088-25-000010/0000034088-25-000010.pdf Use link to help me answer my questions please in picturearrow_forwardPlease solve and show work.arrow_forward

- Sequoia Resorts pays $780,000 plus $17,500 in closing costs to buy out a competitor. The real estate consists of land appraised at $95,000, a building appraised at $342,000, and recreational equipment appraised at $398,000. Compute the cost that should be allocated to the building.arrow_forwardI need help with this solution and general accounting questionarrow_forwardCozy Retreats currently sells 420 Standard hot tubs, 580 Luxury hot tubs, and 190 Premium model hot tubs each year. The firm is considering adding a Comfort model hot tub and expects that, if it does, it can sell 340 of them. However, if the new hot tub is added, standard sales are expected to decline to 290 units while Luxury sales are expected to decline to 310. The sales of the Premium model will not be affected. Standard hot tubs sell for an average of $8,900 each. Luxury hot tubs are priced at $14,500 and the Premium model sells for $22,000 each. The new Comfort model will sell for $12,300. What is the value of erosion?arrow_forward

- Salma Production uses direct labor cost as the allocation base for applying MOH to WIP. The budgeted direct labor cost for the year was $850,000. The budgeted manufacturing overhead was $722,500. The actual direct labor cost for the year was $910,000. The actual manufacturing overhead was $745,000. A. What was Salma's predetermined manufacturing overhead rate per direct labor dollars? B. How much MOH was applied to WIP during the year?arrow_forwardHello tutor solve this question and accountingarrow_forwardThe total factory overhead for Leicester Manufacturing is budgeted for the year at $756,000. Leicester manufactures two product lines: standard lamps and premium lamps. These products each require 4 direct labor hours to manufacture. Each product is budgeted for 8,000 units of production for the year. Determine the factory overhead allocated per unit for premium lamps using the single plantwide factory overhead rate.arrow_forward

- I need help with this solution and accounting questionarrow_forwardhttps://investor.exxonmobil.com/sec-filings/annual-reports/content/0000034088-25-000010/0000034088-25-000010.pdf Use link to help me answer my question please in picturearrow_forwardHello tutor solve this question and accountingarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education