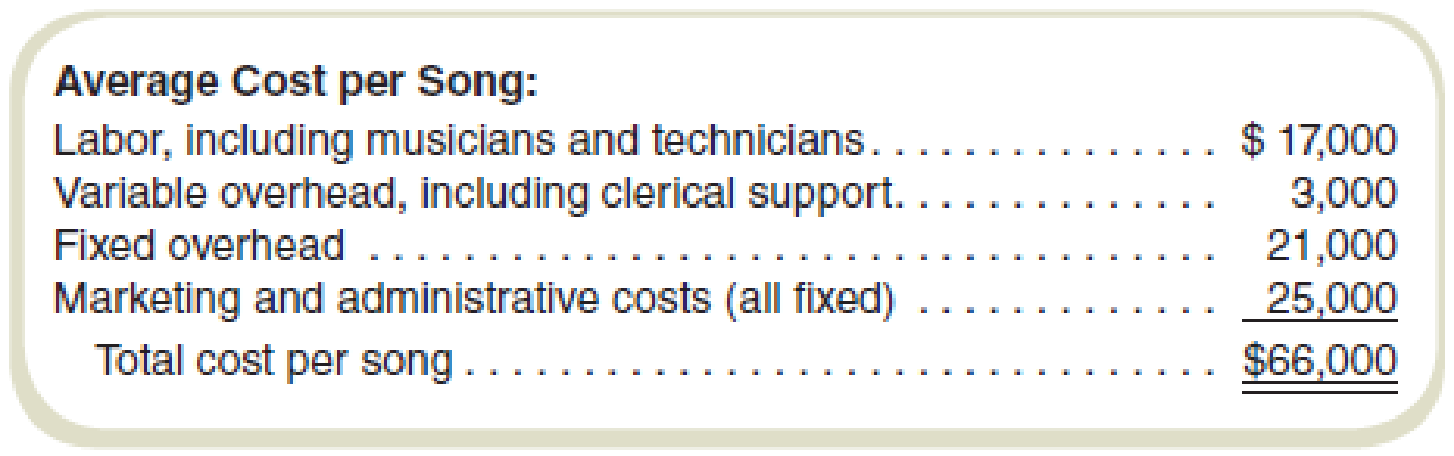

M. Anthony, LLP, produces music in a studio in London. The cost of producing one typical song follows:

The fixed costs allocated to each song are based on the assumption that the studio produces 60 songs per month.

Required

Treat each question independently. Unless stated otherwise, M. Anthony charges $80,000 per song produced.

- a. How many songs must the firm produce per month to break even?

- b.

Market research estimates that a price increase to $90,000 per song would decrease monthly volume to 52 songs. The accounting department estimates that fixed costs would remain unchanged in total, and variable costs per song would remain unchanged if the volume were to drop to 52 songs per month. How would a price increase affect profits? - c. Assume that M. Anthony’s studio is operating at its normal volume of 60 songs per month. It has received a special request from a university to produce 30 songs that will make up a two-CD set. M. Anthony must produce the music next month or the university will take its business elsewhere. M. Anthony would have to give up normal production of 10 songs because it has the capacity to produce only 80 songs per month. Because of the need to produce songs on a timely basis, M. Anthony could not make up the production of those songs in another month. Because the university would provide its own musicians, the total variable cost (labor plus

overhead ) would be cut to $15,000 per song on the special order for the university. The university wants a discounted price; it is prepared to pay only $40,000 per song and believes a fee reduction is in order. Total fixed costs will be the same whether or not M. Anthony accepts the special order. Should M. Anthony accept the special order? - d. Refer to the situation presented in requirement (c) above. Instead of offering to pay $40,000 per song, suppose the university comes to M. Anthony with the following proposition. The university official says, “We want you to produce these 30 songs for us. We do not want you to be worse off financially because you have produced these songs. On the other hand, we want the lowest price we can get.” What is the lowest price that M. Anthony could charge and be no worse off for taking this order?

a.

Calculate the number of songs that are needed to be produced for the break-even.

Answer to Problem 56P

The break-even point is 46 songs.

Explanation of Solution

Break-even point:

The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses.

Calculate the break-even point:

Thus, the break-even point is 46 songs.

Working note 1:

Calculate the fixed costs:

Working note 2:

Calculate the fixed cost per unit:

Working note 3:

Calculate the contribution margin per unit:

Working note 4:

Calculate the variable cost (unit):

b.

Calculate the change in price affect the profit of the company.

Answer to Problem 56P

The change in profit is $40,000 in the case of the price increase.

Explanation of Solution

Operating profit:

The operating profit is the excess of total revenues over total expenses after adjusting for depreciation and taxes.

Calculate the change in the profit after the increase in price:

| Particulars |

Amount (60 songs) |

Amount (52 songs) | Change |

| Revenue | $4,800,000 | $4,680,000 | $120,000 lower |

| Less: variable costs | $1,200,000 | $1,040,000 | $160,000 lower |

| Contribution margin | $3,600,000 | $3,640,000 | $440,000 higher |

| Fixed costs | $2,760,000 | $2,760,000 | No change |

| Profit | $840,000 | $880,000 | $40,000 higher |

Table: (1)

Thus, the change in profit is $40,000 in the case of the price increase.

c.

Suggest whether Mr. M should accept the special offer or not.

Answer to Problem 56P

The change in profit is $150,000 in case of special order.

Explanation of Solution

Special order:

When the company gets a bigger order, then the usual order and the price of the unit is relatively lower than the price of normal units. Then this order is known as special order.

Calculate the change in profit:

| Particulars |

Amount (Status quo sales) |

Amount (alternate) | Change |

| Revenue | $4,800,000 | $5,200,000 | $400,000 lower |

| Less: variable costs | $1,200,000 | $1,450,000 | $250,000 lower |

| Contribution margin | $3,600,000 | $3,750,000 | $150,000 higher |

| Fixed costs | $2,760,000 | $2,760,000 | no change |

| Profit | $840,000 | $990,000 | $150,000 higher |

Table: (2)

Thus, the change in profit is $150,000 in case of special order.

d.

Calculate the change in case of special order.

Answer to Problem 56P

The change in price is $35,000.

Explanation of Solution

Special order:

When the company gets a bigger order, then the usual order and the price of the unit is relatively lower than the price of normal units. Then this order is known as special order.

Calculate the change in price:

Thus, the change in price is $35,000.

Working note 5:

Calculate the contribution margin per unit:

Working note 6:

Calculate the contribution margin foregone:

Mr. M has to foregone the contribution margin of 10 songs in order to produce the school’s songs. Contribution margin is calculated as follows:

Want to see more full solutions like this?

Chapter 4 Solutions

Loose-leaf For Fundamentals Of Cost Accounting

- Which item would appear on the statement of retained earnings?A. DividendsB. InventoryC. Prepaid RentD. Notes Payablearrow_forwardWhat does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetno aiarrow_forward

- 4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetneed helparrow_forward4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardA contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s importantDont use AIarrow_forward

- A contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s important need helparrow_forwardA contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s importantarrow_forwardNo chatgpt 6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landarrow_forward

- Need help hi 6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landarrow_forward6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Land i need helparrow_forward6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landneed helparrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning