Concept explainers

Special Orders

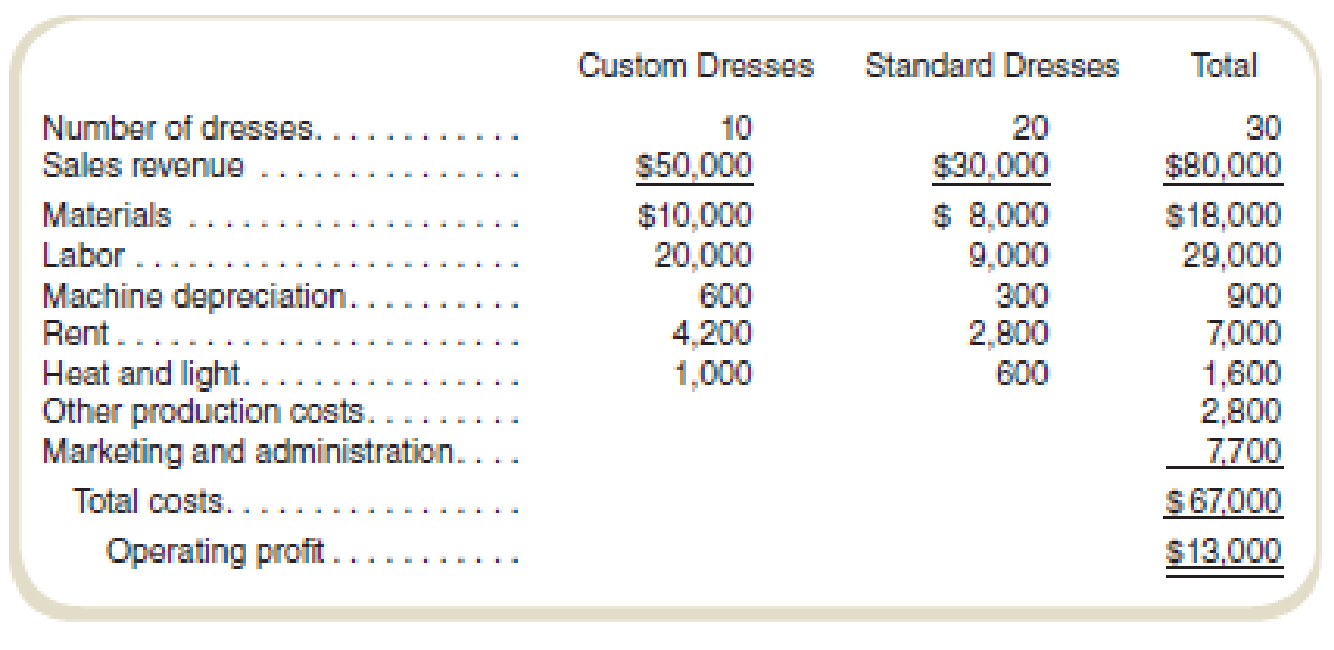

Sherene Nili manages a company that produces wedding gowns. She produces both a custom product that is made to order and a standard product that is sold in bridal salons. Her accountant prepared the following

Ms. Nili already has orders for the 10 custom dresses reflected in the March forecasted income statement. The depreciation charges are for machines used in the respective product lines. Machines

A valued customer, who is a wedding consultant, has asked Ms. Nili for a special favor. This customer has a client who wants to get married in early April. Ms. Nili’s company is working at capacity and would have to give up some other business to make this dress. She can’t renege on custom orders already agreed to, but she can reduce the number of standard dresses produced in March to 10. Ms. Nili would lose permanently the opportunity to make up the lost production of standard dresses because she has no unused capacity for the foreseeable future. The customer is willing to pay $24,000 for the special order. Materials and labor for the order will cost $6,000 and $10,000, respectively. The special order would require 140 hours of machine time. Ms. Nili’s company would save 150 hours of machine time from the standard dress business given up. Rent, heat and light, and other production costs would not be affected by the special order.

Required

- a. Should Ms. Nili take the order? Explain your answer.

- b. What is the minimum price Ms. Nili should accept to take the special order?

- c. What are the other factors, if any, besides price that she should consider?

a.

Determine whether Mr. N should take the order or not.

Answer to Problem 54P

Yes, Mr. N should take the order because of the operating profit increases by $1,510 in case of special order.

Explanation of Solution

Calculate the change in operating profit because of a special order:

| Particulars | Status Quo: without special dress | Alternative: with special dress | Difference |

| Sales | $80,000 | $89,000 (1) | $9,000 higher |

| Less: variable costs | |||

| Material cost | $18,000 | $20,000 (3) | $2,000 higher |

| Labor cost | $29,000 | $34,500 (5) | $5,500 higher |

| Machine depreciation | $900 | $890 (7) | $10 lower |

| Contribution margin | $32,100 | $33,610 | $1,510 higher |

| Less: fixed costs | |||

| Rent | $7,000 | $7,000 | $0 no change |

| Heat and light | $1,600 | $1,600 | $0 no change |

| Other production cost | $2,800 | $2,800 | $0 no change |

| Marketing and administration cost | $7,700 | $7,700 | $0 no change |

| Operating cost | $13,000 | $14,510 | $1,510 higher |

Table: (1)

Thus, the profit increases by $1,510 in case of special order.

Working note 1:

Calculate the sales revenue for special order:

Working note 2:

Calculate the loss of forcasted custome dress sales:

Working note 3:

Calculate the material cost for special order:

Working note 4:

Clculate the saving in cost of marterial of forcasted custom dress:

Working note 5:

Calculate the labor cost for special order:

Working note 6:

Clculate the saving in cost of laborl of forcasted custom dress:

Working note 7:

Calculate the machine depreciation:

Working note 8:

Clculate the saving in cost of laborl of forcasted custom dress:

b.

Calculate the minimum price to accept the offer.

Answer to Problem 54P

The minimum acceptable price for the special order is $22,490.

Explanation of Solution

Calculate the minimum acceptable price for the special order:

The minimum acceptable price will be where the business is neither making any profit nor any loss. Currently business is making the additional profit of $1,510 at the additional revenue of $24,000.

Ms. N can charge $22,490

Thus, the minimum acceptable price is $22,490.

c.

Suggest the factors that should be considered before accepting the special order other than price.

Explanation of Solution

Factors to consider before accepting the special order:

- • Ms. N should consider that the customers of 10 standard dresses will now go to her competitors.

- • Mr. N should also consider that she would get a consistent order of dresses in the future to maintain the sales and profit level

Thus, Ms. N should consider the consistent level of orders and loss of customers because of special order.

Want to see more full solutions like this?

Chapter 4 Solutions

FUND.OF COST ACCT >CUSTOM<

- Bruce Inc. began the year with stockholders' equity of $280,000. During the year, the company recorded revenues of $410,000 and expenses of $325,000, and the company paid dividends of $40,000. What was Bruce's stockholders' equity at the end of the year? Helparrow_forwardA local bakery sells 12,000 loaves of sourdough bread each year. The loaves are ordered from an outside supplier, and it takes 4 days for each shipment of loaves to arrive. Ordering costs are estimated at $18 per order. Carrying costs are $6 per loaf per year. Assume that the bakery is open 300 days a year. What is the maximum inventory of loaves held in a given ordering cycle? a. 180.02 b. 362.07 c. 268.33 d. 152.98arrow_forwardBruce Inc. began the year with stockholders' equity of $280,000. During the year, the company recorded revenues of $410,000 and expenses of $325,000, and the company paid dividends of $40,000. What was Bruce's stockholders' equity at the end of the year?arrow_forward

- What is the variable cost per unit processedarrow_forwardA proposed project has estimated sale units of 2,500, give or take 2 percent. The expected variable cost per unit is $12.79 and the expected fixed costs are $17,500. Cost estimates are considered accurate within a plus or minus 3 percent range. The depreciation expense is $2,850. The sale price is estimated at $15.40 a unit, give or take 3 percent. The company bases its sensitivity analysis on the expected case scenario. If a sensitivity analysis is conducted using a variable cost estimate of $13, what will be the total annual variable costs?arrow_forwardWhat is the maximum inventoryarrow_forward

- Financial Accountingarrow_forwardWhat is the company's plant wide overhead rate on these financial accounting question?arrow_forwardCharlotte's Cleaning Services began the year with total liabilities of $120,000 and stockholders' equity of $55,000. During the year, the company earned $140,000 in net income and paid $10,000 in dividends. Total liabilities at the end of the year were $260,000. How much are total assets at the end of the year? Provide answerarrow_forward

- Sunflower Oil Processors incurred the following plant maintenance costs: 65,000 units processed with maintenance costs of $92,000 48,000 units processed with maintenance costs of $75,000 What is the variable cost per unit processed?arrow_forwardAnswerarrow_forwardPlease provide answer the following requirements a and b on these financial accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,