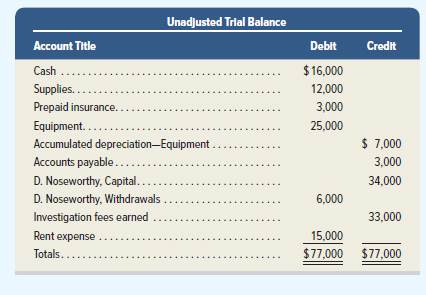

The unadjusted

Additional Year-End Information

1. Insurance that expired in the current period amounts to $2,200.

2. Equipment

3. Unused supplies total $5,000 at period-end.

4. Services in the amount of $800 have been provided but have not been billed or collected.

Responsibilities for Individual Team Members

1. Determine the accounts arid adjusted balances to be extended to the

determine total assets and total liabilities.

2. Determine the adjusted revenue account balance and prepare the entry to close this account.

3. Determine the adjusted account balances for expenses and prepare the entry to dose these accounts.

4. Prepare T-accounts for both D. Noseworthy, Capital (reflecting the unadjusted trial balance amount) and Income Summary. Prepare the third

and fourth closing entries. Ask teammates assigned to parts 2 and 3 for the postings for Income Summary. Obtain amounts to complete the

third closing entry and post both the third and fourth closing entries. Provide the team with the ending capital account balance.

5. The entire team should prove the accounting equation using post-closing balances.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

FUND.ACCT.PRINC.(LL) 25E <C> W/ CONNECT

- I need help with this financial accounting question using accurate methods and procedures.arrow_forwardStarlight Medical Equipment maintains inventory cards. Item #456 shows: beginning 210 units, received 320 units, issued 390 units. Physical count reveals 125 units. Determine the missing units. Need answerarrow_forwardReva Systems budgeted sales at 30,000 units at $80 per unit. The actual sales were 29,000 units at $83 per unit. What was Reva Systems' sales price variance?arrow_forward

- Viler business purchased a 6-month, 8% note receivable for $50,000 on March 1. What is the amount of interest income that should be recorded on June 30?arrow_forwardStarlight Medical Equipment maintains inventory cards. Item #456 shows: beginning 210 units, received 320 units, issued 390 units. Physical count reveals 125 units. Determine the missing units.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

- I want to this question answer for General accounting question not need ai solutionarrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning