To calculate: The value of

Explanation of Solution

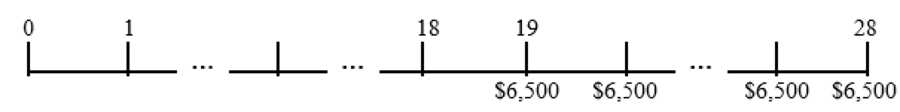

Time line of the sales:

Note: The cash flows in the given information are semiannual, so it is necessary to find the effective semiannual rate. The annual percentage rate is 9%.

Formula to calculate the monthly rate with the annual percentage rate:

Compute the monthly rate with the annual percentage rate:

Hence, the monthly rate is 0.0067

Formula to calculate the effective semiannual rate:

Compute the effective semiannual rate:

Note: To calculate the effective semiannual rate, the time period is assumed to be six months. The APR is the annual percentage rate. The monthly rate for the annual percentage rate is calculated above.

Hence, the effective semiannual rate is 0.0459 or 4.59%.

Formula to calculate the

Note: C denotes the annual cash flow, r denotes the rate of exchange, and t denotes the period.

Compute the present value annuity at year 9:

Note: This is the value for the first period of six months previous to the first payment, thus it is the value at the year nine. Therefore, the value at different periods asked in the question utilizes this value of nine years from now.

Hence, the present value annuity at year nine is $51,217.83.

Formula to calculate the present value:

Note: r denotes the rate of discount and t denotes the number of years.

Compute the present value at year 5:

Note: The present value for the fifth year can also be calculated using the effective annual rate, the present values for the remaining years can also be computed using the effective annual rate.

Hence, the value of annuity at 5 years is $35,781.50

Formula to calculate the effective annual rate:

Compute the effective annual rate:

Hence, the effective annual rate 0.0938 or 9.38%

Formula to calculate the present value:

Note: r denotes the rate of discount and t denotes the number of years.

Compute the present value at year 5:

Hence, the value of annuity at 5 year is $35,781.50.

The value of annuity for the other years is calculated as follows:

Note: The present value at year 3 is calculated using the calculated r values

Hence, the value of year three is $29,907.30

Note: The present value at year 0 is calculated using the calculated r values

Hence, the current value is $22,853.63.

Want to see more full solutions like this?

Chapter 4 Solutions

Corporate Finance: Core Principles and Applications (Mcgraw-hill Education Series in Finance, Insurance, and Real Estate)

- Which type of risk cannot be eliminated through diversification? A. Market riskB. Credit riskC. Operational riskD. Unsystematic riskarrow_forwardThe term "leverage" in finance refers to: A. Use of debt to increase potential returnsB. Investing in high-risk securitiesC. Paying off liabilitiesD. Issuing new shares need step by step.arrow_forwardDon't use chatgpt, i need help! The term "leverage" in finance refers to: A. Use of debt to increase potential returnsB. Investing in high-risk securitiesC. Paying off liabilitiesD. Issuing new sharesarrow_forward

- I need help in this question! The term "leverage" in finance refers to: A. Use of debt to increase potential returnsB. Investing in high-risk securitiesC. Paying off liabilitiesD. Issuing new sharesarrow_forwardNeed help! The term "leverage" in finance refers to: A. Use of debt to increase potential returnsB. Investing in high-risk securitiesC. Paying off liabilitiesD. Issuing new sharesarrow_forwardThe term "leverage" in finance refers to: A. Use of debt to increase potential returnsB. Investing in high-risk securitiesC. Paying off liabilitiesD. Issuing new sharesarrow_forward

- Don't use chatgpt! What is the formula of net persent values ? explain.arrow_forwardNeed answer ! If the Net Present Value (NPV) of a project is positive, it indicates: A. The project is unprofitableB. The project is financially viableC. The project has no riskD. The project will increase costsarrow_forwardDon't use chatgpt! Which of the following refers to the rate at which one currency is exchanged for another? A. Interest rateB. Exchange rateC. Inflation rateD. Capitalization ratearrow_forward

- i need help in this question. Which of the following refers to the rate at which one currency is exchanged for another? A. Interest rateB. Exchange rateC. Inflation rateD. Capitalization ratearrow_forwardWhat is the formula of net persent values ? explain.arrow_forwardIf the Net Present Value (NPV) of a project is positive, it indicates: A. The project is unprofitableB. The project is financially viableC. The project has no riskD. The project will increase costsarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education