Analyze and compare Alphabet (Google) and Microsoft

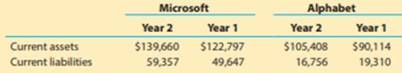

Alphabet Inc. (GOOG) and Microsoft Corporation (MSFT) design and distribute consumer and enterprise software, including overlaps in search, business productivity, and mobile operating systems. Alphabet’s primary source of revenue is from advertising, while Microsoft’s is from software subscription and support fees. The following year-end data (in millions) were taken from recent balance sheets for both companies:

a. Compute the

b. Which company has the larger working capital at the end of Year 2?

c.  Is working capital a good measure of relative liquidity in comparing the two companies? Explain.

Is working capital a good measure of relative liquidity in comparing the two companies? Explain.

d. Compute the

e.  Which company has the larger relative liquidity based on the current ratio?

Which company has the larger relative liquidity based on the current ratio?

f.  Based on your analysis, comment on the short-term debt-paying ability of these two companies.

Based on your analysis, comment on the short-term debt-paying ability of these two companies.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Corporate Financial Accounting - W/CENGAGENOW

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College