1, 3, and 6:

Journal:

Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

T-Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

Adjusted

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting

An adjusting entry is prepared when the trial balance is not up-to-date, and complete, and they are usually prepared at the end of the accounting period. This adjusting entry is essential for preparing the financial statements of the business.

Spreadsheet:

A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Statement of owners’ equity:

This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and drawing is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Income statement:

An income statement is one of the financial statements which shows the revenues, and expenses of the company. The income statement is prepared to ascertain the net income/loss of the company, by deducting the expenses from the revenues.

A balance sheet is a financial statement consists of the assets, liabilities, and the

Closing entries:

Closing entries are recorded in order to close the temporary accounts such as incomes and expenses by transferring them to the permanent accounts. It is passed at the end of the accounting period, to transfer the final balance.

Post-Closing Trial Balance:

After passing all the journal entries and the closing entries of the permanent accounts and then further posting them to each of the respective accounts, a post-closing trial balance is prepared which consists of a list of all the permanent accounts. A post-closing trial balance serves as an evidence to prove that the balance of the permanent accounts is equal.

To prepare: The T-accounts.

1, 3, and 6:

Explanation of Solution

Record the transactions directly in their respective T-accounts, and determine their balances.

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 |

|

✓ | 13,100 | |||

| Account: Supplies Account no. 13 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 |

|

✓ | 8,000 | |||

| 31 | Adjusting | 26 | 5,150 | 2,850 | |||

| Account: Prepaid Insurance Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 |

|

✓ | 7,500 | |||

| 31 | Adjusting | 26 | 3,150 | 4,350 | |||

| Account: Equipment Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 |

|

✓ | 113,000 | |||

| Account: |

|||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 |

|

✓ | 12,000 | |||

| 31 | Adjusting | 26 | 5,250 | 17,250 | |||

| Account: Trucks Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 |

|

✓ | 90,000 | |||

| Account: Accumulated Depreciation- Truck Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 |

|

✓ | 27,100 | |||

| 31 | Adjusting | 26 | 4,000 | 31,100 | |||

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 |

|

✓ | 4,500 | |||

| Account: Wages Payable Account no. 22 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 | Adjusting | 26 | 900 | 900 | ||

| Account: Common Stock Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 |

|

✓ | 900 | 30,000 | ||

| Account: |

|||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 | Balance |

|

96,400 | |||

| 31 | Closing | 27 | 46,150 | 142,550 | |||

| 31 | Closing | 27 | 3,000 | 139,550 | |||

| Account: Dividends Account no. 33 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 |

|

✓ | 3,000 | |||

| 31 | Closing | 27 | 3,000 | ||||

| Account: Income Summary Account no. 34 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 | Closing | 27 | 155,000 | 155,000 | ||

| 31 | Closing | 27 | 108,850 | 46,150 | |||

| 31 | Closing | 27 | 46,150 | ||||

| Account: Service revenue Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 |

|

✓ | 155,000 | |||

| 31 | Closing | 27 | 155,000 | ||||

| Account: Wages expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 1 |

|

✓ | 72,000 | |||

| 31 | Adjusting | 26 | 900 | 72,900 | |||

| 31 | Closing | 27 | 72,900 | ||||

| Account: Rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 |

|

✓ | 7,600 | |||

| 31 | Closing | 27 | 7,600 | ||||

| Account: Truck Expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 |

|

✓ | 5,350 | |||

| 31 | Closing | 27 | 5,350 | ||||

| Account: Depreciation Expense- Equipment Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 | Adjusting | 26 | 5,250 | 5,250 | ||

| 31 | Closing | 27 | 5,250 | ||||

| Account: Supplies Expenses Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 | Adjusting | 26 | 5,150 | 5,150 | ||

| 31 | Closing | 27 | 5,150 | ||||

| Account: Depreciation Expense- Trucks Account no. 56 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 31 | Adjusting | 26 | 4,000 | 4,000 | ||

| 31 | Closing | 27 | 4,000 | ||||

| Account: Insurance expense Account no. 57 | ||||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | |||

| Debit ($) | Credit ($) | |||||||

| 2016 | ||||||||

| January | 31 | Adjusting | 26 | 3,150 | 3,150 | |||

| 31 | Closing | 27 | 3,150 | |||||

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| January | 1 |

|

✓ | 5,450 | |||

| 31 | Closing | 27 | 5,450 | ||||

2.

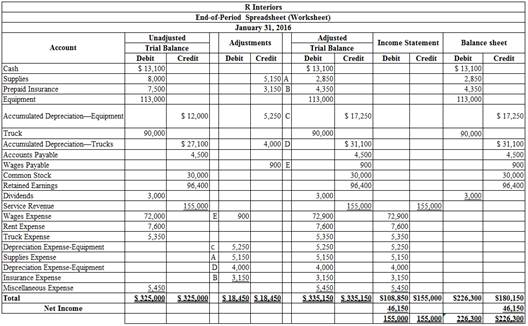

To enter: The unadjusted trial balances on an end-of-period spreadsheet, and complete the spreadsheet.

2.

Explanation of Solution

The unadjusted trial balance on an end-of-period spreadsheet is prepared as follows:

Table (1)

Hence, the unadjusted trial balance on an end-of-period spreadsheet is prepared and completed.

3.

To Journalize and

3.

Explanation of Solution

The adjusting entries are journalized as follows:

| Date | Description | Post Ref. |

Debit ($) | Credit ($) | |

| 2016 | Wages expense | 51 | 900 | ||

| January | 31 | Wages payable | 22 | 900 | |

| (To record the wages accrued) | |||||

Table (2)

- Wages expense is an expense account, and it is increased. Hence, debit the wages expense account by $900.

- Wages payable is a liability account, and it is increased. Hence, credit the wages payable account by $900.

| Date | Description | Post Ref. |

Debit ($) | Credit ($) | |

| 2016 | Depreciation expense-Equipment | 54 | 5,250 | ||

| January | 31 | Accumulated depreciation- Equipment | 17 | 5,250 | |

| (To record the equipment depreciation) | |||||

Table (3)

- Depreciation expense is an expense account, and it is increased. Hence, debit the wages expense account by $5,250.

- Accumulated depreciation is a contra asset account, and it is increased. Hence, credit the accumulated depreciation account by $5,250.

| Date | Description | Post Ref. |

Debit ($) | Credit ($) | |

| 2016 | Depreciation expense-Truck | 56 | 4,000 | ||

| January | 31 | Accumulated depreciation- Truck | 19 | 4,000 | |

| (To record the truck depreciation) | |||||

Table (4)

- Depreciation expense is an expense account, and it is increased. Hence, debit the wages expense account by $4,000.

- Accumulated depreciation is a contra asset account, and it is increased. Hence, credit the accumulated depreciation account by $4,000.

| Date | Description | Post Ref. |

Debit ($) | Credit ($) | |

| 2016 | Supplies expense | 55 | 5,150 | ||

| January | 31 | Supplies

|

13 | 5,150 | |

| (To record the supplies used) | |||||

Table (5)

- Supplies expense is an expense account, and it is increased. Hence, debit the supplies expense account by $5,150.

- Supplies are the asset account, and it is increased. Hence, credit the supplies account by $5,150.

| Date | Description | Post Ref. |

Debit ($) | Credit ($) | |

| 2016 | Insurance expense | 57 | 3,150 | ||

| January | 31 | Prepaid insurance | 14 | 3,150 | |

| (To record the insurance expense) | |||||

Table (6)

- Insurance expense is an expense account, and it is increased. Hence, debit the insurance expense account by $3,150.

- Prepaid insurance is an asset account, and it is decreased. Hence, credit the prepaid insurance account by $3,150.

4.

To prepare: An adjusted trial balance for R interiors, as of January 31, 2016.

4.

Explanation of Solution

Prepare an adjusted trial balance for R interiors, as of January 31, 2016.

| R interiors | |||

| Adjusted Trial Balance | |||

| January 31, 2016 | |||

| Accounts | Account Number | Debit Balances | Credit Balances |

| Cash | 11 | 13,100 | |

| Supplies | 13 | 2,850 | |

| Prepaid Insurance | 14 | 4,350 | |

| Equipment | 16 | 113,000 | |

| Accumulated depreciation- Equipment | 17 | 17,250 | |

| Trucks | 18 | 90,000 | |

| Accumulated depreciation- Trucks | 19 | 31,100 | |

| Accounts payable | 21 | 4,500 | |

| Wages Payable | 22 | 900 | |

| Common Stock | 31 | 30,0 00 | |

| Retained earnings | 32 | 96,400 | |

| Dividends | 33 | 3,000 | |

| Service revenue | 41 | 155,000 | |

| Wages expense | 51 | 72,900 | |

| Rent expense | 52 | 7,600 | |

| Truck Expense | 53 | 5,350 | |

| Depreciation Expense- Equipment | 54 | 5,250 | |

| Supplies expense | 55 | 5,150 | |

| Depreciation Expense- Trucks | 56 | 4,000 | |

| Insurance Expense | 57 | 3,150 | |

| Miscellaneous Expense | 59 | 5,450 | |

| $335,150 | $335,150 | ||

Table (7)

The debit column and credit column of the adjusted trial balance are agreed, both having balance of $335,150.

5.

The net income or net loss of R interiors for the month of January.

5.

Explanation of Solution

The net income of R interiors for the month of January is $46,150.

| R interiors | ||

| Income Statement | ||

| For the year ended January 31, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Laundry revenue | $155,000 | |

| Expenses: | ||

| Wages Expense | $72,900 | |

| Rent Expense | 7,600 | |

| Truck Expense | 5,350 | |

| Depreciation Expense-Equipment | 5,250 | |

| Supplies Expense | 5,150 | |

| Depreciation Expense-Trucks | 4,000 | |

| Insurance Expense | 3,150 | |

| Miscellaneous Expense | 5,450 | |

| Total Expenses | 108,850 | |

| Net Income | $46,150 | |

Table (8)

Hence, the net income of R interiors for the year ended January 31, 2016 is $46,150.

6.

To Journalize: The closing entries for R interiors.

6.

Explanation of Solution

Closing entry for revenue and expense accounts:

| Journal Page 27 | ||||

| Date | Accounts title and Explanation | Post Ref. | Debit ($) |

Credit ($) |

| January 31, 2016 | Service Revenue | 41 | 155,000 | |

| Income Summary | 34 | 155,000 | ||

| (To record the closure of revenues account ) | ||||

| January 31 | Income Summary | 34 | 108,850 | |

| Wages Expense | 51 | 72,900 | ||

| Rent Expense | 52 | 7,600 | ||

| Truck Expense | 53 | 5,350 | ||

| Depreciation Expense-Equipment | 54 | 5,250 | ||

| Supplies Expense | 55 | 5,150 | ||

| Depreciation Expense-Truck | 56 | 4,000 | ||

| Insurance Expense | 57 | 3,150 | ||

| Miscellaneous Expense | 59 | 5,450 | ||

| (To close the revenues and expenses account. Then the balance amount are transferred to income summary account) | ||||

| January 31 | Income Summary | 34 | 46,150 | |

| Retained earnings | 32 | 46,150 | ||

| (To record the closure of net income from income summary to retained earnings) | ||||

| January 31 | Retained earnings | 32 | 3,000 | |

| Dividends | 33 | 3,000 | ||

| (To record the closure of dividend to retained earnings) | ||||

Table (11)

Service revenue account has a normal credit balance of $155,000 in total, now to close this account, the service revenue account must be debited with $155,000 and, income summary account must be credited with $155,000.

- In this closing entry, the fees earned account balance is being transferred to the income summary account, to bring the revenues account balance to zero.

- Thereby, the income summary account balance gets increased by $155,000 and, the revenue account balance gets decreased by $155,000.

All expenses accounts have a normal debit balance, the total of expenses are $108,850 have to be closed by transferring these account balances to the income summary account. All expenses account must be credited, and the income summary account must be debited with $108,850.

- In this closing entry, all the expenses account balances are transferred to the income summary account, to bring the expenses account balances to zero.

- Thereby, both the income summary account, and the expenses account balances get decreased by $108,850.

Determined amount balance of income summary is $46,150, which has to be closed by debiting the income summary account with $46,150, and crediting the retained earnings account with $46,150.

- In this closing entry, the income summary account balance is being transferred to the retained earnings account, to bring the income summary account balance to zero.

- Thereby, the income summary account gets decreased, and the retained earnings account balance gets increased by $46,150.

Dividends account has a normal debit balance of $3,000, now to close this account, retained earnings account must be debited with $3,000 and, dividend account must be credited with $3,000.

- In this closing entry, the dividend account balance is being transferred to the retained earnings account, to bring the dividend account balance to zero.

- Thereby, the retained earnings account balance gets increased by $3,000 and, the dividend account balance gets decreased by $3,000.

7.

To prepare: The post–closing trial balance of R interiors for the month ended January 31, 2016.

7.

Explanation of Solution

Prepare a post–closing trial balance of R interiors for the month ended January 31, 2016 as follows:

R interiors Post-closing Trial Balance January 31, 2016 |

|||

| Particulars | Account Number |

Debit $ | Credit $ |

| Cash | 11 | 13,100 | |

| Supplies | 13 | 2,850 | |

| Prepaid insurance | 14 | 4,350 | |

| Equipment | 16 | 113,000 | |

| Accumulated depreciation- Equipment | 17 | 17,250 | |

| Trucks | 18 | 90,000 | |

| Accumulated depreciation- Trucks | 19 | 31,100 | |

| Accounts payable | 21 | 4,500 | |

| Wages payable | 22 | 900 | |

| Common Stock | 31 | 30,000 | |

| Retained earnings | 32 | 139,550 | |

| Total | 223,300 | 223,300 | |

Table (12)

The debit column and credit column of the post–closing trial balance are agreed, both having balance of $223,300.

Want to see more full solutions like this?

Chapter 4 Solutions

FINANCIAL AND MANAGERIAL ACCOUNTING

- subject=general accountingarrow_forwardI want the correct answer with accounting questionarrow_forwardEverton Production forecasts that total overhead for the current year will be $8,400,000 and that total machine hours will be 180,000 hours. Year to date, the actual overhead is $9,100,000, and the actual machine hours are 195,000 hours. Suppose Everton Production uses a predetermined overhead rate based on machine hours for applying overhead as of this point in time (year to date). In that case, what is the amount of overapplied or underapplied overhead?arrow_forward

- Referring to section “The WH Framework for Business Ethics” of Ch. 2, “Business Ethics” of Dynamic Business Law for information on the WH Framework. Reviewing the scenario and complete the activity below. This scenario can also be found in the “Questions & Problems” section of Ch. 2, “Business Ethics” in Dynamic Business Law. Scenerio Steven J. Trzaska was the head of L’Oreal USA’s regional patent team, managing the procedure by which the company patented products. As an attorney barred in Pennsylvania, Trzaska had to adhere to professional rules of conduct established by the Supreme Court of Pennsylvania in addition to rules promulgated by the US Patent and Trademark Office (USPTO). In 2014, L’Oreal S.A., the French parent company of L’Oreal USA, enacted a global quota of patent applications each regional office had to file each year. Employees were informed that failure to meet the quota would negatively impact their careers and even their continued employment at L’Oreal.…arrow_forwardNot use ai solution please and accounting questionarrow_forwardI need assistance with this financial accounting problem using appropriate calculation techniques.arrow_forward

- I am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardA company has an inventory of 10 units at a cost of $14 each on November 1. On November 3, they purchased 8 units at $17 per unit. On November 10, they purchased 15 units at $18 per unit. On November 14, they sold 28 units. Using the FIFO periodic inventory method, what is the value of the inventory on November 14 after the sale?arrow_forwardWhat is the gross profit?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,