Financial statements

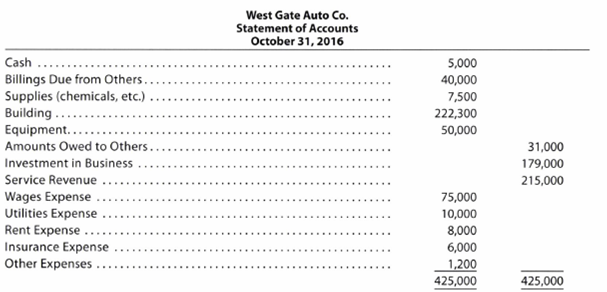

Assume that you recently accepted a position with Five Star National Bank & Trust as an assistant loan officer. As one of your first duties, you have been assigned the responsibility of evaluating a loan request for $300,000 from West Gate Auto Co., a small proprietorship. In support of the loan application, Joan Whalen, owner, submitted a “Statement of Accounts” (

1. Explain to Joan Whalen why a set of financial statements (income statement, statement of owner’s equity, and

2. In discussing the “Statement of Accounts” with Joan Whalen, you discovered that the accounts had not been adjusted at October 31. Analyze the “Statement of Accounts” and indicate possible

3. Assuming that an accurate set of financial statements will be submitted by Joan Whalen in a few days, what other considerations or information would you require before making a decision on the loan request?

Trending nowThis is a popular solution!

Chapter 4 Solutions

Bundle: Accounting, Loose-Leaf Version, 26th + LMS Integrated for CengageNOW, 2 terms Printed Access Card

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage