Concept explainers

Income: $27,350

accounts,

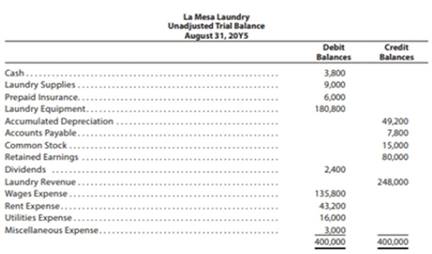

The unadjusted

The data needed to determine >ear-end adjustments are as follows:

(a) Wages accrued but not paid at August 31 are $2,200.

(b)

(c) Laundry supplies on hand at August 31 are $2,000.

(d) Insurance premiums expired during the year are $5,300.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as “Aug. 51 Bal.” In addition, add T accounts for Wages Payable. Depreciation Expense, Laundry Supplies Expense, and Insurance Expense.

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.

3. Journalize and post the adjusting entries. Identify the adjustments by “Adj.” and the new balances as “Adj. Bal.”

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a statement of stockholders’ equity, and a balance sheet. During the year ended August 51, 20Y5, common stock of $3,000 was issued.

6. Journalize and

7. Prepare a post-closing trial balance.

Trending nowThis is a popular solution!

Chapter 4 Solutions

Corporate Financial Accounting

- Which document supports a purchase on account?A. Sales invoiceB. Purchase orderC. Bank deposit slipD. Credit memo Correct solutionarrow_forwardWhich document supports a purchase on account?A. Sales invoiceB. Purchase orderC. Bank deposit slipD. Credit memoneedarrow_forwardWhich document supports a purchase on account?A. Sales invoiceB. Purchase orderC. Bank deposit slipD. Credit memoarrow_forward

- Accrued expenses are recorded:A. When paid in advanceB. When the cash is paidC. When incurred, before paymentD. Only at year-endPlz coarrow_forwardAccrued expenses are recorded:A. When paid in advanceB. When the cash is paidC. When incurred, before paymentD. Only at year-endcorrearrow_forwardAccrued expenses are recorded:A. When paid in advanceB. When the cash is paidC. When incurred, before paymentD. Only at year-endarrow_forward

- Which inventory method results in higher cost of goods sold when prices are rising?A. FIFOB. LIFOC. Weighted AverageD. Specific Identificationcorrect aarrow_forwardWhich inventory method results in higher cost of goods sold when prices are rising?A. FIFOB. LIFOC. Weighted AverageD. Specific Identification needarrow_forwardWhich inventory method results in higher cost of goods sold when prices are rising?A. FIFOB. LIFOC. Weighted AverageD. Specific Identificationarrow_forward

- no aiI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful. need help but clear amswerarrow_forwardThe income summary account is used:A. To record net cash flowB. Only by service businessesC. During the closing processD. To adjust retained earnings directlyneedarrow_forwardNo AI The income summary account is used:A. To record net cash flowB. Only by service businessesC. During the closing processD. To adjust retained earnings directlyarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning