Concept explainers

T accounts,

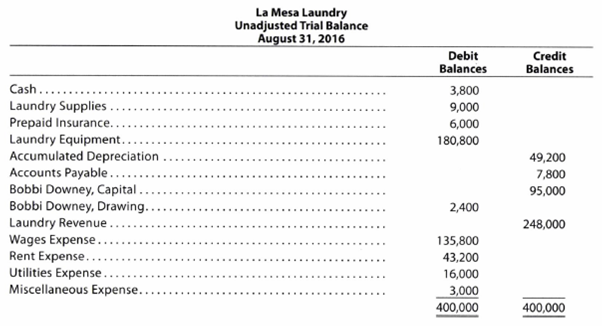

The unadjusted

The data needed to determine year-end adjustments are as follows:

a. Wages accrued but not paid at August 31 are $2,200.

b.

c. Laundry supplies on hand at August 31 are $2,000.

d. Insurance premiums expired during the year are $5,300.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as “Aug. 31 Bal.” In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary.

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.

3. Journalize and post the adjusting entries. Identify the adjustments by “Adj.” and the new balances as “Adj. Bal.”

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a statement of owner's equity (no additional investments were made during the year), and a

6. Journalize and

7. Prepare a post-closing trial balance.

1, 3, and 6

Journal:

Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

T-Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

Adjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Adjusting entries:

An adjusting entry is prepared when the trial balance is not up-to-date, and complete, and they are usually prepared at the end of the accounting period. This adjusting entry is essential for preparing the financial statements of the business.

Spreadsheet:

A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Statement of owners’ equity:

This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and drawing is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Income statement:

An income statement is one of the financial statements which shows the revenues, and expenses of the company. The income statement is prepared to ascertain the net income/loss of the company, by deducting the expenses from the revenues.

Balance sheet:

A balance sheet is a financial statement consists of the assets, liabilities, and the stockholder’s equity of the company. The balance of the assets account must be equal to that of the liabilities and the stockholder’s equity account.

Closing entries:

Closing entries are recorded in order to close the temporary accounts such as incomes and expenses by transferring them to the permanent accounts. It is passed at the end of the accounting period, to transfer the final balance.

Post-Closing Trial Balance:

After passing all the journal entries and the closing entries of the permanent accounts and then further posting them to each of the respective accounts, a post-closing trial balance is prepared which consists of a list of all the permanent accounts. A post-closing trial balance serves as an evidence to prove that the balance of the permanent accounts is equal.

To prepare: The T-accounts.

Explanation of Solution

Record the transactions directly in their respective T-accounts, and determine their balances.

| Cash | |||||||||||

| August 31 | Balance | 3,800 | |||||||||

| Laundry Supplies | |||||||||||

| August 31 | Balance | 9,000 | August 31 | Adjusted | 7,000 | ||||||

| August 31 | Adjusted balance | 2,000 | |||||||||

| Prepaid Insurance | |||||||||||

| August 31 | Balance | 6,000 | August 31 | Adjusted | 5,300 | ||||||

| Adjusted balance | 700 | ||||||||||

| Laundry Equipment | |||||||||||

| August 31 | Balance | 180,800 | |||||||||

| Accumulated Depreciation | |||||||||||

| August 31 | Balance | 49,200 | |||||||||

| August 31 | Adjusted | 8,150 | |||||||||

| August 31 | Adjusted balance | 57,350 | |||||||||

| Accounts Payable | |||||||||||

| August 31 | Balance | 7,800 | |||||||||

| Wages Payable | |||||||||||

| August 31 | Adjusted | 2,200 | |||||||||

| BD, Capital | |||||||||||

| August 31 | Closing | 2,400 | August 31 | Balance | 95,000 | ||||||

| August 31 | Closing | 27,350 | |||||||||

| August 31 | Balance | 119,950 | |||||||||

| BD, Drawing | |||||||||||

| August 31 | Balance | 2,400 | August 31 | Closing | 2,400 | ||||||

| Laundry Revenue | |||||||||||

| August 31 | Closing | 248,000 | August 31 | Balance | 248,000 | ||||||

| Wages Expense | |||||||||||

| August 31 | Balance | 135,800 | August 31 | Closing | 138,000 | ||||||

| August 31 | Adjusted | 2,200 | |||||||||

| August 31 | Adjusted balance | 138,000 | |||||||||

| Rent Expense | |||||||||||

| August 31 | Balance | 43,200 | August 31 | Closing | 43,200 | ||||||

| Utilities Expense | |||||||||||

| August 31 | Balance | 16,000 | August 31 | Closing | 16,000 | ||||||

| Depreciation Expense | |||||||||||

| August 31 | Adjusted | 8,150 | August 31 | Closing | 8,150 | ||||||

| Laundry Supplies Expense | |||||||||||

| August 31 | Adjusted | 7,000 | August 31 | Closing | 7,000 | ||||||

| Insurance Expense | |||||||||||

| August 31 | Adjusted | 5,300 | August 31 | Closing | 5,300 | ||||||

| Miscellaneous Expense | |||||||||||

| August 31 | Balance | 3,000 | August 31 | Closing | 3,000 | ||||||

Table (1)

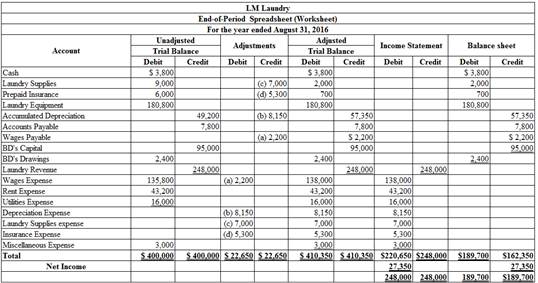

2.

To enter: The unadjusted trial balance on an end-of-period spreadsheet, and complete the spreadsheet.

Explanation of Solution

Table (2)

Hence, the unadjusted trial balance on an end-of-period spreadsheet is prepared and completed.

3.

To Journalize and post: The adjusting entries.

Explanation of Solution

| Date | Description | Debit ($) | Credit ($) | |

| 2016 | Wages expense | 2,200 | ||

| August | 31 | Wages payable | 2,200 | |

| (To record the wages accrued) | ||||

Table (3)

- Wages expense is an expense account, and it is increased. Hence, debit the wages expense account by $2,200.

- Wages payable is a liability account, and it is increased. Hence, credit the wages payable account by $2,200.

| Date | Description | Debit ($) | Credit ($) | |

| 2016 | Depreciation expense | 8,150 | ||

| August | 31 | Accumulated depreciation | 8,150 | |

| (To record the equipment depreciation) | ||||

Table (4)

- Depreciation expense is an expense account, and it is increased. Hence, debit the wages expense account by $8,150.

- Accumulated depreciation is a contra asset account, and it is increased. Hence, credit the accumulated depreciation account by $8,150.

| Date | Description | Debit ($) | Credit ($) | |

| 2016 | Laundry supplies expense | 7,000 | ||

| August | 31 | Laundry supplies |

7,000 | |

| (To record the equipment depreciation) | ||||

Table (5)

- Laundry supplies expense is an expense account, and it is increased. Hence, debit the laundry supplies expense account by $7,000.

- Laundry supplies are the asset account, and it is increased. Hence, credit the laundry supplies account by $7,000.

| Date | Description | Debit ($) | Credit ($) | |

| 2016 | Insurance expense | 5,300 | ||

| August | 31 | Prepaid insurance |

5,300 | |

| (To record the equipment depreciation) | ||||

Table (6)

- Insurance expense is an expense account, and it is increased. Hence, debit the insurance expense account by $5,300.

- Prepaid insurance is an asset account, and it is decreased. Hence, credit the prepaid insurance account by $5,300.

4.

To prepare: An unadjusted trial balance for Laundry LM, as of August 31, 2016.

Explanation of Solution

Prepare an unadjusted trial balance for Laundry LM, as of August 31, 2016.

| Laundry LM | ||

| Unadjusted Trial Balance | ||

| August 31, 2016 | ||

| Accounts | Debit Balances | Credit Balances |

| Cash | 3,800 | |

| Laundry Supplies | 2,000 | |

| Prepaid Insurance | 700 | |

| Laundry Equipment | 180,800 | |

| Accumulated depreciation | 57,350 | |

| Accounts payable | 7,800 | |

| Wages Payable | 2,200 | |

| BD, Capital | 95,000 | |

| BD, Drawing | 2,400 | |

| Laundry revenue | 248,000 | |

| Wages expense | 138,000 | |

| Rent expense | 43,200 | |

| Utilities Expense | 16,000 | |

| Depreciation Expense | 8,150 | |

| Laundry supplies expense | 7,000 | |

| Insurance Expense | 5,300 | |

| Miscellaneous Expense | 3,000 | |

| $410,350 | $410,350 | |

Table (7)

5.

The net income or net loss of Laundry LM for the month of August.

Answer to Problem 4.3BPR

Prepare the balance sheet of LM Laundry at August 31, 2016.

| LM Laundry | ||

| Balance Sheet | ||

| For the year ended August 31, 2016 | ||

| Assets | ||

| Current Assets: | ||

| Cash | $3,800 | |

| Laundry Supplies | 2,000 | |

| Prepaid Insurance | 700 | |

| Total Current Assets | $6,500 | |

| Property, plant and equipment: | ||

| Laundry equipment | $180,800 | |

| Less: Accumulated Depreciation | 57,350 | |

| Total property, plant, and equipment | 123,450 | |

| Total Assets | $129,950 | |

| Liabilities | ||

| Current Liabilities: | ||

| Accounts Payable | $7,800 | |

| Wages Payable | 2,200 | |

| Total Liabilities | $10,000 | |

| Owner’s Equity | ||

| BD’s capital | 119,950 | |

| Total Liabilities and Owners’ Equity | $129,950 | |

Table (9)

Explanation of Solution

| LM Laundry | ||

| Income Statement | ||

| For the year ended August 31, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Laundry revenue | $248,000 | |

| Expenses: | ||

| Wages Expense | $138,000 | |

| Rent Expense | 43,200 | |

| Utilities Expense | 16,000 | |

| Depreciation Expense | 8,150 | |

| Laundry supplies Expense | 7,000 | |

| Insurance Expense | 5,300 | |

| Miscellaneous Expense | 3,000 | |

| Total Expenses | 220,650 | |

| Net Income | $27,350 | |

Table (7)

Hence, the net income of Laundry LM for the month of August r is $27,350.

6.

To Journalize: The closing entries for LM Laundry.

Answer to Problem 4.3BPR

Closing entry for revenue and expense accounts:

| Date | Accounts title and Explanation | Post Ref. | Debit ($) |

Credit ($) |

| August 31, 2016 | Laundry Revenue | 248,000 | ||

| Income Summary | 248,000 | |||

| (To record the closure of revenues account ) | ||||

| August 31, 2016 | Income Summary | 220,650 | ||

| Wages Expense | 138,000 | |||

| Rent Expense | 43,200 | |||

| Utilities Expense | 16,000 | |||

| Depreciation Expense | 8,150 | |||

| Laundry supplies Expense | 7,000 | |||

| Insurance Expense | 5,300 | |||

| Miscellaneous Expense | 3,000 | |||

| (To close the expenses account. Then the balance amount are transferred to income summary account) | ||||

| August 31, 2016 | Income Summary | 27,350 | ||

| BD’s Capital | 27,350 | |||

| (To close balance of income summary are transferred to owners’ capital account) | ||||

| August 31, 2016 | BD’s Capital | 2,400 | ||

| BD’ Drawing | 2,400 | |||

| (To Close the capital and drawings account) | ||||

Table (4)

Explanation of Solution

- Laundry revenue is revenue account. Since the amount of revenue is closed, and transferred to BD’s capital account. Here, LM Laundry earned an income of $248,000. Therefore, it is debited.

- Wages Expense, Rent Expense, Insurance Expense, Utilities Expense, Laundry Supplies Expense, Depreciation Expense, BD Capital, and Miscellaneous Expense are expense accounts. Since the amount of expenses are closed to Income Summary account. Therefore, it is credited.

- Owner’s capital is a component of owner’s equity. Thus, owners ‘equity is debited since the capital is decreased on owners’ drawings.

- Owner’s drawings are a component of owner’s equity. It is credited because the balance of owners’ drawing account is transferred to owners ‘capital account.

7.

To prepare: The post–closing trial balance of LM Laundry for the month ended August 31, 2016.

Explanation of Solution

Prepare a post–closing trial balance of LM Laundry for the month ended August 31, 2016 as follows:

|

Laundry LM Post-closing Trial Balance August 31, 2016 |

||

| Particulars | Debit $ | Credit $ |

| Cash | 3,800 | |

| Laundry Supplies | 2,000 | |

| Prepaid insurance | 700 | |

| Laundry Equipment | 180,800 | |

| Accumulated depreciation | 57,350 | |

| Accounts payable | 7,800 | |

| Wages payable | 2,200 | |

| BD’s Capital | 119,950 | |

| Total | $187,300 | $187,300 |

Table (5)

The debit column and credit column of the post–closing trial balance are agreed, both having balance of $187,300.

Want to see more full solutions like this?

Chapter 4 Solutions

ACCOUNTING,CHAP.1-13

- When iuploading image then it get blurry Comment in comment section I will write data.arrow_forwardCorrect answer pleasearrow_forwardIn 2022, North Shore Community College had a total student body that was 5% more than in 2021, which was 5% more than in 2020. The enrollment in 2022 was 4,200. How many students attended the college in 2021? How many students attended the college in 2020?arrow_forward

- Please don't use AI And give correct answer .arrow_forwardLouisa Pharmaceutical Company is a maker of drugs for high blood pressure and uses a process costing system. The following information pertains to the final department of Goodheart's blockbuster drug called Mintia. Beginning work-in-process (40% completed) 1,025 units Transferred-in 4,900 units Normal spoilage 445 units Abnormal spoilage 245 units Good units transferred out 4,500 units Ending work-in-process (1/3 completed) 735 units Conversion costs in beginning inventory $ 3,250 Current conversion costs $ 7,800 Louisa calculates separate costs of spoilage by computing both normal and abnormal spoiled units. Normal spoilage costs are reallocated to good units and abnormal spoilage costs are charged as a loss. The units of Mintia that are spoiled are the result of defects not discovered before inspection of finished units. Materials are added at the beginning of the process. Using the weighted-average method, answer the following question: What are the…arrow_forwardQuick answerarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning