Concept explainers

T accounts,

The unadjusted

| Epicenter Laundry Unadjusted Trial Balance June 30, 2016 |

||

| Debit Balances | Credit Balances | |

| Cash............................................................. | 11,000 | |

| Laundry Supplies................................................. | 21,500 | |

| Prepaid Insurance................................................. | 9,600 | |

| Laundry Equipment............................................... | 232,600 | |

| 125,400 | ||

| Accounts Payable................................................. | 11,800 | |

| Common Stock................................................... | 40,000 | |

| 65,600 | ||

| Dividends....................................................... | 10,000 | |

| Laundry Revenue................................................. | 232,200 | |

| Wages Expense................................................... | 125,200 | |

| Rent Expense..................................................... | 40,000 | |

| Utilities Expense.................................................. | 19,700 | |

| Miscellaneous Expense............................................ | 5,400 | |

| 475,000 | 475,000 | |

The data needed to determine year-end adjustments are as follows:

- a. Laundry supplies on hand at June 30 are $3,600.

- b. Insurance premiums expired during the year are $5,700.

- c. Depreciation of laundry equipment during the year is $6,500.

- d. Wages accrued but not paid at June 30 are $1,100.

Instructions

- 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as “June 30 Bal." In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary.

- 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.

- 3. Journalize and post the adjusting entries. Identify the adjustments by "Adj." and the new balances as “Adj. BAL.”

- 4. Prepare an adjusted trial balance.

- 5. Prepare an income statement, a retained earnings statement, and a

balance sheet . - 6. Journalize and

post the closing entries. Identify the closing entries by “Clos." - 7. Prepare a post-closing trial balance.

1, 3, and 6:

Journal:

Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

T-Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

Adjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Adjusting entries:

An adjusting entry is prepared when the trial balance is not up-to-date, and complete, and they are usually prepared at the end of the accounting period. This adjusting entry is essential for preparing the financial statements of the business.

Spreadsheet:

A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Retained Earnings Statement:

It is one of the financial statements, which shows the amount of the net income retained by a company at a particular point of time for reinvestment and pay its debts and obligations. It shows the amount of retained earnings that is not paid as dividends to the shareholders.

Income statement:

An income statement is one of the financial statements which shows the revenues, and expenses of the company. The income statement is prepared to ascertain the net income/loss of the company, by deducting the expenses from the revenues.

Balance sheet:

A balance sheet is a financial statement consists of the assets, liabilities, and the stockholder’s equity of the company. The balance of the assets account must be equal to that of the liabilities and the stockholder’s equity account.

Closing entries:

Closing entries are recorded in order to close the temporary accounts such as incomes and expenses by transferring them to the permanent accounts. It is passed at the end of the accounting period, to transfer the final balance.

Post-Closing Trial Balance:

After passing all the journal entries and the closing entries of the permanent accounts and then further posting them to each of the respective accounts, a post-closing trial balance is prepared which consists of a list of all the permanent accounts. A post-closing trial balance serves as an evidence to prove that the balance of the permanent accounts is equal.

To prepare: The T-accounts.

Explanation of Solution

Record the transactions directly in their respective T-accounts, and determine their balances.

| Cash | |||||||||||

| June 30 | Balance | 11,000 | |||||||||

| Laundry Supplies | |||||||||||

| June 30 | Balance | 21,500 | June 30 | Adjusted | 17,900 | ||||||

| June 30 | Adjusted balance | 3,600 | |||||||||

| Prepaid Insurance | |||||||||||

| June 30 | Balance | 9,600 | June 30 | Adjusted | 5,700 | ||||||

| Adjusted balance | 3,900 | ||||||||||

| Laundry Equipment | |||||||||||

| June 30 | Balance | 232,600 | |||||||||

| Accumulated Depreciation | |||||||||||

| June 30 | Balance | 125,400 | |||||||||

| June 30 | Adjusted | 6,500 | |||||||||

| June 30 | Adjusted balance | 131,900 | |||||||||

| Accounts Payable | |||||||||||

| June 30 | Balance | 11,800 | |||||||||

| Wages Payable | |||||||||||

| June 30 | Adjusted | 1,100 | |||||||||

| Retained Earnings | |||||||||||

| June 30 | Closing | 10,000 | June 30 | Balance | 65,600 | ||||||

| June 30 | Closing | 10,700 | |||||||||

| June 30 | Balance | 66,300 | |||||||||

| Dividends | |||||||||||

| June 30 | Balance | 10,000 | June 30 | Closing | 10,000 | ||||||

| Laundry Revenue | |||||||||||

| June 30 | Closing | 232,200 | June 30 | Balance | 232,200 | ||||||

| Wages Expense | |||||||||||

| June 30 | Balance | 125,200 | June 30 | Closing | 126,300 | ||||||

| June 30 | Adjusted | 1,100 | |||||||||

| June 30 | Adjusted balance | 126,300 | |||||||||

| Rent Expense | |||||||||||

| June 30 | Balance | 40,000 | June 30 | Closing | 40,000 | ||||||

| Utilities Expense | |||||||||||

| June 30 | Balance | 19,700 | June 30 | Closing | 19,700 | ||||||

| Depreciation Expense | |||||||||||

| June 30 | Adjusted | 6,500 | June 30 | Closing | 6,500 | ||||||

| Laundry Supplies Expense | |||||||||||

| June 30 | Adjusted | 17,900 | June 30 | Closing | 17,900 | ||||||

| Insurance Expense | |||||||||||

| June 30 | Adjusted | 5,700 | June 30 | Closing | 5,700 | ||||||

| Miscellaneous Expense | |||||||||||

| June 30 | Balance | 5,400 | June 30 | Closing | 5,400 | ||||||

| Common Stock | |||||

| June 30 | Closing | 40,000 | |||

| Income Summary | |||||

| June 30 | Closing | 221,500 | June 30 | Closing | 232,200 |

| Closing | 10,700 | ||||

Table (1)

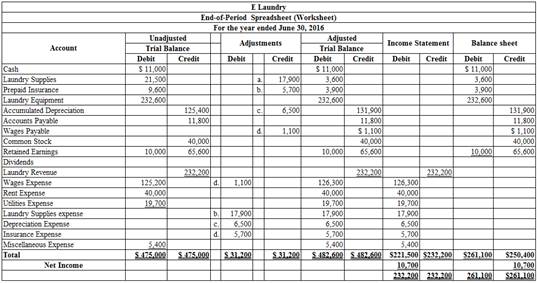

2.

To enter: The unadjusted trial balances on an end-of-period spreadsheet, and complete the spreadsheet.

Explanation of Solution

The unadjusted trial balance on an end-of-period spreadsheet is prepared as follows:

Table (2)

Hence, the unadjusted trial balance on an end-of-period spreadsheet is prepared and completed.

3.

To Journalize and post: The adjusting entries.

Explanation of Solution

The adjusting entries are journalized as follows:

| Date | Description | Debit ($) | Credit ($) | |

| 2016 | Wages expense | 1,100 | ||

| June | 30 | Wages payable | 1,100 | |

| (To record the wages accrued) | ||||

Table (3)

- Wages expense is an expense account, and it is increased. Hence, debit the wages expense account by $1,100.

- Wages payable is a liability account, and it is increased. Hence, credit the wages payable account by $1,100.

| Date | Description | Debit ($) | Credit ($) | |

| 2016 | Depreciation expense | 6,500 | ||

| June | 30 | Accumulated depreciation | 6,500 | |

| (To record the equipment depreciation) | ||||

Table (4)

- Depreciation expense is an expense account, and it is increased. Hence, debit the wages expense account by $6,500.

- Accumulated depreciation is a contra asset account, and it is increased. Hence, credit the accumulated depreciation account by $6,500.

| Date | Description | Debit ($) | Credit ($) | |

| 2016 | Laundry supplies expense | 17,900 | ||

| June | 30 | Laundry supplies

|

17,900 | |

| (To record the supplies expense) | ||||

Table (5)

- Laundry supplies expense is an expense account, and it is increased. Hence, debit the laundry supplies expense account by $17,900.

- Laundry supplies are the asset account, and it is increased. Hence, credit the laundry supplies account by $17,900.

| Date | Description | Debit ($) | Credit ($) | |

| 2016 | Insurance expense | 5,700 | ||

| August | 31 | Prepaid insurance | 5,700 | |

| (To record the insurance expense) | ||||

Table (6)

- Insurance expense is an expense account, and it is increased. Hence, debit the insurance expense account by $5,700.

- Prepaid insurance is an asset account, and it is decreased. Hence, credit the prepaid insurance account by $5,700.

4.

To prepare: An adjusted trial balance for Laundry E, as of June 30, 2016.

Explanation of Solution

Prepare an adjusted trial balance for Laundry E, as of June 30, 2016.

| Laundry E | ||

| Adjusted Trial Balance | ||

| June 30, 2016 | ||

| Accounts | Debit Balances | Credit Balances |

| Cash | 11,000 | |

| Laundry Supplies | 3,600 | |

| Prepaid Insurance | 3,900 | |

| Laundry Equipment | 232,600 | |

| Accumulated depreciation | 131,900 | |

| Accounts payable | 11,800 | |

| Wages Payable | 1,100 | |

| Common Stock | 40,000 | |

| Retained earnings | 65,600 | |

| Dividends | 10,000 | |

| Laundry revenue | 232,200 | |

| Wages expense | 126,300 | |

| Rent expense | 40,000 | |

| Utilities Expense | 19,700 | |

| Depreciation Expense | 17,900 | |

| Laundry supplies expense | 6,500 | |

| Insurance Expense | 5,700 | |

| Miscellaneous Expense | 5,400 | |

| 482,600 | 482,600 | |

Table (7)

The debit column and credit column of the unadjusted trial balance are agreed, both having balance of $482,600.

5.

Explanation of Solution

The net income of Laundry E for the month of June is $10,700.

| E Laundry | ||

| Income Statement | ||

| For the year ended June 30, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Laundry revenue | $248,000 | |

| Expenses: | ||

| Wages Expense | $126,300 | |

| Rent Expense | 40,000 | |

| Utilities Expense | 19,700 | |

| Depreciation Expense | 17,900 | |

| Laundry supplies Expense | 6,500 | |

| Insurance Expense | 5,700 | |

| Miscellaneous Expense | 5,400 | |

| Total Expenses | 221,500 | |

| Net Income | $10,700 | |

Table (8)

Hence, the net income of Laundry E for the year ended June 30, 2016 is $10,700.

6.

To Journalize: The closing entries for E Laundry.

Explanation of Solution

Closing entry for revenue and expense accounts:

| Date | Accounts title and Explanation | Post Ref. | Debit ($) |

Credit ($) |

| June 30, 2016 | Laundry Revenue | 232,200 | ||

| Income Summary | 232,200 | |||

| (To record the closure of revenues account ) | ||||

| June 30 | Income Summary | 221,500 | ||

| Wages Expense | 126,300 | |||

| Rent Expense | 40,000 | |||

| Utilities Expense | 19,700 | |||

| Depreciation Expense | 6,500 | |||

| Laundry supplies Expense | 17,900 | |||

| Insurance Expense | 5,700 | |||

| Miscellaneous Expense | 5,400 | |||

| (To close the revenues and expenses account. Then the balance amount are transferred to income summary account) | ||||

| June 30 | Income Summary | 10,700 | ||

| Retained earnings | 10,700 | |||

| (To record the closure of net income from income summary to retained earnings) | ||||

| Retained earnings | 10,000 | |||

| Dividends | 10,000 | |||

| (To record the closure of dividend to retained earnings) | ||||

Table (11)

Laundry revenue account has a normal credit balance of $232,200 in total, now to close this account, the laundry revenue account must be debited with $232,200 and, income summary account must be credited with $232,200.

- In this closing entry, the laundry revenue account balance is being transferred to the income summary account, to bring the revenues account balance to zero.

- Thereby, the income summary account balance gets increased by $232,200 and, the revenue account balance gets decreased by $232,200.

All expenses accounts have a normal debit balance, the total of expenses are $221,500 have to be closed by transferring these account balances to the income summary account. All expenses account must be credited, and the income summary account must be debited with $ 221,500.

- In this closing entry, all the expenses account balances are transferred to the income summary account, to bring the expenses account balances to zero.

- Thereby, both the income summary account, and the expenses account balances get decreased by $221,500.

Determined amount balance of income summary is $10,700, which has to be closed by debiting the income summary account with $10,700, and crediting the retained earnings account with $10,700.

- In this closing entry, the income summary account balance is being transferred to the retained earnings account, to bring the income summary account balance to zero.

- Thereby, the income summary account gets decreased, and the retained earnings account balance gets increased by $10,700.

Dividends account has a normal debit balance of $10,000, now to close this account, retained earnings account must be debited with $10,000 and, dividend account must be credited with $10,000.

- In this closing entry, the dividend account balance is being transferred to the retained earnings account, to bring the dividend account balance to zero.

- Thereby, the retained earnings account balance gets increased by $10,000 and, the dividend account balance gets decreased by $10,000.

7.

To prepare: The post–closing trial balance of E Laundry for the month ended June 30, 2016.

Explanation of Solution

Prepare a post–closing trial balance of E Laundry for the month ended June 30, 2016 as follows:

Laundry E Post-closing Trial Balance June 30, 2016 |

||

| Particulars | Debit $ | Credit $ |

| Cash | 11,000 | |

| Laundry Supplies | 3,600 | |

| Prepaid insurance | 3,900 | |

| Laundry Equipment | 232,600 | |

| Accumulated depreciation | 131,900 | |

| Accounts payable | 11,800 | |

| Wages payable | 1,100 | |

| Common stock | 40,000 | |

| Retained earnings | 66,300 | |

| Total | $251,100 | $251,100 |

Table (12)

The debit column and credit column of the post–closing trial balance are agreed, both having balance of $251,100.

Want to see more full solutions like this?

Chapter 4 Solutions

Bundle: Financial & Managerial Accounting, 13th + Working Papers, Volume 1, Chapters 1-15 For Warren/reeve/duchac’s Corporate Financial Accounting, ... 13th + Cengagenow™v2, 2 Terms Access Code

- compared to the individual risks of constituting assets. Question 5 (6 marks) The common shares of Almond Beach Inc, have a beta of 0.75, offer a return of 9%, and have an historical standard deviation of return of 17%. Alternatively, the common shares of Palm Beach Inc. have a beta of 1.25, offer a return of 10%, and have an historical standard deviation of return of 13%. Both firms have a marginal tax rate of 37%. The risk-free rate of return is 3% and the expected rate of return on the market portfolio is 9½%. 1. Which company would a well-diversified investor prefer to invest in? Explain why and show all calculations. 2. Which company Would an investor who can invest in the shares of only one firm prefer to invest in? Explain why. RELEASED BY THE CI, MGMT2023, MARCH 2, 2025 5 Use the following template to organize and present your results: Theoretical CAPM Actual offered prediction for expected return (%) return (%) Standard deviation of return (%) Beta Almond Beach Inc. Palm Beach…arrow_forwardprovide correct answerarrow_forwardPlease solve. The screen print is kind of split. Please look carefully.arrow_forward

- Coronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forwardCoronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+ 10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forwardThe completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: Using the payroll registers, complete the General Journal entries as follows: February 10 Journalize the employee pay. February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. February 14 Issue the employee pay. February 24 Journalize the employee pay. February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 28 Issue the employee pay. February 28 Issue payment for the payroll liabilities. March 10 Journalize the employee pay. March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,