Concept explainers

Preparing

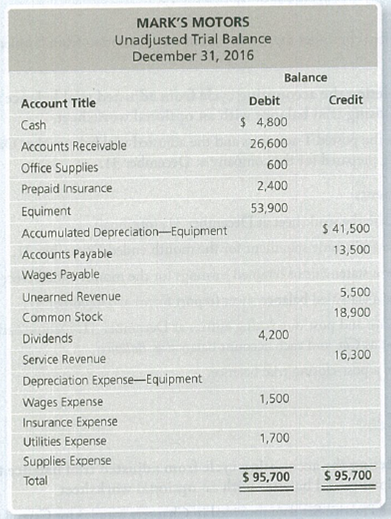

The unadjusted

Adjustment data at December 31, 2016:

a.

b. Accrued Wages Expense, $ 1,000.

c. Office Supplies on hand, $ 100.

d. Prepaid Insurance expired during December, $200.

e. Unearned Revenue earned during December, $4,400.

f. Accrued Service Revenue, $800.

2017 transactions:

a. On January 4, Mark’s Motors paid wages of $1,200. Of this, $1,000 related to the accrued wages recorded on December 31.

b. On January 10, Mark’s Motors received $ 1,500 for Service Revenue. Of this, $800 related to the accrued Service Revenue recorded on December 31.

Requirements

1. Journalize adjusting entries.

2. Journalize reversing entries for the appropriate adjusting entries.

3. Refer to the 2017 data. Journalize the cash payment and the cash receipt chat occurred in 2017.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Horngren's Financial & Managerial Accounting, Student Value Edition (5th Edition)

- Do fast answer of this accounting questionsarrow_forwardNick and Partners, a law firm, worked on a total of 1,000 cases this month, 800 of which were completed during the period. The remaining cases were 40% complete. The firm incurred $180,000 in direct labor and overhead costs during the period and had $4,800 in direct labor and overhead costs in beginning inventory. Using the weighted average method, what was the total cost of cases completed during the period?arrow_forwardWhat was the variable overhead ratearrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning