Concept explainers

Recording Transactions (Including Adjusting and Closing Entries), Preparing Financial Statements, and Performing Ratio Analysis

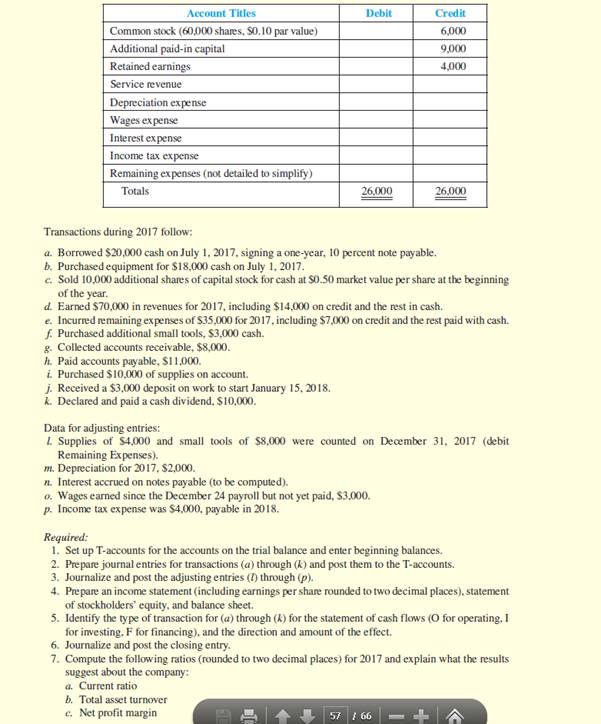

Josh and Kelly McKay began operations of their furniture repair shop (Furniture Refinishers, Inc.) on January 1, 2016. The annual reporting period ends December 31. The

| Account Titles | Debit | Credit |

| Cash | 5,000 | |

| 4,000 | ||

| Supplies | 2,000 | |

| Small tools | 6,000 | |

| Equipment | ||

| Other assets (not detailed to simplify) | 9,000 | |

| Accounts payable | 7,000 | |

| Notes payable | ||

| Wages payable | ||

| Interest payable | ||

| Income taxes payable | ||

| Unearned revenue |

1, 2, 3 and 5

Prepare T-accounts for the accounts on the trial balance and enter beginning balances.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

(a)The title of the account

(b)The left or debit side

(c)The right or credit side

Prepare the T-account (amounts in thousands):

|

Cash (A) account | |||

| Beginning Balance | 5 | b | 18 |

| a | 20 | e | 28 |

| c | 5 | f | 3 |

| d | 56 | h | 11 |

| g | 8 | ||

| j | 3 | k | 10 |

| Ending Balance | 27 | ||

| Accounts Receivable (A) account | |||||||

| Beginning Balance | 4 | ||||||

| d | 14 | g | 8 | ||||

| Ending Balance | 10 | ||||||

|

Supplies (A) account | |||||||

| Beginning Balance | 2 | ||||||

| i | 10 | l | 8 | ||||

| Ending Balance | 4 | ||||||

|

Small tools (A) account | |||||||

| Beginning Balance | 6 | ||||||

| f | 3 | ||||||

| Ending Balance | 8 | ||||||

|

Equipment (A) account | |||

|

Beginning Balance b |

0 18 | ||

| Ending Balance | 18 | ||

|

Accumulated depreciation (xA) account | |||

| Beginning Balance |

0 | ||

| m | 2 | ||

| Ending Balance | 2 | ||

Other assets (A) account | |||

| Beginning Balance | 9 | ||

| Ending Balance | 9 | ||

|

Accounts payable (L) account | |||

| h | 11 | Beginning Balance | 7 |

| e | 7 | ||

| i | 10 | ||

| Ending Balance | 13 | ||

|

Notes payable (L) account | |||

| Beginning Balance | 0 | ||

| a | 20 | ||

| Ending Balance | 20 | ||

|

Wages payable (L) account | |||

| Beginning Balance | 0 | ||

| o | 3 | ||

| Ending Balance | 3 | ||

| Interest payable (L) account | |||

| Beginning Balance | 0 | ||

| n | 1 | ||

| Ending Balance | 1 | ||

|

Income taxes payable (L) account | |||

| Beginning Balance | 0 | ||

| p | 4 | ||

| Ending Balance | 4 | ||

| Unearned revenue (L) account | |||

| Beginning Balance | 0 | ||

| j | 3 | ||

| Ending Balance | 3 | ||

|

Common Stock (SE) account | |||

| Beginning Balance |

6 | ||

| c | 1 | ||

| Ending Balance | 7 | ||

|

Additional paid-in capital account | |||

| Beginning Balance |

9 | ||

| c | 4 | ||

| Ending Balance | 13 | ||

| Retained earnings (SE) account | |||

| Beginning Balance | 4 | ||

| k | 10 | ||

| Closing entry | 16 | ||

| Ending Balance | 10 | ||

| Service Revenue (R) account | |||

| Balance | 0 | ||

| Closing entry | 70 | d | 70 |

| Ending Balance | 0 | ||

| Depreciation expense (E) account | |||

| Balance | 0 | ||

| m | 2 | Closing entry | 2 |

| Ending Balance | 0 | ||

| Income Tax Expense ( E) account | |||

| Balance | 0 | ||

| p | 4 | Closing entry | 4 |

| Ending Balance | 0 | ||

| Interest Expense ( E) account | |||

| Balance | 0 | ||

| n | 1 | Closing entry | 1 |

| Ending Balance | 0 | ||

|

Remaining Expense ( E) account | |||

| Balance | 0 | ||

| e | 35 | ||

| l | 9 | Closing entry | 44 |

| Ending Balance | 0 | ||

| Wages Expense (E) account | |||

| Balance | 0 | ||

| o | 3 | Closing entry | 3 |

| Ending Balance | 0 | ||

2.

Record Journal entries for transactions (a) to (k).

Explanation of Solution

Journal entries for the transactions (a) to (k) as follows:

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| a) | Cash (+A) | 20,000 | |

| Notes payable (Short-term) (+L) | 20,000 | ||

| (To record borrowed cash on note) | |||

| b) | Equipment (+A) | 18,000 | |

| Cash (-A) | 18,000 | ||

| (To record purchase of equipment) | |||

| c) | Cash (+A) | 5,000 | |

| Common Stock (+SE) | 1,000 | ||

| Additional paid-in capital (+SE) | 4,000 | ||

| (To record issued common stock for cash and additional paid in capital) | |||

| d) | Cash (+A) | 56,000 | |

| Accounts Receivable (+A) | 14,000 | ||

| Service Revenue (+R, +SE) | 70,000 | ||

| (To record service revenue earned during the year 2017) | |||

| e) | Remaining expenses (+A) | 35,000 | |

| Accounts payable (+L) | 7,000 | ||

| Cash (-A) | 28,000 | ||

| (To record Purchase of remaining expenses) | |||

| f) | Small tools (+A) | 3,000 | |

| Cash (-A) | 3,000 | ||

| (To record other assets) | |||

| g) | Cash (+A) | 8,000 | |

| Accounts Receivable (-A) | 8,000 | ||

| (To record cash collected on customer’s account) | |||

| h) | Accounts payable (-L) | 11,000 | |

| Cash (-A) | 11,000 | ||

| (To record cash paid to creditors) | |||

| i) | Supplies (+A) | 10,000 | |

| Accounts payable (+L) | 10,000 | ||

| (To record supplies purchased for future use) | |||

| j) | Cash (+A) | 3,000 | |

| Unearned revenue (+L) | 3,000 | ||

| (To record unearned revenue) | |||

| k) | Retained earnings (-SE) | 10,000 | |

| Cash (-A) | 10,000 | ||

| (To record retained earnings) | |||

Table (1)

3.

Record Adjusting journal entries (l) to (p).

Explanation of Solution

Prepare adjusting journal entries (l) to (p):

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| l. | Remaining expense (+E, -SE) | 9,000 | |

| Supplies(-A) | 8,000 | ||

| Small tools (-A) | 1,000 | ||

| (To record the use of supplies and small tools) | |||

| m. | Depreciation expense (+E, -SE) | 2,000 | |

| Accumulated depreciation – (+xA, -A) | 2,000 | ||

| (To record adjusting entry for depreciation expense) | |||

| n. | Interest expense (+E, -SE) | 1,000 | |

| Interest payable(+L) | 1,000 | ||

| (To record the adjusting entry for interest expense) | |||

| o. | Wages expense (+E, -SE) | 3,000 | |

| Wages payable (+L) | 3,000 | ||

| (To record the adjusting entry for wages expenses) | |||

| p. | Income tax expense(+E, -SE) | 4,000 | |

| Income tax payable(+L) | 4,000 | ||

| (To record the adjusting entry for income tax expense) | |||

Table (2)

l.

- Remaining expense is an expense account which is a component of stockholders equity. There is an increase in the expense which decreases the stock holders’ equity. Hence, debit remaining expense with $9,000.

- Supplies are asset. There is a decrease in the asset. Hence, credit asset with $8,000.

- Small tools are asset. There is a decrease in the asset. Hence, credit asset with $1,000.

m.

- Depreciation expense is an expense account which is a component of stockholders’ equity. There is an increase in expense account which decreases the stockholders’ equity. Hence, debit depreciation expense with $2,000.

- Accumulated depreciation is a contra-asset. There is a decrease in the asset. Hence, credit accumulated depreciation with $2,000.

n.

- Interest expense is an expense account which is a component of stockholders’ equity. There is an increase in the expense account which decreases the stockholders’ equity. Hence, debit interest expense with $1,000.

- Interest payable is a liability. There is an increase in the liability. Hence, credit wages with $1,000.

o.

- Wages expense is an expense account which is a component of stockholders equity. There is an increase in the expense which decreases the stock holders’ equity. Hence, debit wages expense with $3,000.

- Wages payable is a liability. There is an increase in the liability. Hence, credit wages payable with $3,000.

p.

- Income tax expense is an expense account which is a component of stock holders’ equity. There is an increase in the expense account which decreases the stockholders’ equity. Hence, debit interest expense with $4,000.

- Income tax payable is a liability. There is an increase in the liability. Hence, credit, interest payable with $4,000.

4.

Prepare an income statement, Statement of stockholders’ equity and balance sheet.

Explanation of Solution

Prepare an income statement for the year ended December 31, 2017:

| Incorporation FR | |

| Income statement | |

| For the year ended December 31, 2017 | |

| Particulars | Amount ($) |

| Revenues: | |

| Service revenue | 70,000 |

| Total revenues | 70,000 |

| Less: Expenses | |

| Depreciation expense | 2,000 |

| Wages expense | 3,000 |

| Remaining expense | 44,000 |

| Total operating expenses | 21,000 |

| Operating income | 53,000 |

| Less: Other item | |

| Interest expense | 1,000 |

| Pretax income | 20,000 |

| Less: Income tax expense | 4,000 |

| Net income | 16,000 |

| Earnings per share | $0.23 |

Table (3)

Incorporation FR net income is $16,000.

Prepare a statement of Stockholders’ equity:

| Incorporation FR | ||||

| Statement of stockholders’ equity | ||||

| For the year ended December 31, 2017 | ||||

| Particulars | Common Stock | Additional Paid-in Capital | Retained earnings | Total Stockholders' Equity |

| Balance, January 1, 2017 | $6,000 | $9,000 | $4,000 | $19,000 |

| Additional stock issuance | 1,000 | 4,000 | 5,000 | |

| Net income | 16,000 | 16,000 | ||

| Dividends declared | (10,000) | (10,000) | ||

| Balance, December 31, 2017 | $7,000 | $13,000 | $10,000 | $30,000 |

Table (4)

Prepare a balance sheet for the year December 31, 2017:

| Incorporation FR | |||

| Balance Sheet | |||

| At December 31, 2017 | |||

| Assets | Amount ($) | Liabilities and Stockholders’ Equity | Amount ($) |

| Current Assets: | Current Liabilities: | ||

| Cash | 27,000 | Accounts payable | 13,000 |

| Accounts receivable | 10,000 | Notes payable | 20,000 |

| Supplies | 4,000 | Interest payable | 1,000 |

| Small tools | 8,000 | Wages payable | 3,000 |

| Income taxes payable | 4,000 | ||

| Unearned revenue | 3,000 | ||

| Total current assets | 49,000 | Total current liabilities | 44,000 |

| Land | 13,000 | Stockholders' Equity: | |

| Equipment | 18,000 | Common stock | 7,000 |

| Less: Accumulated depreciation | (2,000) | Additional paid-in capital | 13,000 |

| Net book value | 16,000 | Retained earnings | 10,000 |

| Other assets | 9,000 | Total stockholders' equity | 30,000 |

| Total assets | 74,000 | Total liabilities and stockholders' equity | 74,000 |

Table (5)

The balance sheet agrees with the $74,000 of both assets and liabilities columns.

5.

Identify the type of transaction for (a) to (k) for the statement of cash flows and the direction and the amount of the effect.

Explanation of Solution

Identify the type of transaction for (a) to (k) for the statement of cash flows and the direction and the amount of the effect:

| Transaction | Type of Effect on Cash Flows | Direction and Amount of Effect |

| a. | F | +20,000 |

| b. | I | -18,000 |

| c. | F | +5,000 |

| d. | O | +56,000 |

| e. | O | -28,000 |

| f. | O | -3,000 |

| g. | O | +8,000 |

| h. | O | -11,000 |

| i. | NE | NE |

| j. | O | +3,000 |

| k. | F | -10,000 |

Table (6)

Statement of cash flow:

A statement that shows the inflows and outflows of cash or cash equivalents is known as a cash flow statement. A cash flow statement includes the following three components.

- 1. Cash flows from operating activities:

These are the cash produced by the normal business operations.

The following amounts are to be adjusted from the Net Income to calculate the cash flows from the operating activities.

- Deduct increase in current assets.

- Deduct decrease in current liabilities.

- Add decrease in current assets.

- Add the increase in current liability.

- Add depreciation expense.

- Add loss on sale of plant assets.

- Less gain on sale of plant assets.

- 2. Cash flows from investing activities:

These are the amount of cash used for the purchase of any fixed assets, and any cash receives from the sale of fixed assets.

- Deduct the amount of cash used to purchase any fixed assets from cash flows from investing activities to calculate the net cash provided or used for investing activities.

- Add the amount of cash received from the sale of any fixed assets to cash flows from investing activities to calculate the net cash provided or used from investing activities.

- 3. Cash flows from financing activities:

These are the sources of finance of the business.

- Add the amount of cash received from any source of finance like amount from stockholders, debenture holders, or from any fixed liability to the cash flows from financing activities to calculate the net cash used or provided by the financing activities.

- Deduct the payment of dividend and interest from the cash flows from financing activities to calculate the net cash used or provided by the financing activities.

- Deduct the amount of cash paid to purchase the treasury stocks from the cash flows from financing activities to calculate the net cash used or provided by the financing activities.

Note:

I refer to investing activity.

F refers to financing activity.

O refers to operating activity.

NE refers to no effect.

6.

Prepare the closing entry for Incorporation FR on December 31, 2017.

Explanation of Solution

Prepare closing entries for Incorporation FR on December 31, 2017:

| Date | Account Title and Explanation | Debit ($) | Credit ($) |

| December 31, 2017 | Service revenue(-R) | 70,000 | |

| Retained earnings(+SE) | 16,000 | ||

| Depreciation expense(-E) | 2,000 | ||

| Interest expense (-E) | 1,000 | ||

| Income tax expense(-E) | 4,000 | ||

| Wages expense(-E) | 3,000 | ||

| Remaining expense(-E) | 44,000 | ||

| (To record the closing entries for Incorporation FR) |

Table (7)

For closing of temporary accounts, the balances of revenues, expenses, and dividend accounts will be transferred to retained earnings in order to bring zero balance for expenses and revenues accounts.

7.

Compute Current ratio, Total asset turnover and net profit margin and explain the results to suggest about the Company FR.

Explanation of Solution

- (a) Calculation of current ratio:

The current ratio is 1.11:1.

For Incorporation FR, suggests that their current ratio is having sufficient current assets to pay current liabilities.

- (b) Calculation of total asset turnover:

For Incorporation FR, suggests that the total asset turnover ratio has generated $1.40 for every dollar of assets.

- (c) Calculation of net profit margin:

For Incorporation FR, suggests that the net profit margin earns $0.23 for every dollar in sales that it generates.

Want to see more full solutions like this?

Chapter 4 Solutions

GB 112/212 MANAGERIAL ACC. W/ACCESS >C<

- I need help with this financial accounting problem using accurate calculation methods.arrow_forwardCan you provide the valid approach to solving this financial accounting question with suitable standards?arrow_forwardPlease explain the accurate process for solving this financial accounting question with proper principles.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning