Concept explainers

Financial statements and closing entries

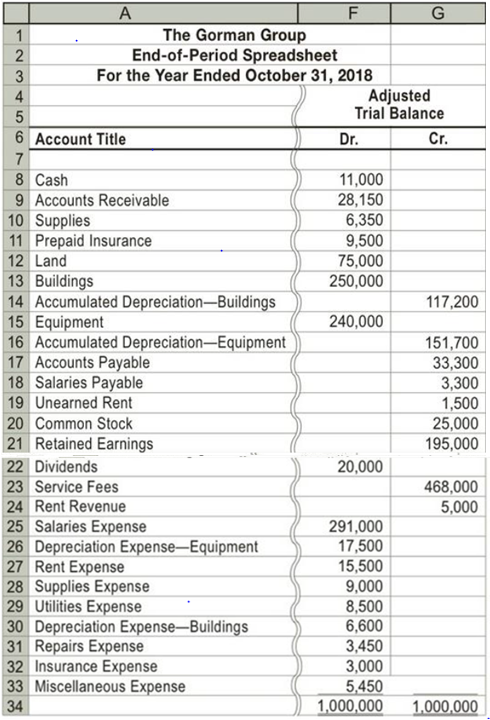

The Gorman Group is a financial planning services firm owned and operated by Nicole Gorman. As of October 31, 2018, the end of the fiscal year, the accountant for The Gorman Group prepared an end-of-period spreadsheet, part of which follows:

Instructions

1. Prepare an income statement, a

2.

3. If the balance of Retained Earnings had instead increased $115,000 after the closing entries were posted, and the dividends remained the same, what would have been the amount of net income or net loss?

Trending nowThis is a popular solution!

Chapter 4 Solutions

Bundle: Corporate Financial Accounting, Loose-leaf Version, 14th + CengageNOWv2, 1 term Printed Access Card

- Can you explain the correct approach to solve this general accounting question?arrow_forwardPlease provide the solution to this financial accounting question with accurate financial calculations.arrow_forwardI need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forward

- Please explain the correct approach for solving this financial accounting question.arrow_forwardWhat is the net income for the one year?arrow_forwardArdor Ltd. purchased a new equipment that is expected to be used in operations for 6 years for $60,000. The salvage value of the equipment after 6 years is $6,000. Assume the equipment was purchased on the first day of the fiscal year so no partial-year depreciation is needed. Using the Straight-Line Depreciation Method, what is the value of accumulated depreciation at the end of year 4?arrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub